FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

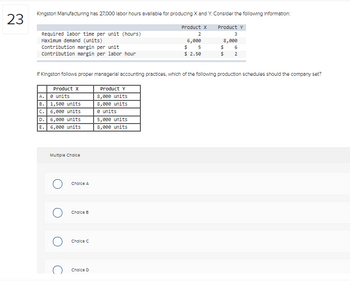

Transcribed Image Text:23

Kingston Manufacturing has 27,000 labor hours available for producing X and Y. Consider the following Information:

Product X

2

6,000

$ 5

$ 2.50

Required labor time per unit (hours)

Maximum demand (units)

Contribution margin per unit

Contribution margin per labor hour

If Kingston follows proper managerial accounting practices, which of the following production schedules should the company set?

Product Y

8,000 units

8,000 units

e units

5,000 units

8,000 units

Product X

A.

B. 1,500 units

C. 6,000 units

D. 6,000 units

6,000 units

E.

0 units

Multiple Choice

O

O

Choice A

Choice B

Choice C

Product Y

3

8,000

$ 6

$ 2

Choice D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost Per Unit $6.00 $3.50 Average fixed manufacturing cost per unit $ 1.50 $ 4.00 $ 3.00 $2.00 $ 1.00 $ 0.50 7. If 8,000 units are produced, what is the average fixed manufacturing cost per unit produced? Note: Round your answer to 2 decimal places.arrow_forwardnarubhaiarrow_forwardUnits produced Production runs per quarter Direct materials cost per unit Direct labor cost per unit Supervision Setup labor Incoming inspection Total overhead Manufacturing overhead in the plant has three main functions: supervision, setup labor, and Incoming material Inspection. Data on manufacturing overhead for a representative quarter follow: $ 288,750 336,000 241,500 $ 866,250 Standard 14,000 a. Using current costing system b. Using proposed ABC system 50 $30 50 Required: a. Compute the unit costs for the two products, Standard and Premium, using the current costing system at Benton (using direct labor costs as the allocation basis for overhead). b. Compute the unit costs for the two products, Standard and Premium, using the proposed ABC system at Benton. Note: For all requirements, do not round Intermediate calculations. Round your answers to 2 decimal places. S S Answer is complete but not entirely correct. Premium 3,500 25 $64 75 Unit cost Standard 120.00 X S 117.67 X S…arrow_forward

- S Activity Cost Pool Labor-related Purchase orders Product testing Template etching General factory Activity Cost Pool Labor-related (DLHS) Activity Measure Direct labor-hours Number of orders Number of tests Number of templates Machine-hours Product A Product B Product C Product D Cost $ 19,250 $ 1,820 $ 6,320 $ 960 $ 68,600 Total Overhead Cost 2. The expected activity for the year was distributed among the company's four products as follows: Expected Activity 1,375 DLHS Expected Activity Product A Product B Product C Product D 300 650 125 300 20 65 180 190 Purchase orders (orders) Product testing (tests) 65 0 80 Template etching (templates) 250 0 26 10 4 General factory (MHs) 3,800 2,000 1,200 2,800 Using the ABC data, determine the total amount of overhead cost assigned to each product. 455 orders 395 tests 40 templates S 9,800 MHsarrow_forwardA corporation's cost data is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense What is the amount of product costs, if 4,000 units are produced? Multiple Choice O O O O $57,200 $8,800 $44,400 $53,200 Cost per Cost per Unit Period $ 6.00 $ 3.35 $ 1.75 $ 1.00 $ 0.40 $ 8,800 $ 4,000arrow_forwardVanvalkenburg. Inc., manufactures and sells two products: Product GQ5 and Product JO. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Overhead Activity Cost Pools Measures Cost Product Q5 Product JØ Total Labor-related DLHS $191,748 70,536 295,592 Production orders 3,000 2,800 5,800 orders 300 500 800 Order size MHs 4,300 4,500 8,800 $557,876 The activity rate for the Order Size activity cost pool under activity-based costing is closest to: Multiple Cholce $36.23 per MH $68.48 per MH $96.19 per MHarrow_forward

- Kubin Company's relevant range of production is 15,000 to 19,000 units. When it produces and sells 17,000 units, its average costs per unit are as follows: Amount per Unit $ 7.60 $ 4.60 $ 2.10 $ 5.60 $ 4.10 $ 3.10 $ 1.60 $ 1.10 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Required: 1. If 15,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 19,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 15,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 19,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 15,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 19,000 units are produced,…arrow_forward0 Ellerie, Incorporated, manufactures and sells two products Product G8 and Product 00. Data concerning the expected production of each product and the expected total direct labor hours (DLH) required to produce that output appear below: Activity Cost Pools Labor-related Expected Hours Per Production Unit 710 5.1 310 2.1 Product CB Product 00 Total direct labor-hours The direct labor rate is $22.20 per DLH. The direct materials cost per unit for each product is given below Direct Materials Cost per Unit $114.10 $ 114.50 Machine setups Order sice Direct Labor- Product CB Product 00 The company is considering adopting an activity based costing system with the following activity cost pools, activity measures, and expected activity Estimated Overhead Multiple Choice Activity Measures Total Direct Labor- Hours 3,621 651 4,272 Cost $56,055 54,890 366,008 $ 476,953 Which of the following statements concerning the unit product cost of Product GB is true? (Round your intermediate calculations…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education