Question

Subject: accounting

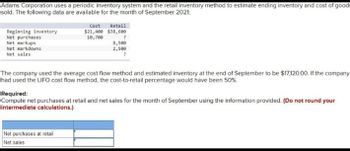

Transcribed Image Text:Adams Corporation uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods

sold. The following data are available for the month of September 2021:

Beginning inventory

Net purchases

Net markups

Net markdowns

Net sales

Cost Retail

$21,400 $38,600

10,700

?

8,500

2,500

?

The company used the average cost flow method and estimated inventory at the end of September to be $17,120.00. If the company

had used the LIFO cost flow method, the cost-to-retail percentage would have been 50%

Net purchases at retail

Net sales

Required:

Compute net purchases at retail and net sales for the month of September using the information provided. (Do not round your

intermediate calculations.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- QUESTION 1 You have been consulted by Marie who is an Australian resident adult individual taxpayer entity and a real estate agent employed by Adelaide property firm Supreme Properties. Her employment duties involve selling homes on behalf of clients, including conducting open inspections of those homes. Marie moved to Adelaide from Sydney, New South Wales, at the beginning of July 2022 after the breakdown of her marriage. She has custody of their two children, Harry aged 4 years and Larry aged 2 years, who Marie places in child care during some week days and on weekends while she works. During the income year ended 30 June 2023, Marie received and derived the following: (1) Wages totalling $100,000 and commissions of $20,000 that Marie received from her employer Supreme Properties. The commissions were received by Marie on 15 June 2023 and were calculated as a percentage of the total value of properties sold by her during the year, and were paid as an incentive to employees of the…arrow_forwardWhich of the following departments would be responsible for accounting for hotel assets and liabilities? Question 15 options: a) Controller’s office b) Security c) Front office d) Reservationsarrow_forwardAn interest in a general partnership is a form of a security under the 1933 Act. Question 12 options: True Falsearrow_forward

- 5. Which of the following is a disadvantage of partnership? Question 5 options: Unlimited liability. More independence than proprietorship. Easy to form. Pooled talent.arrow_forwardKerrigan Corporation announced on November 1, 2021 that company's CEO has been terminated and that James McCabe will become the company's new CEO. Kerrigan has had decreasing income over the last several of years. McCabe will be responsible for improving Kerrigan's future performance. What earnings management technique will the company probably utilize as a result of hiring a new CEO? Question 31 options: a) Accelerating future period expenses into the current period b) Accelerate current period revenues into future periods c) Big Bath d) Increase cookie jar reservesarrow_forwardQUESTION 25 LF Corporation, a manufacturer of Mexican foods, contracted in 2025 to purchase 2,000 pounds of a spice mixture at $5.00 per pound, delivery to be made in spring of 2026. By 12/31/25, the price per pound of the spice mixture had increased to $5.30 per pound. In 2025, LF should recognize a loss of $10,000 a loss of $600. no gain or loss. O a gain of $600arrow_forward

- QUESTION FOUR [35] 4.1 Discuss the people element affecting the operational risk environment. (10) 4.2 Assess the importance of investment and financing considerations during the risk management prioritisation process. (10) 4.3 Explain the correlation between deductibles and risk management. (15arrow_forwardQuestion 24:arrow_forwardQuestion9  Under the modified accrual basis of accounting: a. Revenues are recognized at the time an exchange transaction occurs. b. Expenses are recognized when an obligation occurs for costs incurred in providing services. c. Expenditures are recognized as the cost of an asset expires or is used up in providing governmental services. d. Revenues are recognized when current financial resources become measurable and available to pay current-period obligations.arrow_forward

- Pls help ASAParrow_forwardA suburban office building in Fort Worth, Texas with 36,000 square feet was purchased for $4,500,000 at an 8% cap rate. Debt service for the first year was $305,000 of which $236,000 was interest and $69,000 was principal. Annual depreciation for tax purposes was $148,000. What was the property’s first year taxable income? a. $124,000 b. $212,000 c. - $24,000 d. $55,000arrow_forwardIncorrect Question 7 After you finish speaking at a business law conference, an eager fan asks you how long is an offer considered open for acceptance by the offeree. Your pithy reply is which of the following? Unless the terms of the offer state otherwise, the offer is open for a reasonable amount of time. Indefinitely, until the offeror revokes or rescinds it. Only 10 days, no exceptions. 30 days unless the parties agree otherwise.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios