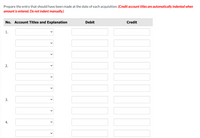

Plant acquisitions for selected companies are as follows.

1. Sarasota Corporation purchased a company car by making a $4,680 cash down payment and signing a 1-year, $20,800, 10% note payable. The purchase was recorded as follows.

| Automobiles | 27,560 | |||

| Cash | 4,680 | |||

| Notes Payable | 20,800 | |||

| Interest Payable | 2,080 |

2. As an inducement to locate its new branch office in the city of Greenwood Acres, Ivanhoe Co. received land and a building from the city at no cost. The appraised value of the land was $52,000. The appraised value of the building was $182,000. Since it paid nothing for the land and building, Ivanhoe Co. made no

3. Bonita Corporation purchased warehouse shelving for $104,000, terms 1/10, n/30. At the purchase date, Bonita intended to take the discount. Therefore, it made no entry until it paid for the acquisition. The entry was:

| Warehouse fixtures | 104,000 | |||

| Cash | 102,960 | |||

| Purchase Discounts | 1,040 |

4. Pharoah Company built a piece of equipment for its factory. The cost of constructing the equipment was $166,400. Pharoah could have purchased the equipment for $197,600. The controller made the following entry.

| Equipment | 197,600 | |||

| Cash, Materials, etc. | 166,400 | |||

| Profir on Construction | 31,200 |

5. Metlock Inc. acquired land, buildings, and equipment from Sale Corp., for a lump-sum price of $1,040,000. The book values of the assets on Sale’s books at the date of purchase, as well as fair values for the assets, based on an appraisal performed shortly before the purchase, were as follows.

| Asset |

Book Value

|

Fair Value

|

||||

|---|---|---|---|---|---|---|

| Land | $260,000 | $364,000 | ||||

| Buildings | 468,000 | 676,000 | ||||

| Equipment | 520,000 | 312,000 | ||||

| Total | $1,248,000 | $1,352,000 |

The company decided to take the lower of the two values for each asset acquired. The following entry was made.

| Land | 260,000 | |||

| Buildings | 468,000 | |||

| Equipment | 312,000 | |||

| Cash | 1,040,000 |

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Sweets Inc. made several capital purchases during the last month of the year. As part of the purchases the company sold some existing fixed assets. Yesterday, as you were walking to the compnay cafeteria, you saw the President of Sweets Inc. While walking the President you mentioned the recent capital purchases would significantly impact the financial statments. Today, the President called you directly and asked you to write a memorandum explaining the impact of the capital purchases (and related sales of some existing fixed assets) on each of the following financial statments; Income Statement, Balance Sheet, Statement of Cash Flows. Summary of December Capital Transactions On Dec 1, 2021 Sweets Inc purchased a new delivert truck for $100,000 The following additional information was provided: The truck was paid for with cash. The truck is expected to have a service life of 10 years. No salvage value is expected after the service life. The company uses straight line depreciation for…arrow_forwardFranklin Manufacturing Company was started on January 1, year 1, when it acquired $81,000 cash by issuing common stock. Franklin immediately purchased office furniture and manufacturing equipment costing $7,700 and $24,900, respectively. The office furniture had an eight-year useful life and a zero salvage value. The manufacturing equipment had a $3,600 salvage value and an expected useful life of three years. The company paid $11,200 for salaries of administrative personnel and $15,500 for wages to production personnel. Finally, the company paid $16,110 for raw materials that were used to make inventory. All inventory was started and completed during the year. Franklin completed production on 4,900 units of product and sold 3,970 units at a price of $15 each in year 1. (Assume that all transactions are cash transactions and that product costs are computed in accordance with GAAP.) Required a. Determine the total product cost and the average cost per unit of the inventory produced in…arrow_forwardBensen Company started business by acquiring $26,900 cash from the issue of common stock on January 1, Year 1. The cash acquired was immediately used to purchase equipment for $26,900 that had a $4,500 salvage value and an expected useful life of four years. The equipment was used to produce the following revenue stream (assume that all revenue transactions are for cash). At the beginning of the fifth year, the equipment was sold for $4,950 cash. Bensen uses straight-line depreciation. Revenue Year 1 $ 7,820 Year 2 $ 8,320 Year 3 $ 8,520 Year 4 $ 7,320 Year 5 $ 0 Required Prepare income statements, statements of changes in stockholders' equity, balance sheets, and statements of cash flows for each of the five years. Complete this question by entering your answers in the tabs below. Statement of Income Statement Statement of Changes in Balance Sheet Stockholders Cash Flows Prepare the statements of cash flows for each of the five years. Note: Amounts to be deducted and cash outflows…arrow_forward

