Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

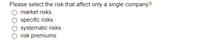

Transcribed Image Text:Please select the risk that affect only a single company?

market risks.

specific risks.

systematic risks.

risk premiums.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Another name for systematic risk is: Unique risk None of these are correct Diversifiable risk Firm-specific riskiarrow_forwardThe systematic risk principle states that the expected return on a risky asset depends only on which one of the following? Unsystematic risk Market risk Diversifiable riskarrow_forwardidentify the assumptions underlying the interest coverage ratio appropriate measure for analyzing long-term solvency risk? Alternatively, can you identify the assumptions underlying the interest coverage ratio appropriate measure for analyzing short-term solvency risk?arrow_forward

- Define each of the following terms: d. Stand-alone risk; corporate (within-firm) risk; market (beta) riskarrow_forwardDefine the terms, or give short explanations. -risk-free rate -risk management -risk neutrality risk preference -risk premium -risk-return trade-offarrow_forwardWhat type of risk is the risk that belongs to the market as a whole? Systematic risk Unsystematic risk (or nonsystematic risk) Total riskarrow_forward

- Give an example of a risk that is clearly a diversifiable risk and one that is clearly a non-diversifiable risk.arrow_forward8. Fluctuations of a security's return that are due to market-wide news representing common risk is the ________. A. Idiosyncratic risk B. Systematic risk C. Unique risk D. Unsystematic riskarrow_forwardExplain the concept of risk - return trade-off in investing. How do investors balance risk and return. when making investment decisions?arrow_forward

- Which are the different assets that have the potential to be combined efficiently in a portfolio that will provide an optimal risk-return relationship for investors?arrow_forwardProvide a review of the most important risk measures available for assessing the risk of a portfolio. Explain what the advantages and disadvantages of each metric are. Give an overview of the latest regulatory guidelines in terms of which measures to use and which one to decommission, and the rationale behind these guidelines.arrow_forwardSystematic risk is diversifiable, so it is an investment's relevant risk. Unsystematic risk is O True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education