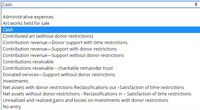

PLEASE HELP WITH THE ACCOUNTS FOLLOWED BY THE RED "X" (SEE IMAGE)

Prepare journal entries to record the following transactions.

1. Donor A gave the nonprofit a cash gift of $50,000 in June 2019, telling the nonprofit the gift could not be used until 2020. (Identify the affected net asset classification(s) in the journal entries made both in June 2019 and at the start of 2020.)

2. Attorney Howard Gorman volunteered his services to Taconic Singers, a nonprofit. He spent 12 hours preparing contracts for the services of professional singers and 8 hours serving as an usher before performances. Gorman normally gets $200 an hour for legal services, and Taconic normally pays $8 an hour when it hires ushers.

3. Donor B sent a letter to a nonprofit, saying she would donate $20,000 in cash to the nonprofit, to be used for any purpose the nonprofit’s trustees desired, provided the nonprofit raised an equal amount of cash from other donors.

4. Regarding the previous transaction, the nonprofit raised $23,000 in cash from other donors and then notified Donor B of its success in meeting her condition for the gift.

5. Donor C donates to a local museum a work of art having a fair value of $5,000, with the understanding that the museum will sell it at auction and use the funds for its general activities.

6. Donor D advises a university that he has established an irrevocable charitable remainder trust, administered by his attorney, whereby his wife will receive income from the trust as long as she lives. At her death, the remaining trust assets will be distributed to the university as a permanent endowment. The university’s actuary estimates the fair value of the university’s beneficial interest to be $400,000.

7. As of December 31, 2019, the fair value of investments held in perpetuity by a nonprofit had increased by $30,000.

If a transaction doesn't require a

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- A donor gave $75,000 to a nongovernmental, not-for-profit charity with instructions that s be transferred to Sam Smith, an individual who lost his home in a fire. The not-for-profit w A) A. Record the $75,000 cash and credit revenue with donor restrictions. B) B. Record the $75,000 cash and credit a liability. C) C. Not record the transaction, because the money is going directly to the intended D) D. Do either of the choice A or B, depending upon the policy of the not-for-profit.arrow_forwardOn January 1, 2020, a rich citizen of the Town of Ristoni donates a painting valued at $370,000 to be displayed to the public in a government building. Although this painting meets the three criteria to qualify as an artwork, town officials choose to record it as an asset. The gift has no eligibility requirements. These officials judge the painting to be inexhaustible so that depreciation will not be reported. o. For the year ended December 31,2020 , what does the town report on its government-wide financial statements in connection with this gift? b. How does the answer to requirement (a) change if the government decides to depreciate this asset over a 10-year period using straight-line depreciation? c. How does the answer to requirement (a) change if the government decides not to capitalize the asset? Complete this question by entering your answers in the tabs below. Required A For the year ended December 31,2020, what does the town report on its government-wide financial statements…arrow_forwardA person pledges a new additional long-term multi-year donation. They do trust the staff of the nonprofit and its daily leadership to grow the mission but this time for the multiple years of the grant, the donor wants the money to go to a particular one of the services the nonprofit offers. How should donor designate the grant?arrow_forward

- do not give solution in image formatarrow_forwardIn need help with preparing the following for journal entries, balance and statement sheets. I would like to know how close I'm to the right answers A donor made a $1,000,000 pledge, giving the foundation a legally enforceable 90-day note for the full amount. The same donor paid $500,000 of the amount pledged. The foundation purchased a building for $900,000, paying $90,000 in cash and giving a ten-year mortgage for the balance. The building has a 25-year useful life. The foundation charges a half-year’s depreciation for all assets in the year they are acquired. The foundation hired five employees. By year-end, these employees have earned $10,000 in salaries and wages for which they have not been paid. The foundation accounts for its activities in a single fund. Prepare journal entries to record the transactions, making the following alternative assumptions as to the fund’s measurement focus: Cash only Cash plus other current financial resources (cash plus short-term receivables…arrow_forwardE13.1 Reporting Various Contributions The Castile County Rescue Mission receives the following donations: 1. A donor contributes cash, with no restrictions or conditions. 2. An accountant provides services in completing and filing Form 990. 3. Volunteers provide services in staffing the local soup kitchen. 4. A donor signs an agreement promising to contribute cash in two years. 5. A donor contributes land with no restrictions as to use. 6. A donor contributes cash, specifying that it be used to support a program to teach life skills to battered women. Required Identify how each contribution is reported on the Mission’s statement of activities. The contribution either (a) increases or decreases net assets without donor restrictions, (b) increases or decreases net assets with donor restrictions, or (c) is not reported as a change in net assets. Transaction Affects on net assets 1 2 3 4 5 6arrow_forward