- Gaffney Corporation is a wholesale distributor of auto parts and uses the cash method of accounting. The company's sales have been about $11,175,000 per year for the last few years. However, Gaffney has the opportunity to acquire an unincorporated competitor with annual sales of $12,292,500. Complete the following paragraph regarding the accounting implications of acquiring the competitor. For the year of acquisition. Gaffney and the acquired business will be treated as o single business consider the combined gross receipts of both businesses in determining if the average annual gross receipts for the prior three-year period EV.Gaffney must Y exceed $ statutory threshold. Therefore, Gaffney will likely be able to continue using the cash method EV for the year of the acquisition.arrow_forwardPlant acquisitions for selected companies are as follows. 1. Novak Industries Inc. acquired land, buildings, and equipment from a bankrupt company, Torres Co., for a lump-sum price of $1.050,000. At the time of purchase, Torres's assets had the following book and appraisal values. Land Buildings Equipment Land Book Values Buildings Equipment Cash $300,000 375,000 450,000 To be conservative, the company decided to take the lower of the two values for each asset acquired. The following entry was made. 225,000 Appraisal Values $225,000 525,000 450,000 375,000 450,000 1,050,000 SUPPORTarrow_forwardA1arrow_forward

- Borrowing cost (IAS-23) If the acquisition/construction of asset is financed through borrowings then any interest paid on such debt would be capitalized in the value of asset. Test your understanding.3 Acquisition Costs of Realty: Pollachek Co. purchased land as a factory site for $450,000. Process of tearing down two old buildings on the site and constructing the factory required 6 months, The company paid $42,000 to raze the old buildings and sold salvaged lumber and brick for $6,300. Legal fees of $1,850 were paid for title investigation and drawing the purchase contract. Pollachek paid $2,200 to an engineering firm for a land survey, and $65,000 for drawing the factory plans. The land survey had to be made before definitive plans could be drawn. Title insurance on the property cost $1,500, and a liability insurance premium paid during construction was $900. The contractor's charge for construction was $2,740,000. The company paid the contractor in two installments: $1,200,000 at…arrow_forwardRecord the acquisition of each of these assets. E10.17 (LO 3) (Nonmonetary Exchange) Busytown Corporation, which manufactures shoes, hired a recent college graduate to work in its accounting department. On the first day of work, the accountant was assigned to total a batch of invoices with the use of an adding machine. Before long, the accountant, who had never before seen such a machine, managed to break the machine. Busytown Corporation gave the machine plus $340 to Dick Tracy Business Machine Company (dealer) in exchange for a new machine. Assume the following information about the machines. Busytown Corp. (Old Machine) Dick Tracy Co. (New Machine) Machine cost $290 $270 Accumulated depreciation 140 -0- Fair value 85 425 Instructions For each company, prepare the necessary journal entry to record the exchange. (The exchange has commercial substance.)arrow_forwardDynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items.Patent with 4 remaining years of legal life $32,200Goodwill 43,700Dynamo’s financial condition just prior to the acquisition of these assets is shown in the following statements model.Balance Sheet Income StatementAssets= Liabilities +Stockholders’Equity Revenue − Expenses = Net IncomeStatementof CashCash Flows + Patent + Goodwill92,000 + NA + NA = NA + 92,000 NA − NA = NA NARequireda. Compute the annual amortization expense for these items.b. Show the acquisition of the intangible assets and the related amortization expense for Year 1 in a horizontal statements model.c. Prepare the journal entries to record the acquisition of the intangible assets and the related amortization for yeararrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education