Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

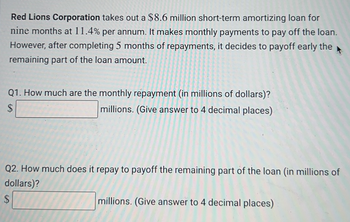

Transcribed Image Text:Red Lions Corporation takes out a $8.6 million short-term amortizing loan for

nine months at 11.4% per annum. It makes monthly payments to pay off the loan.

However, after completing 5 months of repayments, it decides to payoff early the

remaining part of the loan amount.

Q1. How much are the monthly repayment (in millions of dollars)?

millions. (Give answer to 4 decimal places)

$

Q2. How much does it repay to payoff the remaining part of the loan (in millions of

dollars)?

$

millions. (Give answer to 4 decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- 5.-DO IT IN EXCEL, AND SHOW THE FORMULASThe company purchases a machine, its cost of $726,000 will be financed with a loan at 13.8% interest for three years that requires equal semi-annual payments (annuities) that include principal and interest. What is the amount of the payment? A) $185,674.92 B) None of these amounts C) $311,662.137 D) $151,841.86 (Choose one option) D) $151,841.86arrow_forward17. A start-up company that makes hydraulic seals borrowed $800000 to expand its packaging and shipping facility. The contract required the company to repay the investors through an innovative mechanism called faux dividends, a series of uniform annual payments over a fixed period of time. If the company paid $250000 per year for 5 years, what was the interest rate on the loan? A 7% per year 7.1% per year 11.7% per year 17% per yeararrow_forwardAcme Industries Ltd. borrowed $50,000 and amortized the loan over 10 years at a rate of j1=8.00%. They will make monthly payments on the loan. a) Calculate the monthly loan payment rounded UP to the next cent: b) What is the balance owing on the loan after 3 years?arrow_forward

- 9. A man borrows Php10,000 from a loan firm. The rate of simple interest is 15%, but the interest is to be deducted from the loan at the time the money is borrowed. At the end of one year he has to pay back Php10,000. What is the actual rate of interest?arrow_forward3. 4. Suppose you recently bought a house for R1 650 000 and secured a home loan from the bank, with an interest rate of 9% per annum (compounded monthly) for a 20-year (240-month) term. You are obligated to make equal monthly payments, and your first payment is due in one month's time. However, after reviewing the bank's repayment calculation, you realize that you can afford to pay R1 000 more each month. How many months less will it take you to repay the home loan if you consistently make an additional monthly payment of R1 000. You may assume that the interest rate will remain fixed over the term of the home loan. a) 203.24 months. b) 0.24 months c) 36.76 months d) 60.10 months e) None of the above Nombulelo Makwete has been shopping around for a loan to finance the purchase of a used car she is buying. She needs to borrow R205 000. She found four offers that seem to be attractive, but would like to choose the offer with the lowest annual interest rate. The information she was…arrow_forwardAn open loan of $17,000 was taken out today where payments (deposits) and withdrawals can be made freely with a loan rate of 2.8% compounded semi-annually. To reduce the balance of the loan, $1030 was paid 12 months from today, and $5730 was paid 16 months from today. What is the final outstanding balance of the loan 24 months from today (8 months after the last payment)? State your final answer in dollars ($) with two decimals.arrow_forward

- The Johnson Family borrowed $3,000 for 18 months at 4% interest. What is the total payback on the Single Payment loan(round to the nearest dollar){DO NOT INCLUDE COMMAS OR $}?arrow_forward$255,000 is borrowed to purchase a block of land. It is to be repaid with monthly repayments at 4.2% interest over 25 years: (HINT: Use AMORT on your calculator) (a) Calculate the monthly repayments. (b) How much interest is paid over the life of the loan? (c) How much is still owed at the end of 10 years?arrow_forwardSuppose a bank makes a two-year $20,000 loan with the entire principal amount due in two years at an annual rate of 4.25%. The bank funds this with a six-month $20,000 CD at a cost of 1.75%. What is the bank's six month static GAP? O $20,000 O $10.000 O $0 O $10,000 O $20,000arrow_forward

- Mf6. Please give only typed answer.arrow_forwardA radio commercial for a loan company states: "You only pay 36¢ a day for each $500 borrowed." If you borrow $2,710 for 162 days, what amount will you repay, and what annual interest rate is the company actually charging? (Assume a 360-day year.) a. Amount you repay=$(Round to two decimal places.) IDarrow_forward1. An amortized loan of P250,000 with an interest rate of 9% will be paid monthly for 3 years. Find the monthly amortization. A high-end laptop computer was bought at an amortized loan of P100,000 with 12% annual interest for 24 months. Find the semi- annually amortization and construct an amortization schedule.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education