Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Print Rem

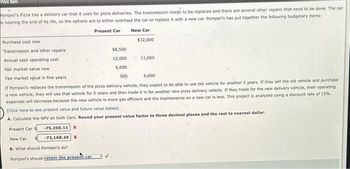

Pompeil's Pizza has a delivery car that it uses for pizza deliveries. The transmission needs to be replaced and there are several other repairs that need to be done. The car

s nearing the end of its life, so the options are to either overhaul the car or replace it with a new car. Pompell's has put together the following budgetary items:

Present Car

New Car

Purchase cost new

Transmission and other repairs.

Annual cash operating cost

Fair market value now.

$8,500

12,000

6,000

500

✓

$32,000

11,000

Fair market value in five years

6,000

If Pompeii's replaces the transmission of the pizza delivery vehicle, they expect to be able to use the vehicle for another 5 years. If they sell the old vehicle and purchase.

a new vehicle, they will use that vehicle for 5 years and then trade it in for another new pizza delivery vehicle. If they trade for the new delivery vehicle, their operating

expenses

will decrease because the new vehicle is more gas efficient and the maintenance on a new car is less. This project is analyzed using a discount rate of 15%,

(Click here to see present value and future value tables)

A. Calculate the NPV on both Cars. Round your present value factor to three decimal places and the rest to nearest dollar.

Present Car S

-75,250.11 X

New Car

-73,168.20 x

B. What should Pompeil's do?

Pompeil's should retain the present car

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- just A.arrow_forwardPlease explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forwardWendell’s Donut Shoppe is investigating the purchase of a new $40,000 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $5,200 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,000 dozen more donuts each year. The company realizes a contribution margin of $2.40 per dozen donuts sold. The new machine would have a six-year useful life. Required: 4. In addition to the data given previously, assume that the machine will have a $10,515 salvage value at the end of six years. Under these conditions, what is the internal rate of return? (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero.) (Round your final answer to the nearest whole percentage.)arrow_forward

- The city of Bloomington is deciding if they are going to be able to justify an additional street light. The cost of the light to install is $14,000. City officials believe it will reduce the death rate at that intersection from 1.0% to 0.6%. Our guideline for valuing human life is $8M per person. What is the net of this cost benefit proposal? A. 32,000 B. 18,000 C. (18,000) D. (32,000)arrow_forwardBrown's, a local bakery, is worried about increased costs particularly energy. Last year's records can provide a fairly good estimate of the parameters for this year. Wende Brown, the owner, does not believe things have changed much, but she did invest an additional $3,000 for modifications to the bakery's ovens to make them more energy efficient. The modifications were supposed to make the ovens at least 20% more efficient. Brown has asked you to check the energy savings of the new ovens and also to look over other measures of the bakery's productivity to see if the modifications were beneficial. You have the following data to work with Production (dozen) Labor (hours) Capital Investment (5) Energy (BTU) Last Year 1,600 340 15,000 3,000 Now 1,600 320 18,000 2,800 Energy productivity increase=% (enter your response as a percentage rounded to two decimal places and include a minus sign if necessary) Capital productivity increase=% (enter your response as a percentage rounded to two…arrow_forwardA hospital germ-fighting and floor cleaning robot, named Maurice, costs $104,000. Patients are billed $1 per day for Maurice’s use and upkeep. A certain 300-bed hospital is considering purchasing this robot. What is the simple payback period for Maurice? What assumptions did you make?arrow_forward

- Vancouver Shakespearean Theater's board of directors is considering the replacement of the theater's lighting system. The old system requires two people to operate it, but the new system would require only a single operator. The new lighting system will cost $115,700 and save the theater $24,000 annually for the next eight years. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Exercise 16-28 New Present Value with Different Discount Rates (Section 1) (LO 16-1) Required: 1-a. Prepare a table showing the proposed lighting system's net present value for each of the following discount rates: 8 percent, 10 percent, 12 percent, 14 percent, and 16 percent. 1-b. Based on your findings in requirement 1-a., Which statement is true? Complete this question by entering your answers in the tabs below. Req 1A Prepare a table showing the proposed lighting system's net present value for each of the following discount rates: 8 percent, 10 percent, 12 percent, 14…arrow_forwardJeff & Bezos is a fresh groceries delivery company. The company has access to borrowing funds at a pre-tax rate of 8 % per year. Jeff & Bezos pays income taxes using 22 % tax rate. The company would like to start using high-speed low-altitude drones to deliver grocery purchases directly to residential customers' backyards. The required fleet of drones costs $7,500,000. The fleet of drones, due to their heavy usage, would have no salvage value in four years. If the company chooses to buy them, the drones would be losing their economic value following the three-year property class under the MACRS depreciation method. Instead of buying the fleet of the drones, Jeff & Bezos is also contemplating leasing them for an estimated pre-tax annual cost of $2,205,000 per year for four years from a different company, Nets & Flicks, that currently owns the required number of the drones. Jeff & Bezos' net advantage to leasing, a.k.a. NAL, equals (Do not round intermediate calculations and round your…arrow_forwardPompeii's Pizza has a delivery car that it uses for pizza deliveries. The transmission needs to be replaced and there are several other repairs that need to be done. The car is nearing the end of its life, so the options are to either overhaul the car or replace it with a new car. Pompeii's has put together the following budgetary items: Present Car New Car Purchase cost new $31,000 Transmission and other repairs $9,000 Annual cash operating cost 13,000 10,000 Fair market value now 6,000 Fair market value in five years 500 6,000 If Pompeii's replaces the transmission of the pizza delivery vehicle, they expect to be able to use the vehicle for another 5 years. If they sell the old vehicle and purchase a new vehicle, they will use that vehicle for 5 years and then trade it in for another new pizza delivery vehicle. If they trade for the new delivery vehicle, their operating expenses will decrease because the new vehicle is more gas efficient and the maintenance on a new car is less. This…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education