FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

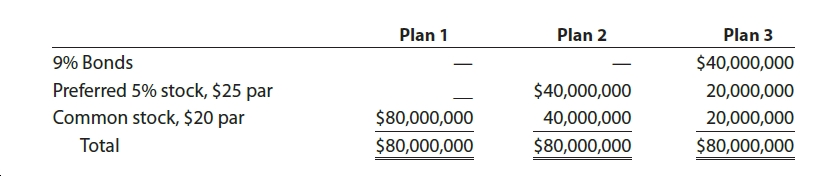

Three different plans for financing an $80,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 40% of income:

Please see the attachment for details:

Instructions

1. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $10,000,000.

2. Determine for each plan the earnings per share of common stock, assuming that the income before bond interest and income tax is $6,000,000.

3. Discuss the advantages and disadvantages of each plan.

Transcribed Image Text:Plan 1

Plan 2

Plan 3

9% Bonds

$40,000,000

Preferred 5% stock, $25 par

Common stock, $20 par

$40,000,000

20,000,000

$80,000,000

40,000,000

20,000,000

Total

$80,000,000

$80,000,000

$80,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1 of this year, Diego Corporation sold bonds with a face value of $530,000 and a coupon rate of 5 percent. The bonds mature in 10 years and pay interest annually on December 31. Diego uses the effective-interest amortization method. Ignore any tax effects. Each case is independent of the other cases. (FV of $1, PV of $1, FVA of $1, and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. Required:1. Complete the following table. The interest rates provided are the annual market rate of interest on the date the bonds were issued. Case A (5 percent) Case B (7 percent) Case C (4 percent) a. Cash received at issuance b. Interest expense recorded in Year 1 c. Cash paid for interest in Year 1 d. Cash paid at maturity for bond principalarrow_forwardPDQ, Inc. expects EBIT to be approximately $12.2 million per year for the foreseeable future, and it has 100,000 20-year, 6 percent annual coupon bonds outstanding. (Use Table 11.1.)What would the appropriate tax rate be for use in the calculation of the debt component of PDQ’s WACC? (Round your answer to 2 decimal places.)arrow_forwardjournal entries to capture the following event. ignore the interests and bond amortization. Use a tax rate of 20%. 12/15/2021: Purchased $200,000 of Harbox bonds, which is viewed as an AFS investment.arrow_forward

- An investor purchases one municipal and one corporate bond that pay rates of return of 7.2% and 9.1%, respectively. If the investor is in the 15% marginal tax bracket, his or her and _, respectively. after-tax rates of return on the municipal and corporate bonds would be 7.2%;7.735% 8.471%:9.1% O 7.2%;9.1% 6.12%;7.735%arrow_forwardOn January 1 of this year, Barnett Corporation sold bonds with a face value of $507,500 and a coupon rate of 7 percent. The bonds mature in 20 years and pay interest annually on December 31. Barnett uses the effective-interest amortization method. Ignore any tax effects. Each case is independent of the other cases. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided. Round your final answers to nearest whole dollar amount.) Required: 1. Complete the following table. The interest rates provided are the annual market rate of interest on the date the bonds were issued. Case A (7%) Case B (8%) Case C (6%) a. Cash received at issuance $ 507,500 b. Interest expense recorded in Year 1 $ 35,525 c. Cash paid for interest in Year 1 $ 35,525 d. Cash paid at maturity for bond principal $ 507,500arrow_forwardCooley Corporation has $20,000 that it plans to invest in marketable securities. It is choosing between MCI bonds which yield 10 percent, state of Colorado municipal bonds which yield 7 percent, and MCI preferred stock with a dividend yield of 8 percent. Cooley's corporate tax rate is 40 percent, and 70 percent of its dividends received are tax exempt. What is the after-tax rate of return on the highest yielding security? A. a. 7.04% B. b. 7.0% C. c. 8.43% D. d. 6.9% E. e. 6.0%arrow_forward

- [The following information applies to the questions displayed below.] TeslaShock Corporation manufactures electrical test equipment. The company's board of directors authorized a bond issue on January 1 of this year with the following terms: (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Face (par) value: $802,500 Coupon rate: 8 percent payable each December 31 Maturity date: December 31, end of Year 5 Annual market interest rate at issuance: 12 percent P10-15 Part 1 Required: 1. Compute the bond issue price. (Round your final answers to nearest whole dollar amount.) Answer is complete but not entirely correct. Bond issue price $ 686,767 Xarrow_forwardOn March 1, 2024, Baddour, Incorporated, issued 10% bonds, dated January 1, with a face amount of $160 million. The bonds were priced at $142.00 million (plus accrued interest) to yield 12%. The price if issued on January 1 would have been $139.25 million. Interest is paid semiannually on June 30 and December 31. Baddour’s fiscal year ends September 30. Required: 1. to 3. What would be the amount(s) related to the bonds Baddour would report in its balance sheet, income statement and statement of cash flows for the year ended September 30, 2024?arrow_forwardAssume that Western Asset Management Company LLC (WAMC) has $10,000 par value zero-coupon bonds outstanding. WAMC bonds are currently trading at $5,500 with 8 years to maturity. WAMC tax bracket is 35%. Calculate the cost of debt for WAMC (System will not accept percentage (%) sign, therefore write your answer upto four decimals).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education