FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please help solve the rest of 2B

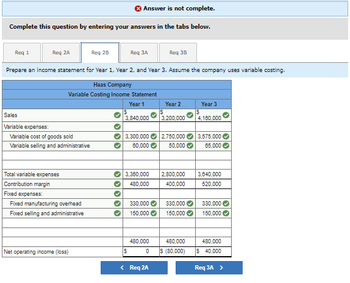

Transcribed Image Text:**Income Statement Preparation Using Variable Costing for Years 1, 2, and 3: Haas Company**

This section entails the preparation of income statements for Haas Company for three consecutive years under the variable costing method.

---

**Variable Costing Income Statement**

| | Year 1 | Year 2 | Year 3 |

|--------------------|----------------|---------------|----------------|

| **Sales** | $3,840,000 | $3,200,000 | $4,160,000 |

| **Variable Expenses** | | | |

| - Variable Cost of Goods Sold | $3,300,000 | $2,750,000 | $3,575,000 |

| - Variable Selling and Administrative | $60,000 | $50,000 | $65,000 |

| **Total Variable Expenses** | $3,380,000 | $2,800,000 | $3,840,000 |

| **Contribution Margin** | $480,000 | $400,000 | $520,000 |

| **Fixed Expenses** | | | |

| - Fixed Manufacturing Overhead | $330,000 | $330,000 | $330,000 |

| - Fixed Selling and Administrative | $150,000 | $150,000 | $150,000 |

| **Total Fixed Expenses** | $480,000 | $480,000 | $480,000 |

| **Net Operating Income (Loss)** | $0 | ($80,000) | $40,000 |

---

**Explanation of Table Components:**

1. **Sales**: The total revenue generated from goods sold by the company.

2. **Variable Expenses**: Costs that vary directly with the level of production or sales volume.

- **Variable Cost of Goods Sold**: Direct costs attributable to the production of goods that were sold.

- **Variable Selling and Administrative Expenses**: Costs associated with the variable aspect of selling and administrative activities.

3. **Total Variable Expenses**: The sum of the variable cost of goods sold and variable selling and administrative expenses.

4. **Contribution Margin**: Sales revenue minus total variable expenses. It contributes towards covering fixed expenses and improving net profit.

5. **Fixed Expenses**: Costs that do not vary with the level

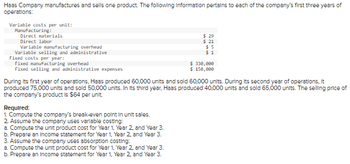

Transcribed Image Text:**Haas Company Overview for Educational Website**

Haas Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations:

### Variable Costs per Unit:

**Manufacturing:**

- Direct materials: $29

- Direct labor: $21

- Variable manufacturing overhead: $5

**Variable Selling and Administrative:**

- $1 per unit

### Fixed Costs per Year:

**Manufacturing Overhead:**

- $330,000

**Selling and Administrative Expenses:**

- $150,000

### Production and Sales Data:

- **Year 1:** Produced 60,000 units; Sold 60,000 units.

- **Year 2:** Produced 75,000 units; Sold 50,000 units.

- **Year 3:** Produced 40,000 units; Sold 65,000 units.

The selling price of the company's product is $64 per unit.

### Required Calculations and Analysis:

1. **Compute the company’s break-even point in unit sales.**

2. **Assume the company uses variable costing:**

- Compute the unit product cost for Year 1, Year 2, and Year 3.

- Prepare an Income Statement for Year 1, Year 2, and Year 3.

3. **Assume the company uses absorption costing:**

- Compute the unit product cost for Year 1, Year 2, and Year 3.

- Prepare an Income Statement for Year 1, Year 2, and Year 3.

In this case, further analysis and detailed calculation would be needed to answer the specific required points such as break-even analysis, unit product cost computation, and preparation of income statements using variable and absorption costing for different years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Can you simplify this please.arrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forwardWould you please provide the answer for #4 as well? Thank you!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education