Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

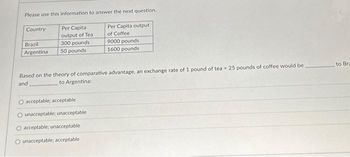

Transcribed Image Text:Please use this information to answer the next question.

Country

Brazil

Argentina

Per Capita

output of Tea

300 pounds

50 pounds

O acceptable; acceptable

unacceptable; unacceptable.

Per Capita output

of Coffee

Based on the theory of comparative advantage, an exchange rate of 1 pound of tea 25 pounds of coffee would be

and

to Argentina:

O acceptable; unacceptable

O unacceptable; acceptable

9000 pounds

1600 pounds

to Bra

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please explain how the bolded option is the correct answerarrow_forwardAn investor based in the US invests $1,200 in Mexico and this generates a future value in one year of $1,344.44, US. If the interest rate in Mexico is 10% and the future expected exchange rate is Et41 = 5.4, this implies that the current exchange rate must be O 5.25 O 5.7 O 4.85 O 5.5arrow_forward1 Suppose that 1-year interest rate in US is 2%, 1-year interest rate in Japan is 3%, spot exchange rate is Yen 110/$, 1-year forward rate is Yen 112/$. Will you prefer to invest in Japan or in US? No difference to invest in Japan or in US A₁ B₁ C₁ In China D₂ In US In Japanarrow_forward

- 3. Trading in foreign exchange What are spot rates and forward rates? Purple Whale Foodstuffs Inc., a U.S. company, produces and exports industrial machinery overseas. It recently made a sale to a Japanese manufacturing firm for ¥625 million, but the Japanese firm has 60 days before it must make the payment to Purple Whale Foodstuffs Inc. The spot exchange rate is ¥128.75 per dollar, and the 60-day forward rate is ¥133.45 per dollar. Is the yen selling at a premium or at a discount in the forward market relative to the U.S. dollar? The yen is trading at a discount in the forward market. In the forward market, the yen is trading at a premium. If the customer pays Purple Whale Foodstuffs Inc. the ¥625 million today, how much will Purple Whale Foodstuffs Inc. receive in dollars? O $4.85 million $5.34 million $5.09 million O $5.58 million Assuming that the forward market is correct and the spot exchange rate in 60 days will equal the 60-day forward exchange rate today, Purple Whale…arrow_forwardFinance 5. On 4/10/2022, the exchange rates are as follows: 1 British Pound = USD $1.30 1 Australian dollar = 0.57 British Pound 1 Australian dollar = 87.59 Japanese Yen $1 USD = 1.34 Australian dollar $1 USD = 124.46 Japanese Yen (a) ABC is considering expanding its sales of orange juice overseas. If the product is produced in ABC’s Australian brunch with cost 2.20 Australian dollars, ship to UK, where it can be sold for 1.54 British pound. What is the profit measured by US dollars on the sale? (b) If ABC produces a liter of orange juice in its US headquarters and ship it to Japan for USD $1.45 per unit. If the firm wants a 25% markup on the project, what should be the price of the juice sold in Japan measured by Yen, if using the exchange rate as shown above? (c) If the shipped orange juice in Japan is actually sold for 215 Yen, by PPP, what is the exchange rate between USD and Yen (Yen/USD $1) implied? Do not provide handwritten solution. Maintain accuracy and quality in your…arrow_forwardSee the ECONOMICS Table below: New York London Zurich Big Mac price $5.65 £3.49 CHF 6.89 Exchange rate of $1 $1 £0.73 CHF 0.92 Exchange rate of CHF1 $1.09 £0.79 CHF1 Using the above values determine whether the Purchasing Power Parity is valid and if not identify if the £ and the Swiss Franc (CHF) are overvalued or undervalued against the $ and whether the £ is undervalued / overvalued against the CHFarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education