Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:< Principles of Accounting, Vol... T ime Value of Money

E Table of contents

Search this book

E My highlights

B Print

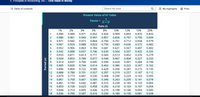

Present Value of $1 Table

1

Factor =

(1 + i)"

Rate (i)

1%

2%

3%

5%

8%

10%

12%

15%

20%

1

0.990

0.980

0.971

0.952

0.926

0.909

0.893

0.870

0.833

0.980

0.961

0.943

0.907

0.857

0.826

0.797

0.756

0.694

3

0.971

0.942

0.915

0.864

0.794

0.751

0.712

0.658

0.579

4

0.961

0.924

0.888

0.823

0.735

0.683

0.636

0.572

0.482

0.952

0.906

0.863

0.784

0.681

0.621

0.567

0.497

0.402

0.942

0.888

0.837

0.746

0.630

0.564

0.507

0.432

0.335

7

0.933

0.871

0.813

0.711

0.583

0.513

0.452

0.376

0.279

8

0.924

0.853

0.789

0.677

0.540

0.467

0.404

0.327

0.233

9

0.914

0.837

0.766

0.645

0.500

0.424

0.361

0.284

0.194

10

0.905

0.820

0.744

0.614

0.463

0.386

0.322

0.247

0.162

11

0.896

0.804

0.722

0.585

0.429

0.350

0.287

0.215

0.135

12

0.888

0.788

0.701

0.557

0.397

0.319

0.257

0.187

0.112

13

0.879

0.773

0.681

0.530

0.368

0.290

0.229

0.163

0.093

14

0.861

0.758

0.661

0.505

0.340

0.263

0.205

0.141

0.078

15

0.861

0.743

0.642

0.481

0.315

0.239

0.183

0.123

0.065

16

0.853

0.728

0.623

0.458

0.292

0.218

0.163

0.107

0.054

17

0.844

0.714

0.605

0.436

0.270

0.198

0.146

0.093

0.045

18

0.836

0.700

0.587

0.416

0.250

0.180

0.130

0.081

0.038

(u) poļua

Transcribed Image Text:Homework Assignment #13

E Print Item

Pompeii's Pizza has a delivery car that it uses for pizza deliveries. The transmission needs to be replaced and there are several other repairs that need to be done. The car is nearing the end of its life, so the options

are to either overhaul the car or replace it with a new car. Pompeii's has put together the following budgetary items:

Present Car

New Car

Purchase cost new

$32,000

Transmission and other repairs

$8,000

Annual cash operating cost

13,000

10,000

Fair market value now

5,000

Fair market value in five years

1,000

5,000

If Pompeii's replaces the transmission of the pizza delivery vehicle, they expect to be able to use the vehicle for another 5 years. If they sell the old vehicle and purchase a new vehicle, they will use that vehicle for 5

years and then trade it in for another new pizza delivery vehicle. If they trade for the new delivery vehicle, their operating expenses will decrease because the new vehicle is more gas efficient and the maintenance on

a new car is less. This project is analyzed using a discount rate of 10%.

(Click here to see present value and future value tables)

A. Calculate the NPV on both Cars. Round your present value factor to three decimal places and the rest to nearest dollar.

Present Car $

New Car

2$

B. What should Pompeii's do?

Pompeii's should

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Wildhorse's Auto Care is considering the purchase of a new tow truck. The garage doesn't currently have a tow truck, and the $59,950 price tag for a new truck would represent a major expenditure. Wildhorse Austen, owner of the garage, has compiled the following estimates in trying to determine whether the tow truck should be purchased. Initial cost $59,950 Estimated useful life 8 years Net annual cash flows from towing $7,990 Overhaul costs (end of year 4) $5,970 Salvage value $12,000 Show Transcribed Text د Wildhorse's good friend, Rick Ryan, stopped by. He is trying to convince Wildhorse that the tow truck will have other benefits that Wildhorse hasn't even considered. First, he says, cars that need towing need to be fixed. Thus, when Wildhorse tows them to her facility, her repair revenues will increase. Second, he notes that the tow truck could have a plow mounted on it, thus saving Wildhorse the cost of plowing her parking lot. (Rick will give her a used plow blade for free if…arrow_forwardA water pump to be used by the city’s maintenance department costs $10 000 new. A running-in period, costing $1000 immediately, is required for a new pump. Operating and maintenance costs average $500 the first year, increasing by $300 per year thereafter. The salvage value of the pump at any time can be estimated by the declining balance rate of 20 percent. Interest is at 10 percent. Using a spreadsheet, calculate the EAC for replacing the pump after one year, two years, etc. How often should the pump be replaced?arrow_forwardWendell’s Donut Shoppe is investigating the purchase of a new $40,000 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $5,200 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,000 dozen more donuts each year. The company realizes a contribution margin of $2.40 per dozen donuts sold. The new machine would have a six-year useful life. Required: 4. In addition to the data given previously, assume that the machine will have a $10,515 salvage value at the end of six years. Under these conditions, what is the internal rate of return? (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero.) (Round your final answer to the nearest whole percentage.)arrow_forward

- The city of Bloomington is deciding if they are going to be able to justify an additional street light. The cost of the light to install is $14,000. City officials believe it will reduce the death rate at that intersection from 1.0% to 0.6%. Our guideline for valuing human life is $8M per person. What is the net of this cost benefit proposal? A. 32,000 B. 18,000 C. (18,000) D. (32,000)arrow_forwardSdarrow_forwardCharlie's Hamburgers is considering adding pizza to its menu. The pizza require purchasing cooking equipment on sale for $55,000. The asset has a 6-year life, will produce a cash flow of $17,600 in the first year, $19,000 in the second year, $20, 250 in the third year, $21,750 in the fourth year, 22, 500 in the fifth year, and $23,000 in the sixth year. The cost of capital is 10%. What is the project's Internal Rate of Return (IRR)? Net Present Value (NPV)? and Profitability Index (PI)?arrow_forward

- City of Oliver is considering automating a process in its accounting department that has been labor-intensive. The equipment currently used in the department can be sold. The new equipment will have a projected useful life of 10 years. The old equipment has a remaining useful life of 10 years. The following data are available to be used in making the decision. Should the city invest in the new equipment? Support your answer with appropriate calculations. Current equipment Current equipment book value $ 30,000 Annual depreciation charges 3,000 Current estimated disposal value 5,000 New equipment Cost $150,000 Annual depreciation charge 12,500 Expected disposal value 25,000 Labor savings each year $ 50,000 Present value factors @ 6% $1…arrow_forwardPompeii's Pizza has a delivery car that it uses for pizza deliveries. The transmission needs to be replaced and there are several other repairs that need to be done. The car is nearing the end of its life, so the options are to either overhaul the car or replace it with a new car. Pompeii's has put together the following budgetary items: Present Car New Car Purchase cost new $31,000 Transmission and other repairs $9,000 Annual cash operating cost 13,000 10,000 Fair market value now 6,000 Fair market value in five years 500 6,000 If Pompeii's replaces the transmission of the pizza delivery vehicle, they expect to be able to use the vehicle for another 5 years. If they sell the old vehicle and purchase a new vehicle, they will use that vehicle for 5 years and then trade it in for another new pizza delivery vehicle. If they trade for the new delivery vehicle, their operating expenses will decrease because the new vehicle is more gas efficient and the maintenance on a new car is less. This…arrow_forwardA university student painter is considering the purchase of a new air compressor and paint gun to replace an old paint sprayer. (Both items belong to Class 9 and have a 25% CCA rate.) These two new items cost $12,000 and have a useful life of four years, at which time they can be sold for $1,600. The old paint sprayer can be sold now for $500 and could be scrapped for $250 in four years. The entrepreneurial student believes that operating revenues will increase annually by $8,000. The tax rate is 22% and the required rate of return is 15%. What is the NPV of the new equipment? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $ Should the purchase be made? O Yes O Noarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education