FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

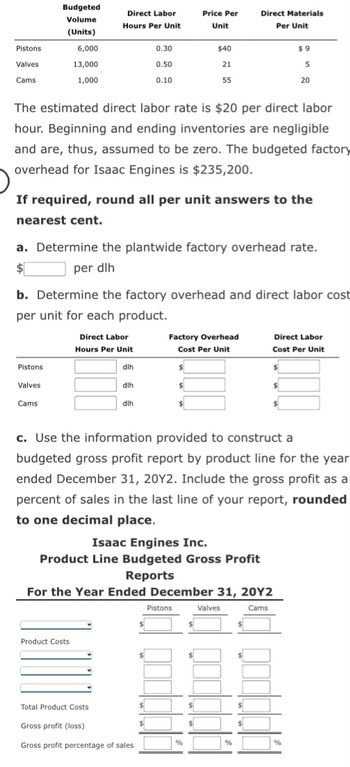

Transcribed Image Text:Pistons

Valves

Cams

Budgeted

Volume

(Units)

Pistons

6,000

13,000

1,000

Valves

Direct Labor

Hours Per Unit

Cams.

The estimated direct labor rate is $20 per direct labor

hour. Beginning and ending inventories are negligible

and are, thus, assumed to be zero. The budgeted factory

overhead for Isaac Engines is $235,200.

0.30

0.50

0.10

If required, round all per unit answers to the

nearest cent.

Direct Labor

Hours Per Unit

dih

dlh

dih

Product Costs

a. Determine the plantwide factory overhead rate.

$

per dlh

b. Determine the factory overhead and direct labor cost

per unit for each product.

Total Product Costs

Gross profit (loss)

Gross profit percentage of sales

Price Per

Unit

$

$40

21

55

Isaac Engines Inc.

Product Line Budgeted Gross Profit

Reports

$

$

Factory Overhead

Cost Per Unit

$

$

For the Year Ended December 31, 20Y2

Cams

Pistons

%

c. Use the information provided to construct a

budgeted gross profit report by product line for the year

ended December 31, 20Y2. Include the gross profit as a

percent of sales in the last line of your report, rounded

to one decimal place.

$

Direct Materials

Per Unit

$

Valves

%

$

$9

$

5

20

$

Direct Labor

Cost Per Unit

$

%

Expert Solution

arrow_forward

Step 1

Plant wide overhead rate is simple method of cost allocation. In this method a single rate is uses to allocate overhead to products. This method is useful for small entities.

Plant wide overhead rate is

Total overhead / basis of allocation

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Northern Sparks. sells sparkplug for $48 each. The direct materials cost per unit is $15 and the direct labor is 0.50 hours at a rate of $28 per hour. Fixed manufacturing overhead is budgeted at $72,500 per period. Calculate the break even point in units. (Remember: You cannot sell partial units).arrow_forwardBaxter Company sold 9,200 units at $145 per unit. Normal production is 9,600 units. Standard: 5 yards per unit at $6.30 per yard Standard: 2.75 hours per unit at $16.00 Standard: Variable overhead at $1.05 per unit Standard: Fixed overhead $216,000 (budgeted and actual amount) Actual yards used: 47,020 yards at $6.25 per yard Actual hours worked: 25,050 hours at $15.90 per hour Actual total factory overhead: $236,500 Prepare an income statement that includes variances for the year ending December 31 through gross profit for Baxter Company using the above information. Enter favorable variances as negative numbers. Do not round fixed overhead rate calculation when determining fixed factory overhead volume variance. Line Item Description Sales Baxter Company Income Statement Through Gross Profit For the Year Ending December 31 Cost of goods sold-at standard Gross profit-at standard Less variances from standard cost Direct materials price Direct materials quantity Direct labor rate Direct…arrow_forwardThe per-unit production costs for a product is as follows: $15 direct materials; $10 direct labour; $5 variable overhead. In addition, there is a $20,000 fixed overhead per week. Period costs are $10 variable selling costs per unit, and $40,000 fixed selling and administrative costs per week. The break-even point for the week was 3,000 units. What was the selling price used? 1) $60 2) $40 3) $20 4) None of the listed choices are correctarrow_forward

- A company has the following budgeted and actual cost data for manufacturing 2,000 Product X units: Direct materials $50 per unit Direct labor $40 per unit Variable manufacturing overhead $ 5 $40,000 per year per unit Fixed manufacturing Overhead Product X sells for $200 per unit. Assume no beginning or ending inventories. The Gross Profit for selling 15 Product X units is %24arrow_forwardThe following information for Donoghue Manufacturing Company for the period just ended: Actual: Variable manufacturing overhead $96,000 Fixed manufacturing overhead $90,000 Actual production completed 84,000 units Actual machine hours worked 30,000 hours Standard and Budgeted: Standard variable overhead rate per machine hour $3 Standard fixed overhead rate per machine hour $2 Standard machine processing time make 2 units per hour Budgeted machine hours 41,000 machine hours Budgeted production 82,000 units The fixed overhead budget variance for Donoghue Manufacturing Company is: A. $6,000 U B. $2,000 F C. $8,000 U D. $4,000 F E. None of the above.arrow_forwardas Great Outdoze Company manufactures sleeping bags, which sell for $67.00 each. The variable costs of production are as follows: $18.20 9.10 7.00 Direct material Direct labor Variable manufacturing overhead Budgeted fixed overhead in 20x1 was $160,000 and budgeted production was 20,000 sleeping bags. The year's actual production was 20,000 units, of which 16,700 were sold. Variable selling and administrative costs were $1.90 per unit sold; fixed selling and administrative costs were $25,000. Required: 1. Calculate the product cost per sleeping bag under (a) absorption costing and (b) variable costing. 2-a. Prepare an operating income statement for the year using absorption costing. 2-b. Prepare an operating income statement for the year using variable costing. 3. Reconcile reported operating income under the two methods using the shortcut method.arrow_forward

- 3arrow_forwardNonearrow_forwardNovak Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows: Indirect labor: $1.10, Indirect materials: 0.80, Utilities: 0.50. Fixed overhead costs per month are Supervision $4, 000, Depreciation $1, 200, and Property Taxes $800. The company believes i will normally operate in a range of 7, 000-10, 000 direct labor hours per month. Prepare a monthly manufacturing overhead flexible budget for 2022 for the expected range of activity, using increments of 1, 000 direct labor hours. (List variable costs before fixed costs.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education