Understanding Business

12th Edition

ISBN: 9781259929434

Author: William Nickels

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Question

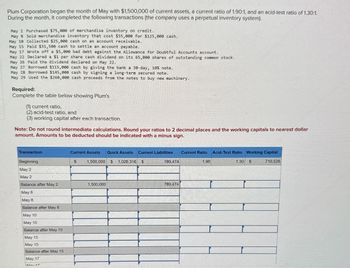

Transcribed Image Text:Plum Corporation began the month of May with $1,500,000 of current assets, a current ratio of 1.90:1, and an acid-test ratio of 1.30:1.

During the month, it completed the following transactions (the company uses a perpetual inventory system).

May 2 Purchased $75,000 of merchandise inventory on credit.

May 8 Sold merchandise inventory that cost $55,000 for $125,000 cash.

May 10 Collected $25,000 cash on an account receivable.

May 15 Paid $31,500 cash to settle an account payable.

May 17 Wrote off a $5,000 bad debt against the Allowance for Doubtful Accounts account.

May 22 Declared a $1 per share cash dividend on its 65,000 shares of outstanding common stock.

May 26 Paid the dividend declared on May 22.

May 27 Borrowed $115,000 cash by giving the bank a 30-day, 10% note.

May 28 Borrowed $145,000 cash by signing a long-term secured note.

May 29 Used the $260,000 cash proceeds from the notes to buy new machinery.

Required:

Complete the table below showing Plum's

(1) current ratio,

(2) acid-test ratio, and

(3) working capital after each transaction.

Note: Do not round intermediate calculations. Round your ratios to 2 decimal places and the working capitals to nearest dollar

amount. Amounts to be deducted should be indicated with a minus sign.

Transaction

Beginning

Current Assets Quick Assets Current Liabilities

$

1,500,000 $ 1,026,316 $

789,474

1.90

Current Ratio Acid-Test Ratio Working Capital

1.30 $

710,526

May 2

May 2

Balance after May 2

1,500,000

May 8

May 8

Balance after May 8

May 10

May 10

Balance after May 10

May 15

May 15

Balance after May 15

May 17

May 17

789,474

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Perpetual Inventory Using LIFO Beginning inventory, purchases, and sales data for DVD players are as follows: November 1 Inventory 79 units at $63 10 Sale 63 units 15 Purchase 102 units at $67 20 Sale 57 units 24 Sale 14 units 30 Purchase 21 units at $70 The business maintains a perpetual inventory system, costing by the last-in, first-out method. Determine the cost of merchandise sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 4. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Goods Sold LIFO Method DVD Players Quantity Date Purchased Purchases Unit Cost Purchases Total Cost Quantity Sold Cost of Goods Cost of Goods Sold Unit Cost Sold Total Cost Inventory Quantity Inventory Unit Cost Inventory Total Cost Nov. 1 Nov. 10 Nov. 000…arrow_forwardThe Majestic Theater had 378 cans of Kettle Corn and 132 cans of regular Pop Corn on hand at month end. During the next month Majestic sold 142 cans of Kettle Corn and 67 cans of regular Pop Corn. Cans of each cost $28.40. What is the value of the inventory on hand at the end of the second month?arrow_forwardPipe Company orders six irrigation pumps from Quality Pumps Inc. The pumps are stored in Re-storage Warehouse. Under the terms of the order, Quality must give Pipe a warehouse receipt for the goods, which the buyer will then pick up. Title to the goods passes to Pipe when a. Quality stores the pumps. b. Pipe picks up the pumps. c. Quality gives Pipe the warehouse receipt. d. Pipe orders the pumps.arrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardDistinguish between FOB destination and FOB origin. Whatprocedures should the auditor follow concerning acquisitions of inventory on an FOBorigin basis near year-end?arrow_forward5. Suppose you are expecting your fourth child in six months and you need a bigger car. You have your eye on a used three-year-old minivan that currently costs approximately $10,000. You are concerned about the pricing and availability of this specific car in six months' time, but you won't have enough money to purchase the car until six months from today. a. How could you advertise in the newspaper for a forward contract with a counterparty that would eliminate your risk? b. Who would be willing to take the short position on your forward contract? (Who is the likely counterparty?)arrow_forward

- In 2018, Proctor and Gamble reported Inventory of $5.017 billion and cost of goods sold of $66.832 billion. Proctor and Gamble has an annual holding cost percentage of 30%. Express your answer as a percentage and round to two decimal places. What was their holding cost as a percentage of cost of goods sold during 2018? %arrow_forwardIntangible capital assets are included in which CCA class(es) for income tax purposes? O A. Classes 14 and 14.1 B. Classes 10 and 10.1 OC. Class 13 OD. Classes 8 and 10arrow_forwardSubject: accountingarrow_forward

- Use the inventory table and the gross profit inventory method to estimate the ending inventory and cost of goods sold if a 40% gross profit is realized on sales and net sales are $115,990. Date of purchase Units Cost per Total Retail price Total retail purchased unit cost per unit value Beginning inventory 41 $830 $34,030 $985 $40,385 February 5 20 $1,750 $35,000 $2,115 $42,300 February 19 15 $975 $14,625 $1,996 $29,940 March 3 28 $470 $13,160 $610 $17,080 Goods available for sale 104 $129,705 Units sold 81 Ending inventory 23 The estimated cost of goods sold is $arrow_forward3arrow_forward6. At the beginning of November, children’s toys had a retail stock of $148,270. Sales for the month were $40,510. What was the stock-sales ratio for November? Round to two decimal points.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education

Understanding BusinessManagementISBN:9781259929434Author:William NickelsPublisher:McGraw-Hill Education Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON

Management (14th Edition)ManagementISBN:9780134527604Author:Stephen P. Robbins, Mary A. CoulterPublisher:PEARSON Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning

Spreadsheet Modeling & Decision Analysis: A Pract...ManagementISBN:9781305947412Author:Cliff RagsdalePublisher:Cengage Learning Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON

Management Information Systems: Managing The Digi...ManagementISBN:9780135191798Author:Kenneth C. Laudon, Jane P. LaudonPublisher:PEARSON Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON

Business Essentials (12th Edition) (What's New in...ManagementISBN:9780134728391Author:Ronald J. Ebert, Ricky W. GriffinPublisher:PEARSON Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Fundamentals of Management (10th Edition)ManagementISBN:9780134237473Author:Stephen P. Robbins, Mary A. Coulter, David A. De CenzoPublisher:PEARSON

Understanding Business

Management

ISBN:9781259929434

Author:William Nickels

Publisher:McGraw-Hill Education

Management (14th Edition)

Management

ISBN:9780134527604

Author:Stephen P. Robbins, Mary A. Coulter

Publisher:PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract...

Management

ISBN:9781305947412

Author:Cliff Ragsdale

Publisher:Cengage Learning

Management Information Systems: Managing The Digi...

Management

ISBN:9780135191798

Author:Kenneth C. Laudon, Jane P. Laudon

Publisher:PEARSON

Business Essentials (12th Edition) (What's New in...

Management

ISBN:9780134728391

Author:Ronald J. Ebert, Ricky W. Griffin

Publisher:PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:9780134237473

Author:Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:PEARSON