Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

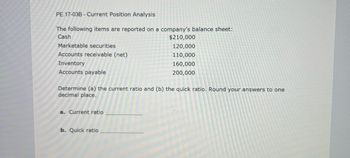

Transcribed Image Text:PE.17-03B Current Position Analysis

The following items are reported on a company's balance sheet:

Cash

Marketable securities

Accounts receivable (net)

Inventory

Accounts payable

Determine (a) the current ratio and (b) the quick ratio. Round your answers to one

decimal place.

a. Current ratio

$210,000

120,000

110,000

160,000

200,000

b. Quick ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Liquidity Ratios NWAs financial statements contain the following information: Note: Round answers to two decimal places. Required: 1. What is its current ratio? 2. What is its quick ratio? 3. What is its cash ratio? 4. Discuss NWAs liquidity using these ratios.arrow_forwardom/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocat- Current Position Analysis The following items are reported on a company's balance sheet: Cash $248,600 Marketable securities 194,200 Accounts receivable (net) 197,000 Inventory 137,100 Accounts payable 457,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. a. Current ratio b. Quick ratio Check My Work Email Ins All work saved. %23arrow_forwardThe following items are reported on a company's balance sheet: $212,700 90,200 252,800 196,700 278,400 Cash Marketable securities Accounts receivable Inventory Accounts payable Determine the (a) current ratio, and (b) quick ratio. Round your answers to one decimal place. a. Current ratio b. Quick ratioarrow_forward

- Current Position Analysis The following items are reported on a company's balance sheet: $450,900 Marketable securities 352,300 Accounts receivable (net) 389,200 Inventory 216,800 Accounts payable 542,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. Cash a. Current ratio b. Quick ratioarrow_forwardCurrent Position Analysis The following items are reported on a company's balance sheet: Cash $255,200 Marketable securities 199,400 Accounts receivable (net) 121,300 Inventory 221,500 Accounts payable 443,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. a. Current ratio b. Quick ratioarrow_forwardCurrent position analysisarrow_forward

- Current Position Analysis The following items are reported on a company's balance sheet: Cash $519,900 Marketable securities 406,200 Accounts receivable (net) 360,200 Inventory 338,500 Accounts payable 677,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. a. Current ratio fill in the blank b. Quick ratio fill in the blankarrow_forwardCurrent Position Analysis The following items are reported on a company's balance sheet: Cash $354,100 Marketable securities 276,700 Accounts receivable (net) 297,400 Inventory 178,500 Accounts payable 357,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place.arrow_forwardCalculate the dividend payout ratio.arrow_forward

- What is the Days Payables Outstanding? Use the attached financial data to calculate the ratios. Round to the nearest decimal. Abercrombie & Fitch Co (ANF) Financial Data Revenues Cost of Sales Total Operating Expenses Interest Expense Income Tax Expense Diluted Weighted Shares Outstanding Cash + Equivalents Accounts Receivable Inventories Total Current Assets Total Assets Accounts Payable Total Current Liabilities Total Stockholders' Equity ANF Stock Price = $10.30 Select one O A. 42.3 days, 37.0 days OB. 76.1 days, 89.4 days OC. 89.4 days, 37.0 days OD. 76.1 days, 97.7 days 2022 $3,659.3 $1,545.9 $2,026.9 $28.5 $37.8 52.8 $257.3 $108.5 $742.0 $1,220.4 $2,694.0 $322.1 $935.5 $656.1 2021 $3,712.8 $1,400.8 $1,968.9 $34.1 $38.9 62.6 $823.1 $69.1 $525.9 $1,507.8 $2,939.5 $374.8 $1,015.2 $826.1arrow_forwardFind the following using the data bellow a. Accounts receivable B. Current assets C. Total assets D. Return on assets E. Common equity F. Quick ratioarrow_forwardCurrent Position Analysis The following items are reported on a company's balance sheet: Cash $537,500 Marketable securities 419,900 Accounts receivable (net) 334,600 Inventory 387,600 Accounts payable 646,000 Determine (a) the current ratio and (b) the quick ratio. Round your answers to one decimal place. a. Current ratio fill in the blank 1 b. Quick ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning