Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

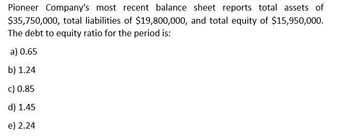

Transcribed Image Text:Pioneer Company's most recent balance sheet reports total assets of

$35,750,000, total liabilities of $19,800,000, and total equity of $15,950,000.

The debt to equity ratio for the period is:

a) 0.65

b) 1.24

c) 0.85

d) 1.45

e) 2.24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ernst Companys balance sheet shows total liabilities of 32,500,000, total stockholders equity of 8,125,000, and total assets of 40,625,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forwardKlynveld Companys balance sheet shows total liabilities of 94,000,000, total stockholders equity of 75,000,000, and total assets of 169,000,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forwardCharger Company's most recent balance sheet reports total assets of $29,133,000, total liabilities of $16,683,000 and total equity of $12,450,000. The debt to equity ratio for the period is (rounded to two decimals):arrow_forward

- Stark Company's most recent balance sheet reported total assets of $1,840,000, total liabilities of $830,000, and total equity of $1,010,000. Its debt-to-equity ratio is: 1.00 0.82 0.55 1.22 0.45arrow_forwardI need answer of this questionarrow_forwardThe debt to equity ratio for the period?arrow_forward

- Stark Company's most recent balance sheet reported total assets of $2,000,000, total liabilities of $750,000, and total equity of $1,250,000. Its debt-to-equity ratio is: Mutiple Choice 0.37 0.63 1.67 0.60 1.00arrow_forwardA company’s balance sheet reveals it has total assets of $8,081,700, total liabilities of $2,966,700, and total equity of $5,115,000. The current debt-to-equity ratio for this company is: 0.37. 0.58. 0.63. 1.72. 2.72.arrow_forwardThe debt to equity ratio for the period? General accountingarrow_forward

- Charger Company's most recent balance sheet reports total assets of $30,107,000, total liabilities of $17,457,000 and total equity of $12,650,000. What is the debt to equity ratio for the period?arrow_forwardStark Company's most recent balance sheet reported total assets of $1.84 million, total liabilities of $0.83 million, and total equity of $1.01 million. Its Debt to equity ratio is:arrow_forwardA company's balance sheet reveals they have total assets of $7,322,500, total liabilities of $2,272,500, and total equity of $5,050,000. The current debt-to-equity ratio for the company is: A. 2.22 B. 0.69 C. 0.45 D. 0.31 E. 3.22arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning