Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

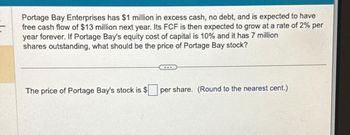

Transcribed Image Text:Portage Bay Enterprises has $1 million in excess cash, no debt, and is expected to have

free cash flow of $13 million next year. Its FCF is then expected to grow at a rate of 2% per

year forever. If Portage Bay's equity cost of capital is 10% and it has 7 million

shares outstanding, what should be the price of Portage Bay stock?

The price of Portage Bay's stock is $ per share. (Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Zoom Enterprises expects that one year from now it will pay a total dividend of $4.9 million and repurchase $4.9 million worth of shares It plans to spend $9.8 million on dividends and repurchases every year after that forever, although it may not always be an even split between dividends and repurchases If Zoom's equity cost of capital is 12 5% and it has 5 4 million shares outstanding, what is its share price today? The price per share is $ (Round to the nearest cent)arrow_forwardBoston Company has just paid dividends of $2.5 per share, which the company projects will grow at a constant rate of 5 percent forever. If Boston Company’s shareholders require 15 percent rate of return, what is the price of its common stock? Can you show the excel formula?arrow_forwardNewman Manufacturing is considering a cash purchase of the stock of Grips Tool. During the year just completed, Grips earned $3.72 per share and paid cash dividends of $2.02 per share (D0=$2.02). Grips' earnings and dividends are expected to grow at 40% per year for the next 3 years, after which they are expected to grow 9% per year to infinity. What is the maximum price per share that Newman should pay for Grips if it has a required return of 10% on investments with risk characteristics similar to those of Grips?arrow_forward

- Scarab Technologies is expected to generate $175 million in free cash flow next year, and FCF is expected to grow at a constant rate of 7% per year indefinitely. Scarab has no debt or preferred stock, and its WACC is 10%. If Scarab has 45 million shares of stock outstanding, what is the stock's value per share? Do not round intermediate calculations. Round your answer to the nearest cent. How much is each share of common stock is worth dollars, according to the corporate valuation model?arrow_forwardShatin Intl. has 10 million shares, an equity cost of capital 12%, and is expected to pay a total dividend of $20 million each year forever. It announces that it will increase its payout to shareholders. Instead of increasing its dividend, it will keep it constant and will start repurchasing $12 million of stock each year as well. How much will its stock price increase? The stock price will increase by $ (Round to the nearest cent.)arrow_forwardNHL Inc.’s current return on equity (ROE) is 20%, its current book equity per share is $50, and it pays out half of its earnings as dividends. Both the ROE and payout ratio will stay constant for the next two years. After year 2, competition will force ROE down to 8%, and NHL will increase its payout ratio to 75%. The cost of capital is 10%. What is NHL’s stock price today?arrow_forward

- NoGrowth Corporation currently pays a dividend of $1.72 per year, and it will continue to pay this dividend forever. What is the price per share if its equity cost of capital is 12% per year?arrow_forwardYou expect that Bean Enterprises will have earnings per share of $2 for the coming year. Bean plans to retain all of its earnings for the next three years. For the subsequent two years, the firm plans on retaining 50% of its earnings. It will then retain only 25% of its earnings from that point forward. Retained earnings will be invested in projects with an expected return of 20% per year. If Bean's equity cost of capital is 11%, then the price of a share of Bean's stock is closest to: A. $53.31 B. $33.32 *C. $19.99 D. $13.33arrow_forward11arrow_forward

- Scampini Technologies is expected to generate $100 million in free cash flow next year, and FCF is expected to grow at a constant rate of 6% per year indefinitely. Scampini has no debt or preferred stock, and its WACC is 11%. If Scampini has 50 million shares of stock outstanding, what is the stock's value per share? Do not round intermediate calculations. Round your answer to the nearest cent. Each share of common stock is worth $ , according to the corporate valuation model.arrow_forwardCovan, Inc. is expected to have the following free cash flow: a. Covan has 8 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2, what is its expected price? c. Assume you bought Covan stock at the beginning of year 1. What is your expected return from holding Covan stock until year 2? a. Covan has 8 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? The stock price should be $ (Round to the nearest cent.) A b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2, what is its expected price? If you plan to sell Covan at the beginning of year 2, its price should be $ (Round to the nearest cont.) c. Assume you bought Covan stock at the beginning of…arrow_forwardXYZ corporation is expecting free cash flow of $100 million next year, and it will grow by 3% per year indefinitely afterward. XYZ’s discount rate is 12%. XYZ has $300 million worth of long term bonds outstanding, and 10 million shares of stock outstanding. What is a fair value for a share of XYZ? Do not include the $ sign and answer to the nearest $0.01.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education