FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![Post the transactions using the standard account form. (Post entries in the order of journal entries presented in the previous part.)

Cash

Date

]!!

Equipment

Date

Date

Accounts Payable

Common Stock

Date

Explanation Ref.

Dividends

Date

J1

J1

J1

J1

Explanation Ref.

J1

Explanation Ref.

J1

J1

Explanation Ref.

J1

Explanation Ref.

J1

Debit

Debit

Debit

Debit

Debit

Credit

Credit

Credit

Credit

Credit

No. 101

Balance

No. 157

Balance

No. 201

Balance

No. 311

Balance

No. 332

Balance](https://content.bartleby.com/qna-images/question/3ae0660d-5301-4b30-8361-0f1bb7fa4959/1520f022-c7ab-4bf7-b628-5a833bac6694/lyxbzd_thumbnail.png)

Transcribed Image Text:Post the transactions using the standard account form. (Post entries in the order of journal entries presented in the previous part.)

Cash

Date

]!!

Equipment

Date

Date

Accounts Payable

Common Stock

Date

Explanation Ref.

Dividends

Date

J1

J1

J1

J1

Explanation Ref.

J1

Explanation Ref.

J1

J1

Explanation Ref.

J1

Explanation Ref.

J1

Debit

Debit

Debit

Debit

Debit

Credit

Credit

Credit

Credit

Credit

No. 101

Balance

No. 157

Balance

No. 201

Balance

No. 311

Balance

No. 332

Balance

Transcribed Image Text:Selected transactions for Metlock, Inc. during its first month in business are as follows.

Sept. 1

5

25

30

Stockholders invested $12,900 cash in the business in exchange for common stock

Purchased equipment for $11,100 paying $4,500 in cash and the balance on account.

Paid $2,660 cash on balance owed for equipment.

Declared and paid a $650 cash dividend.

Metlock's chart of accounts shows No. 101 Cash, No. 157 Equipment, No. 201 Accounts Payable, No. 311 Common Stock, and No. 332 Dividends.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

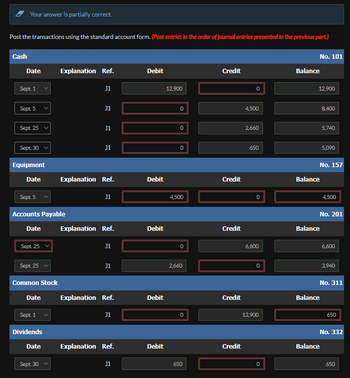

Transcribed Image Text:Your answer is partially correct.

Post the transactions using the standard account form. (Post entries in the order of journal entries presented in the previous part.)

Cash

Date

Sept. 1

Sept. 5

Sept. 25 v

Sept. 30 ✓

Equipment

Date

Sept. 25

Sept. 5

Accounts Payable

Date

Sept. 25 v

Common Stock

Date

Sept. 1

Dividends

Date

Explanation Ref.

Sept. 30

J1

J1

J1

J1

Explanation Ref.

J1

Explanation Ref.

J1

J1

Explanation Ref.

J1

Explanation Ref.

J1

Debit

Debit

Debit

Debit

Debit

12,900

0

0

0

4,500

0

2,660

650

Credit

Credit

Credit

Credit

Credit

0

4,500

2,660

650

0

6,600

0

12,900

0

No. 101

Balance

12,900

Balance

Balance

8,400

No. 157

5,740

Balance

5,090

No. 201

Balance

4,500

6,600

No. 311

3,940

650

No. 332

650

Transcribed Image Text:Selected transactions for Metlock, Inc. during its first month in business are as follows.

Sept. 1

5

25

30

Stockholders invested $12,900 cash in the business in exchange for common stock

Purchased equipment for $11,100 paying $4,500 in cash and the balance on account.

Paid $2,660 cash on balance owed for equipment.

Declared and paid a $650 cash dividend.

Metlock's chart of accounts shows No. 101 Cash, No. 157 Equipment, No. 201 Accounts Payable, No. 311 Common Stock, and No. 332 Dividends.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

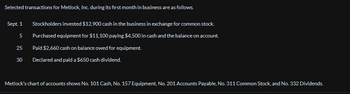

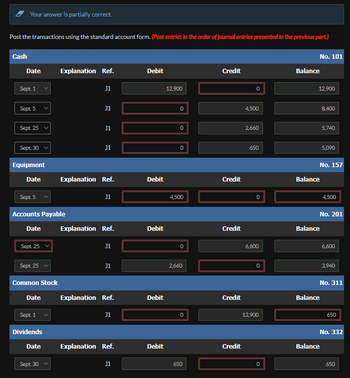

Transcribed Image Text:Your answer is partially correct.

Post the transactions using the standard account form. (Post entries in the order of journal entries presented in the previous part.)

Cash

Date

Sept. 1

Sept. 5

Sept. 25 v

Sept. 30 ✓

Equipment

Date

Sept. 25

Sept. 5

Accounts Payable

Date

Sept. 25 v

Common Stock

Date

Sept. 1

Dividends

Date

Explanation Ref.

Sept. 30

J1

J1

J1

J1

Explanation Ref.

J1

Explanation Ref.

J1

J1

Explanation Ref.

J1

Explanation Ref.

J1

Debit

Debit

Debit

Debit

Debit

12,900

0

0

0

4,500

0

2,660

650

Credit

Credit

Credit

Credit

Credit

0

4,500

2,660

650

0

6,600

0

12,900

0

No. 101

Balance

12,900

Balance

Balance

8,400

No. 157

5,740

Balance

5,090

No. 201

Balance

4,500

6,600

No. 311

3,940

650

No. 332

650

Transcribed Image Text:Selected transactions for Metlock, Inc. during its first month in business are as follows.

Sept. 1

5

25

30

Stockholders invested $12,900 cash in the business in exchange for common stock

Purchased equipment for $11,100 paying $4,500 in cash and the balance on account.

Paid $2,660 cash on balance owed for equipment.

Declared and paid a $650 cash dividend.

Metlock's chart of accounts shows No. 101 Cash, No. 157 Equipment, No. 201 Accounts Payable, No. 311 Common Stock, and No. 332 Dividends.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- PA4. Use the journals and ledgers that follow. Total the journals. Post the transactions to the subsidiary ledger and (using T-accounts) to the general ledger accounts. Then prepare a schedule of accounts receivable.arrow_forward1. When posting all transactions to the ledgers, the cash account will show a total amount in the credit side of A. 118,200 B. 362,000 C. 243,800 D. 100,000 2. What is the final balance of the cash account after posting all related transactions to the ledger and after taking the difference between the total debits and credits? A. 243,800 credit balance B. 243,800 debit balance C. 362,000 debit balance D. 362,000 credit balance 3. After posting all related transactions to the ledger, the service revenue account will show a total balance of A. 82,000 debit B. 58,000 debit C. 82,000 credit D. 58,000 creditarrow_forward7arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education