FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

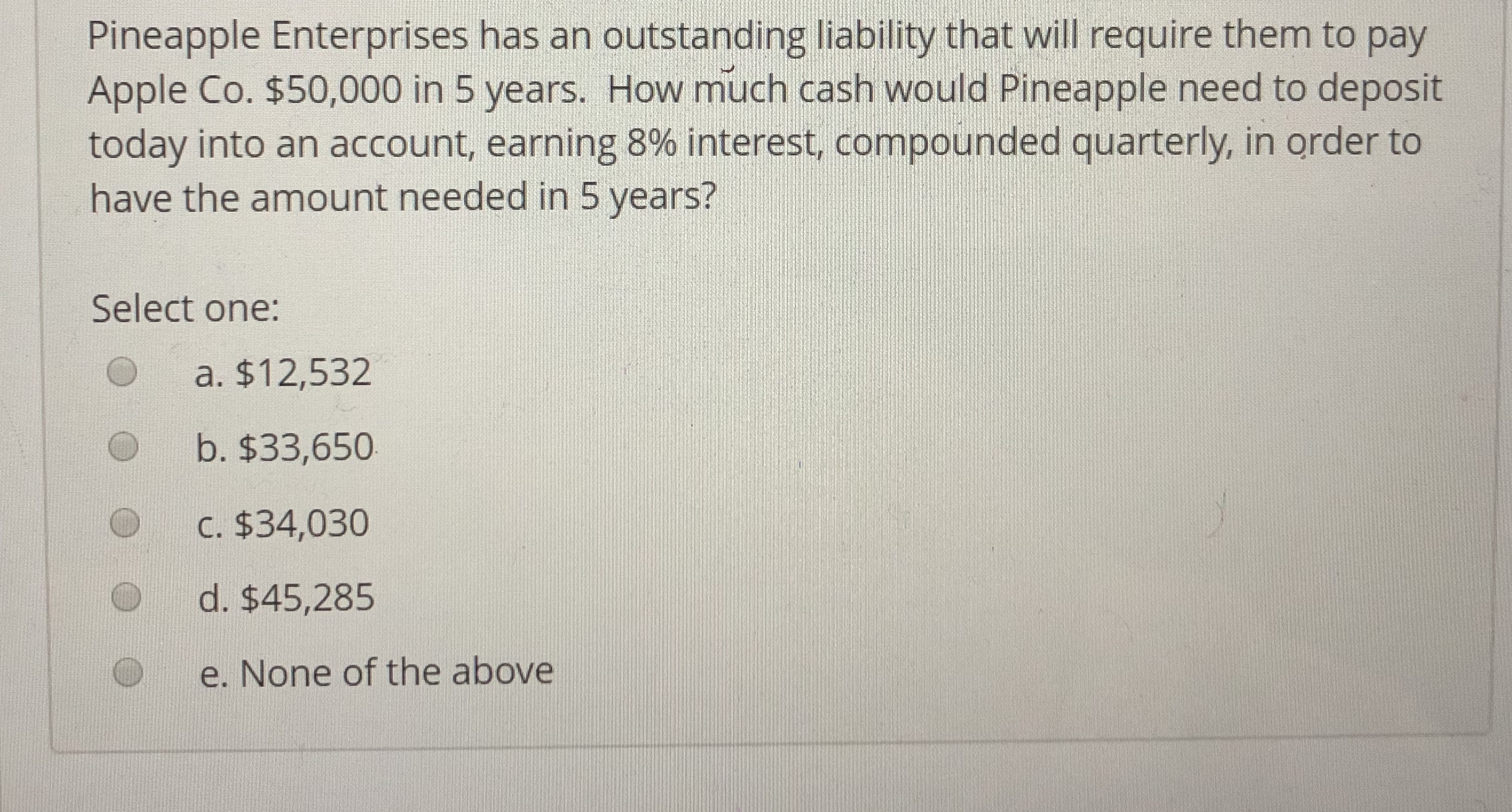

Transcribed Image Text:Pineapple Enterprises has an outstanding liability that will require them to pay

Apple Co. $50,000 in 5 years. How much cash would Pineapple need to deposit

today into an account, earning 8% interest, compounded quarterly, in order to

have the amount needed in 5 years?

Select one:

O a. $12,532

O b. $33,650

O C. $34,030

d. $45,285

e. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- Nonearrow_forwardPlease answer A-Darrow_forward1. Pronghorn Company acquires a delivery truck at a cost of $57,000. The truck is expected to have a salvage value of $6,000 at the end of its 10-year useful life. Compute annual depreciation expense for the first and second years using the straight-line method. 2. On January 1, 2020, Whispering Winds Country Club purchased a new riding mower for $24,000. The mower is expected to have an 8-year life with a $8,000 salvage value. What journal entry would Whispering Winds make at December 31, 2020, if it uses straight-line depreciation?arrow_forward

- Please help!!!! I'm not sure how to do these This is question 2:arrow_forward43. The Bluebird Company has a $10,000 liability it must pay three years from today. The company is opening a savings account so that the entire amount will be available when this debt needs to be paid. The plan is to make an initial deposit today and then deposit an additional $2,500 a year for the next three years, starting one year from today. The account pays a 3% rate of return. How much does the Bluebird Company need to deposit today? A. $1,867.74 B. $2,079.89 C. $3,108.09 D. $4,276.34 E. $4,642.28arrow_forwardDpn't provide handwritten solution ... The Taylors have purchased a $300,000 house. They made an initial down payment of $10,000 and secured a mortgage with interest charged at the rate of 7%/year on the unpaid balance. Interest computations are made at the end of each month. If the loan is to be amortized over 30 years, what monthly payment will the Taylors be required to make? What is their equity (disregarding appreciation) after 5 years? After 10 years? After 20 years?arrow_forward

- Red Lions Corporation takes out a $8.6 million short-term amortizing loan for nine months at 11.4% per annum. It makes monthly payments to pay off the loan. However, after completing 5 months of repayments, it decides to payoff early the remaining part of the loan amount. Q1. How much are the monthly repayment (in millions of dollars)? millions. (Give answer to 4 decimal places) $ Q2. How much does it repay to payoff the remaining part of the loan (in millions of dollars)? $ millions. (Give answer to 4 decimal places)arrow_forwardA 153. Subject:- financearrow_forwardStatistics. Full procedure please!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education