FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need help with this general accounting question

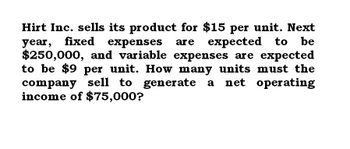

Transcribed Image Text:Hirt Inc. sells its product for $15 per unit. Next

year, fixed expenses are expected to be

$250,000, and variable expenses are expected

to be $9 per unit. How many units must the

company sell to generate a net operating

income of $75,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The ABC Corporation is considering introducing a new product, which will require buying new equipment for a monthly payment of $5,000. Each unit produced can be sold for $20.00. ABC incurs a variable cost of $10.00 per unit. Suppose that ABC would like to realize a monthly profit of $50,000. How many units must they sell each month to realize this profit?arrow_forwardDesk company has a product that it currently sales in the market for $50 per unit. Desk has develop in new feature that, if added to existing product, will allow Desk to receive a price of $65 per unit. The total cost of adding this new future is $44,000 and Desk expects to sell 2,800 units in the coming year. What is the net effect on the next-year's operating income of adding the feature to the product?arrow_forwardThe ABC Corporation is considering introducing a new product, which will require buying new equipment for a monthly payment of $5,000. Each unit produced can be sold for $20.00. ABC incurs a variable cost of $10.00 per unit. How many units must ABC sell each month to break even?arrow_forward

- a. what is the EOQ for a firm that sells 5,000 units when the cost of placing an order is $5 and the carrying cost are $3.50 per unit? b. how long will the EOQ last? how many orders are placed annually? c. as a result of lower interest rates, the finnancial manager determines the carrying cost are now $1.80 per unit. what are the new EOQ and annual number of objects?arrow_forwardSolve this general accounting questionarrow_forwardIf the current market price for selling a product at Andrew Materials is $15.50 per unit, and the company wishes to make a 12% profit, what is the target cost?arrow_forward

- The Price Company will produce 55,000 widgets next year. Variable costs will equal 40 percent of sales, while fixed costs will total R110,000. At what price must each widget be sold for the company to achieve an EBIT of R95,000?arrow_forwardSuppose you sell8000 of the 3 pack of lenses in one year. your cost on each 3 pack is $29.95 and you sell them for $59.95 .If your operating expenses for the year total is $144,080,what are your net income and net profit margin percentage?arrow_forwardCan you please provide correct answer the general accounting question?arrow_forward

- The ABC Corporation is considering introducing a new product, which will require buying new equipment for a monthly payment of $5,000. Each unit produced can be sold for $20.00. ABC incurs a variable cost of $10.00 per unit. What is ABC's monthly break-even amount in dollars?arrow_forwardABB Company reported the results from sales of 5,000 units of Product Y for April 2022. See image.Assume that ABB plans to increase the selling price of Product Y by 10% in June 2022. How many units of the product would have to be sold to maintain an operating income of P20,000? Assume that ABB plans to increase the selling price of Product Y by 10% in June 2022. How many units of the product would have to be sold to earn a net income of P48,000? ABB is subject to 25% corporate income tax.arrow_forward2. A new copier company plans to produce one model of copier. The copiers will sell for $820 each. The annual fixed costs of operation are $5,600,000 and the variable cost is $210 per unit. a. Assuming that they can sell everything they produce at this price, compute the breakeven quantity QBEP. b. If the company actually produces 11,000 copiers the first year, what will the profit/loss be? c. Include a fully-labeled breakeven chart illustrating the problem. 3. Fixed and variable cost for three potential facility locations are as shown below. Fixed cost Variable cost Location per year $240,000 $100,000 $150,000 per unit $15 $30 $20 a. Plot the total cost lines for these four locations on a single cost-volume graph. b. If expected output is to be 12,000 units per year, which location would provide the lowest cost? c. Identify the range of output over which each location alternative would be preferred (lowest cost). Compute the relevant crossover points, and clearly indicate your…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education