- The Kare Counseling Center was incorporated as a not-for-profit organization 10 years ago. Its adjusted trial balance as of June 30, 2023, follows. Cash Pledges Receivable-Without Donor Restrictions Estimated Uncollectible Pledges Inventory Investments Furniture and Equipment Accumulated Depreciation Furniture and Equipment Accounts Payable Net Assets Without Donor Restrictions Net Assets With Donor Restrictions-Programs Net Assets With Donor Restrictions-Permanent Endowment Contributions-Without Donor Restrictions Contributions-With Donor Restrictions Programs Investment Income-Without Donor Restrictions Net Assets Released from Restrictions-With Donor Restrictions Net Assets Released from Restrictions-Without Donor Restrictions Salaries and Fringe Benefit Expense Occupancy and Utility Expense Supplies Expense Printing and Publishing Expense Telephone and Postage Expense Unrealized Gain on Investments Depreciation Expense Totals Required a. Prepare a statement of financial position as…arrow_forwardThe Foundation had the following preclosing trial balance at December 31, 2020, the end of its fiscal year: Trial Balance-December 31, 2020 Accounts payable Accounts receivable (net) Accrued interest receivable Accumulated depreciation Cash Contributed services Contributions-no restrictions Contributions-purpose restrictions Contributions-endowment Current pledges receivable Education program expenses Fund-raising expenses Investment revenue-purpose restrictions Training seminars expenses Land, buildings, and equipment Long-term investments Management and general expenses Net assets without donor restrictions Net assets with donor restrictions Net gains on endowments no restrictions Noncurrent pledges receivable Program service revenue - no restrictions Post-employment benefits payable (long-term) Reclassification-Satisfaction Reclassification-Satisfaction Reclassification-Satisfaction Reclassification-Satisfaction Research program expenses Short-term investments Supplies inventory…arrow_forwardOn January 1, 2020, a rich citizen of the Town of Ristoni donates a painting valued at $300,000 to be displayed to the public in a government building. Although this painting meets the three criteria to qualify as an artwork, town officials choose to record it as an asset. The gift has no eligibility requirements. These officials judge the painting to be inexhaustible so that depreciation will not be reported. For the year ended December 31, 2020, what does the town report on its government-wide financial statements in connection with this gift? How does the answer to (a) change if the government decides to depreciate this asset over a 10-year period using straight-line depreciation? How does the answer to (a) change if the government decides not to capitalize the asset?arrow_forward

- On July 1, 2019, the Morgan County School District received a $40,000 gift from a local civic organization with the stipulation that, on June 30 of each year, $2,500 plus any interest earnings on the unsoent principal be awarded as a collegescholorship to the high school graduate with the highest academic average. A private-purpose trust fund, the Civic Scholorship Fund, was created. Required: a. Record the followin gtransactions on the books of the Civic Scholorship Fund =: 1. On July 1, 2019, the gift was received and immediatly invested. 2. On June 30, 2020, $2,500 of the principal was converted to cash. In addition, $1,000 of interest was received. 3. On June 30 , the $3,500 was awarded to a student who had maintained a 4.0 gpa throughout her four years. 4. The nominal accounts were closed. B. Prepare a Statement of Changes in Fiduciary Net Position for the Civic Scholorship Fund for the year ended June 30, 2020.arrow_forward3.) Required: On January 1, 2024, a foundation made a pledge to pay $20,000 per year at the end of each of the next five years to the Cancer Research Center, a nonprofit voluntary health and welfare organization, as a salary supplement for a well-known researcher. On December 31, 2024, the first payment of $20,000 was received and paid to the researcher. On the books of the Cancer Research Center, record the pledge in January, assuming the appropriate discount rate is 5 percent on an annual basis. The appropriate present value annuity factor is 4.3295. Record the increase in the present value as of December 31. Record the receipt of the first $20,000 on December 31 and the payment to the researcher. Note: If no entry is required for a transaction or event, select "No Journal Entry Required" in the first account field. Round intermediate calculations and final answers to the nearest whole dollar.arrow_forwardA private not-for-profit entity receives numerous pledges of financial support to be conveyed at various times over the next few years. Under what condition should these pledges be recognized as receivables and contributed support? At what amount should these pledges be reported?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education