FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

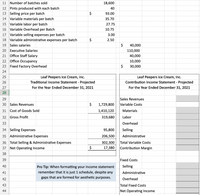

Transcribed Image Text:11 Number of batches sold

18,600

12 Pints produced with each batch

13 Selling price per batch

40

93.00

14 Variable materials per batch

35.70

15 Variable labor per batch

27.75

16 Variable Overhead per Batch

10.75

17 Variable selling expenses per batch

18 Variable administrative expenses per batch

3.00

$

2.50

19 Sales salaries

40,000

20 Executive Salaries

110,000

21 Office Staff Salary

40,000

22 Office Occupancy

10,000

23 Fixed Factory Overhead

$

30,000

24

25

Leaf Peepers Ice Cream, Inc.

Traditional Income Statement - Projected

Leaf Peepers Ice Cream, Inc.

Contribution Income Statement - Projected

26

27

For the Year Ended December 31, 2021

For the Year Ended December 31, 2021

28

29

Sales Revenues

30 Sales Revenues

1,729,800

Variable Costs

31 Cost of Goods Sold

1,410,120

Materials

32 Gross Profit

319,680

Labor

33

Overhead

34 Selling Expenses

95,800

Selling

35 Administrative Expenses

206,500

Administrative

36 Total Selling & Administrative Expenses

302,300

Total Variable Costs

37 Net Operating Income

$

17,380

Contribution Margin

38

39

Fixed Costs

40

Selling

Pro Tip: When formatting your income statement

remember that it is just 1 schedule, despite any

41

Administrative

gaps that are formed for aesthetic purposes.

42

Overhead

43

Total Fixed Costs

44

Net Operating Income

Expert Solution

arrow_forward

Step 1

Costs are bifurcated into variable and fixed elements. This is done for cost-volume-profit analysis.

These help in identifying fixed costs, variable costs, break-even point, margin of safety, etc.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Total Amount Units Sales Variable Costs: 31,250 Per Unit $ 445,313 $ 14.25 Direct Materials $ 125,000 4.00 = Direct Labor $ 28,000 0.90 = Variable Manufacturing Overhead $ 66,250 2.12 = Sales Commissions $ 15,625 0.50 = Shipping Variable Billing Total Variable Costs $ 3,125 0.10 $ 313 0.01 $ 238,313 7.63 Contribution Margin $ 207,000 6.62 Fixed Costs: Fixed Manufacturing Overhead Advertising Sales and Admin. Salaries Fixed Billing Total Fixed Costs Net Operating Income (Loss) 40,000 16,800 87,300 10,000 154,100 $ 52,900 F. Using the budgeted contribution margin income statement in part E. above, calculate the following: a. Breakeven in units: b. Operating Leverage Multiplier: Given a sales volume increase of 8%, operating income will increase by: c. Percent: d. Dollars: #N/A #N/A #N/A #N/Aarrow_forwardDeliveries to the retailers Sh.so 2,400,000 Set-up costs 6,000,000 Purchase order costs 3,600,000 Total overheads 12,000,000 All director labor is paid at $ 5 per hour. The company holds no inventories. Required: a. Calculate the total profit on each of General Motor's three types of products using each of the following methods: 1. The existing method based upon labor hours 2. Activity based costingarrow_forwardThe entity reports the following transactions for the 2022 tax year. The trustee accumulates all accounting income for the year. Operating income from a business $855,000 Dividend income, all from U.S. corporations(20% tax rate) 51,300 Interest income, City of San Antonio bonds 6,840,000 Trustee fees, deductible portion (25,650) Net rental losses, passive activity (171,000) Compute the Federal income tax liability for the Valerio Trust by providing the following amounts: The amount of the trustee's gross income taxed at 20% for the Valerio Trust is $fill in the blank 1.The Trustee taxable income taxed at ordinary rates for the Valerio Trust is $fill in the blank 2.The Federal income tax liability for the Valerio Trust is $fill in the blank 3.arrow_forward

- Please don't provide answer in image format thank youarrow_forwardRequired information [The following information applies to the questions displayed below.] Kubin Company's relevant range of production is 18,000 to 22,000 units. When it produces and sells 20,000 units, its average costs per unit are as follows: Average Cost per Unit $ 7.00 $ 4.00 $ 1.50 $ 5.00 $ 3.50 $ 2.50 $ 1.00 $ 0.50 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expensearrow_forwardgpu.9arrow_forward

- Sales (17,500 units) $1,750,000 Production costs (23,000 units): Direct materials $851,000 Direct labor 409,400 Variable factory overhead 204,700 Fixed factory overhead 135,700 1,600,800 Selling and administrative expenses: Variable selling and administrative expenses $248,100 Fixed selling and administrative expenses 96,000 344,100 If required, round interim per-unit calculations to the nearest cent. *** I only need assistance with the ones that are blank. Could you also leave the steps on how to solve it, please? a. Prepare an income statement according to the absorption costing concept. Shawnee Motors Inc. Absorption Costing Income Statement For the Month Ended August 31 Sales $1750000 Cost of goods sold Gross profit $ Selling and administrative expenses 344100 Income from operations $ b. Prepare an income statement according to the variable costing concept. Shawnee Motors Inc.…arrow_forwardNonearrow_forwardProvide tablearrow_forward

- 6 Dake Corporation's relevant range of activity is 2.000 units to 6.000 units. When it produces and sells 4,000 unts, its average costs per un are as follows Average Cost per Unit $ 6.55 $ 3.50 $ 1.40 $ 2.60 5.0.70 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense $ 0.40 Fixed administrative expense Sales commissions $ 1.50 Variable administrative expense $ 0.45 For financial reporting purposes, the total amount of product costs incurred to make 4.000 units is closest to Multiple Choice $56.200arrow_forward5arrow_forwardPlease don't provide answer in image format thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education