Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Can you please give me correct answer this accounting question?

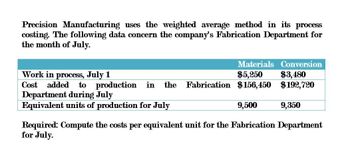

Transcribed Image Text:Precision Manufacturing uses the weighted average method in its process

costing. The following data concern the company's Fabrication Department for

the month of July.

Work in process, July 1

Materials Conversion

Cost added to production in the Fabrication $156,450

Department during July

Equivalent units of production for July

$5,250 $3,480

$192,720

9,500

9,350

Required: Compute the costs per equivalent unit for the Fabrication Department

for July.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kokomo Kayak Inc. uses the process cost system. The following data, taken from the organizations books, reflect the results of manufacturing operations during the month of March: Production Costs Work in process, beginning of period: Costs incurred during month: Production Data: 18,000 units finished and transferred to stockroom. Work in process, end of period, 3,000 units, two-thirds completed. Required: Prepare a cost of production summary for March.arrow_forwardThe records of Burris Inc. reflect the following data: Work in process, beginning of month2,000 units one-half completed at a cost of 1,250 for materials, 675 for labor, and 950 for overhead. Production costs for the monthmaterials, 99,150; labor, 54,925; factory overhead, 75,050. Units completed and transferred to stock38,500. Work in process, end of month3,000 units, one-half completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost.arrow_forwardDuring March, the following costs were charged to the manufacturing department: $22,500 for materials; $45,625 for labor; and $50,000 for manufacturing overhead. The records show that 40,000 units were completed and transferred, while 10,000 remained in ending inventory. There were 45,000 equivalent units of material and 42,500 units of conversion costs. Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forward

- Cost of Direct Materials, Cost of Goods Manufactured, Cost of Goods Sold Bisby Company manufactures fishing rods. At the beginning of July, the following information was supplied by its accountant: During July, the direct labor cost was 43,500, raw materials purchases were 64,000, and the total overhead cost was 108,750. The inventories at the end of July were: Required: 1. What is the cost of the direct materials used in production during July? 2. What is the cost of goods manufactured for July? 3. What is the cost of goods sold for July?arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardFoamy Inc. manufactures shaving cream and uses the weighted average cost method. In November, production is 14,800 equivalent units for materials and 13,300 units for labor and overhead. During the month, materials, labor, and overhead costs were as follows: Beginning work in process for November had a cost of 11,360 for materials, 11,666 for labor, and 9,250 for overhead. Compute the following: a. Weighted average cost per unit for materials b. Weighted average cost per unit for labor c. Weighted average cost per unit for overhead d. Total unit cost for the montharrow_forward

- The records of Stone Inc. reflect the following data: Work in process, beginning of month4,000 units one-fourth completed at a cost of 2,500 for materials, 1,400 for labor, and 1,800 for overhead. Production costs for the monthmaterials, 130,000; labor, 70,000; and factory overhead, 82,000. Units completed and transferred to stock45,000. Work in process, end of month5,000 units, one-half completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost. (Round unit costs to three decimal places.)arrow_forwardBasic Cost Flows Linsenmeyer Company produces a common machine component for industrial equipment in three departments: molding, grinding, and finishing. The following data are available for September: During September, 18,000 components were completed. There is no beginning or ending WIP in any department. Required: 1. Prepare a schedule showing, for each department, the cost of direct materials, direct labor, applied overhead, product transferred in from a prior department, and total manufacturing cost. 2. Calculate the unit cost. (Note: Round the unit cost to two decimal places.)arrow_forwardHolmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: direct materials, 90,000; conversion costs, 33,750. Manufacturing costs incurred during April: direct materials, 75,000; conversion costs, 220,000. Holmes uses the weighted average method. Required: 1. Compute the unit cost for April. 2. Determine the cost of ending work in process and the cost of goods transferred out.arrow_forward

- Premier Products Inc. has three departments and uses the process cost system of accounting. A portion of the departmental cost work sheet prepared by the cost accountant at the end of July is reproduced below. Required: Prepare a cost of production summary for each department. (Round unit costs to three decimal places and totals to the nearest whole dollar.)arrow_forwardWork in process account data for two months; cost of production reports Pittsburgh Aluminum Company uses a process cost system to record the costs of manufacturing rolled aluminum, which consists of the smelting and rolling processes. Materials are entered from smelting at the beginning of the rolling process. The inventory of Work in ProcessRolling on September 1 and debits to the account during September were as follows: During September, 2,600 units in process on September 1 were completed, and of the 28,900 units entering the department, all were completed except 2,900 units that were 45 completed. Charges to Work in ProcessRolling for October were as follows: During October, the units in process at the beginning of the month were completed, and of the 31,000 units entering the department, all were completed except 2,000 units that were 25 completed. Instructions 1. Enter the balance as of September 1 in a four-column account for Work in ProcessRolling. Record the debits and the credits in the account for September. Construct a cost of production report and present computations for determining (A) equivalent units of production for materials and conversion, (B) costs per equivalent unit, (C) cost of goods finished, differentiating between units started in the prior period and units started and finished in September, and (D) work in process inventory. 2. Provide the same information for October by recording the October transactions in the four-column work in process account. Construct a cost of production report, and present the October computations (A through D) listed in part (1). 3. Comment on the change in costs per equivalent unit for August through October for direct materials and conversion cost.arrow_forwardCost of Production report The Cutting Department of Karachi Carpet Company provides the following data for January. Assume that all materials are added at the beginning of the process. A. Prepare a cost of production report for the Cutting Department. B. Compute and evaluate the change in the costs per equivalent unit for direct materials and conversion from the previous month (December).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,