ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

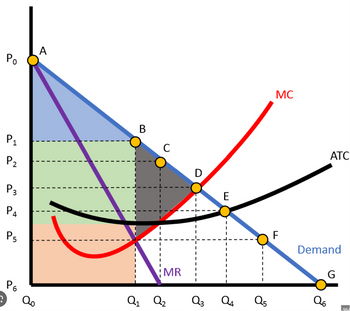

Please help me find the true statements, I originally choose 1,5,8, 9, 11, and 12 but I got an incorrect. Thank you.

1. This firm is a

2. This firm is competing in a perfectly competitive market

3.The firm will choose to produce quantity Q1

4.The firm will choose to produce quantity Q3

5.The firm will choose to produce quantity Q4

6.The area circumscribed by the points (Q0,Q1,B,P1) is equal to total revenue

7.The area circumscribed by the points (Q0,Q1,B,P1) is equal to total cost

8.The area circumscribed by the points (Q0,Q3,D,P3) is equal to total revenue

9.The area circumscribed by the points (Q0,Q3,D,P3) is equal to total cost

10.If the firm is producing Q1, it will make a profit

11. If the firm is producing Q3, it will make a profit

12. If the firm is producing Q1, it will not make a profit

13. If the firm is producing Q3, it will not make a profit

14. If the firm is producing Q4, it will make a profit

15. If the firm is producing Q4, it will not make a profit

Transcribed Image Text:Po

A

P1

P2

P3

Ра

P5

B

C

D

E

MC

MR

P6

Q1 Q2

Q3

Од

Q5

ATC

F

Demand

Q6

G

964

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 7 images

Knowledge Booster

Similar questions

- Question 3: Monopoly graph. Do parts a, b., c Draw the short-run ATC, AVC, MC, MR and Demand graphs for a monopoly market. In each part, show Total Cost (TC), Total Revenue (TR), shade the profit or loss. Clearly label Q for the equilibrium quantity point and P for market price point. a. Draw a profit situation b. Draw a loss (not shutdown) situation c. Draw a monopoly and perfectly competitive industry on the same graph space. Only show equilibrium quantity and price of monopoly (Qm and Pm) and quantity and price for a perfect competition situation denoted as (Qpc and Ppc). You do not need to identify TR, TC or shade the profit in this graph.arrow_forwardIn 2015, Apple introduced the Apple Watch. Assume that the cost of producing the 38mm Apple Watch Sport was $83. The price was $336. What was Apple's price/marginal cost ratio? What was its Lerner Index? If Apple is a short-run profit-maximizing monopoly, what elasticity of demand did Apple believe it faced? Part 2 Apple's price/marginal cost ratio was enter your response here.arrow_forward1. For a price searching firm it's marginal revenue curve (a). Is below it's marginal cost curve (b). Must be vertical (c). Must be horizontal (d). Is below it's a demand curve 2. The most common source of illegal Monopoly today is (a). Predatory pricing (b). Intellectual property rights (c). Royal edict (d). Natural monopoly 3. The market demand is given by p= 420-0.05Q, vrp is the price of the good and Q is the quantity demanded at that price. The monopolist marginal revenue function in this market is (a). MR= 210-0.05Q (b). MR= 420-0.05Q (c). MR= 420- 0.025Q (d). MR= 420-0.1Q 4. In the monopolized ( profit maximizing) market equilibrium p> MC( the price exceeds the marginal cost) this implies that (a). The consumer surplus is equal to the producer surplus (b). The total value of the good is maximized (c). The equilibrium is Marshall inefficient (d). The market price is equal to the market quantity 5. The market demand is given Q= 440-40P, where P is the price of the good…arrow_forward

- What is true about the monopoly's marginal revenue? Assume no price discrimination please (just one price can be used ) a.Marginal revenue is lower than the price (except for the first unit), because selling more requires the monopoly to discount the former units as well b. Marginal revenue is equal to price c.Marginal revenue is higher than price d.None of the other answers is correct Which one?arrow_forwardWhich of the following statements is true of a monopoly as compared to a perfectly competitive market with the same costs? * Consumer surplus is smaller. Profit is smaller. Deadweight loss is smaller. Total surplus is larger. O Quantity is larger.arrow_forwardYou are the owner of a monopoly firm. The demand curve that you face is: 100 0. 5Q - Your Total Cost and Marginal Cost are: 1035 +10Q +0. 5Q2 10 +Q TC |3| MC The government decides to regulate your firm and imposes the Efficient Price. What is the price you must set? Regulated Efficient price $77.5 Regulated Efficient price = $55 Regulated Efficient price = $60 Regulated Efficient Price = $70arrow_forward

- Compared to a competitive firm, a monopoly will ... (select all correct answers) A. produce an output where marginal revenue is lower than marginal cost B. charge a higher price □ C. produce greater quantities OD. be less efficientarrow_forwardSuppose there are 5 types of consumers: Type A. Type B. Type C. Type D, and Type E. There are 3,000 of each type. Two software products are sold by a monopolist: spreadsheets and word processing. Assume the marginal cost of production is $0. Consumer Type A B C D E Number 3,000 3.000 3,000 3.000 3,000 Spreadsheet 800 300 200 100 0 b. What is profit at this pricing policy? $ Willingness to Pay Word Processor Instructions: Round your answers to the nearest whole number. a. What will be the profit-maximizing bundle price? $ 0 100 200 300 800 Both 800 400 400 400 800 c. How will profit from this pricing policy compare to profit under independent pricing of the two goods? When pricing independently, the profit-maximizing price for spreadsheets is $ processing is $ d. What is profit under independent pricing? $ and the profit-maximizing price for wordarrow_forwardMarkbury is a monopoly selling widgets. If the government imposes a $100 000 tax on every monopolistic firm in the country, then Select one: a. Markbury’s annual profit will no change since its marginal cost is unchanged b. Markbury’s annual profit will fall by $100 000 since its marginal cost would rise by $100 000 c. Markbury’s annual profit will fall by less than $100 000 since its marginal cost would rise by less than $100 000 d. Markbury’s annual profit will fall by $100 000 but its marginal cost will not change e. The impact on Markbury’s profit is difficult ascertain, without more informationarrow_forward

- The graph shown represents the cost and revenue curves faced by a monopoly. 22 P3 P2 P1 PO MC ATC Q1 Q2 MR Which of the following statements is true? 1. The outcome in a monopoly market would be Q1, P1. II. The outcome in a perfectly competitive market would be Q2, P2. III. The efficient outcome is Q2, P2. Multiple Choice I and II only ○ I only II and Ill only I, II, and III barrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPrice Average (dollars Marginal cost per unit) 10 cost 6 Demand Marginal revenue 10 20 30 40 45 Quantity (units per day) The graph above shows the average cost, marginal cost, demand, and marginal revenue curves for a monopoly firm. If the firm seeks to maximize profit, it should set a price equal to Select one: $4. O b. $8. O c. $6 O d. $10. Clear my choicearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education