FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

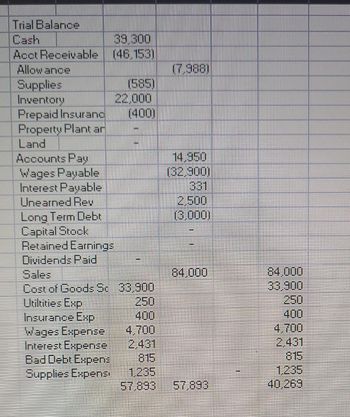

please take below

conver it into financial statements.

questions

1- make an income statement for this month

2- make a statement of equity for this month

3- make a

4- how many units and at what cost are in inventory to start the next month (february)?

Transcribed Image Text:Trial Balance

Cash

Acct Receivable

Allowance

Supplies

Inventory

Prepaid Insuranc

Property Plant ar

Land

Accounts Pay

Wages Payable

Interest Payable

Unearned Rey

39,300

(46,153)

Long Term Debt

Capital Stock

Retained Earnings

Dividends Paid

Bad Debt Expens

Supplies Expensi

22,000

(400)

Cost of Goods Sc 33,900

Utiltities Exp

Insurance Exp

Wages Expense

Interest Expense

250

400

4,700

815

14,950

(32,900)

2,500

13,000)

84,000

57,893

84,000

33,900

815

40,269

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Given that selling, distribution and administrative costs for the quarter were $23,445, $10,250 and $75,435 respectively, prepare an income statement for All Things Auto (DieHard) for the quarter ended December 31, 2020, to determine the net profit for the quarter.arrow_forwardAnother way to look at the concept of inventory turnover is by measuring sales per square foot. Taking the average inventory at retail and dividing it by the number of square feet devoted to a particular product will give you average sales per square foot. When you multiply this figure by the inventory turnover rate, you get the annual sales per square foot.arrow_forwardhe following data are available for Sellco for the fiscal year ended on January 31, 2020: Sales 1,600 units Beginning inventory 500 units @ $ 4 Purchases, in chronological order 600 units @ $ 5 800 units @ $ 6 500 units @ $ 8 Required:a. Calculate cost of goods sold and ending inventory under the cost flow assumptions, FIFO, LIFO and weighted average (using a periodic inventory system): (Round unit cost to 2 decimal places.) b. Assume that net income using the weighted-average cost flow assumption is $80,000. Calculate net income under FIFO and LIFO. (Round unit cost to 2 decimal places.)arrow_forward

- Find the On Balance Volume(photo) 1. What is the OBV on 10 May?2. What is the OBV on 05 May?arrow_forwardWhat is the value of the ending inventory using the FIFO cost assumption if 600 units remain on hand at October 31.arrow_forwardOahu Kiki tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each month, as if it uses a periodic inventory system. Assume Oahu Kiki’s records show the following for the month of January. Sales totaled 260 units. Date Units Unit Cost Total Cost Beginning Inventory January 1 100 $ 75 $ 7,500 Purchase January 15 360 95 34,200 Purchase January 24 240 115 27,600 Required: Calculate the number and cost of goods available for sale. Calculate the number of units in ending inventory. Calculate the cost of ending inventory and cost of goods sold using the (a) FIFO, (b) LIFO, and (c) weighted average cost methods.arrow_forward

- I just need help with journalizing the transactions. thank youarrow_forwardYou have been provided with the following information for Lns Shoe Outlet which accounts for its inventory using the periodic system. Its financial year ends September 30. All purchases and sales are made on account. Physical count at beginning of September 30, 2020 valued inventory of shoes at $469,780. Included in the physical count was shoes purchased for $20,840 on September 17 from Kmart. The shoes were shipped f.o.b. destination point on September 30 and arrived October 7. The invoice was received and recorded on appropriately. Shoes purchased from Walmart on September 25 for $17,080 and shipped f.o.b. destination were received on September 30 after inventory had been counted. The invoice was received and recorded appropriately. On September 29, shoes were received from Leather Made with an invoice price of 531,260. The shoes were shipped to Lns Shoe Outlet f.o.b. destination. The invoice, which had not yet arrived, had not been recorded on September 30. Chef shoes sold to…arrow_forwardThe units of an item available for sale during the year were as follows: Date Line Item Description Value Jan. 1 Inventory 2,900 units at $5 Feb. 17 Purchase 2,800 units at $7 Jul. 21 Purchase 3,200 units at $9 Nov. 23 Purchase 1,100 units at $11 There are 1,400 units of the item in the physical inventory at December 31. The periodic inventory system is used. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. a. Determine the inventory cost by the first-in, first-out method. b. Determine the inventory cost by the last-in, first-out method. c. Determine the inventory cost by the weighted average cost method. Round your answer to the nearest dollararrow_forward

- Apply mathematical skills around cost structures and appropriate equations to answer the following, inclusive of all associated workings to maximise marks: The inventory value for the financial statements of Zyon for the year ended 31st Oct 2022 was based on an inventory count on 3rd Nov 2022, which gave a total inventory value of $836,200.Between 31st Oct and 3rd Nov, the following transactions took place:Purchases of goods $8,600. Sales of goods (profit margin 35% on sales $14,000). Goods returned by Zyon to supplier $878. What adjusted figure should be included in the financial statements for inventories at 31st Oct 2022 to nearest hundred?arrow_forwardLuke's Lamps had a beginning inventory January 1, 2020 of $970,000. They sold goods that cost $770,000 and purchased $300,000 during the month. What should Luke expect its ending inventory balance is at the end of month (January 31, 2020)? a. $1,770,000 b. $500,000 c. $300,000 d. $1,270,000arrow_forwardComplete the table: (Round your "Unit cost" answers to the nearest cent.) Units Cost Dollar cost Beginning inventory Jan 1 20 $8.00 May 10 15 $11.00 June 30 17 $20.00 Dec 10 12 $21.00arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education