FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

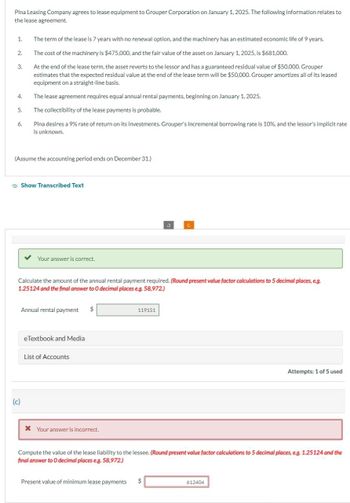

Transcribed Image Text:Pina Leasing Company agrees to lease equipment to Grouper Corporation on January 1, 2025. The following information relates to

the lease agreement.

1.

2.

3.

4.

5.

6.

The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years.

The cost of the machinery is $475,000, and the fair value of the asset on January 1, 2025, is $681,000.

At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $50,000. Grouper

estimates that the expected residual value at the end of the lease term will be $50,000. Grouper amortizes all of its leased

equipment on a straight-line basis.

The lease agreement requires equal annual rental payments, beginning on January 1, 2025.

The collectibility of the lease payments is probable.

Pina desires a 9% rate of return on its investments. Grouper's incremental borrowing rate is 10%, and the lessor's implicit rate

is unknown.

(Assume the accounting period ends on December 31.)

(c)

Show Transcribed Text

Your answer is correct.

Calculate the amount of the annual rental payment required. (Round present value factor calculations to 5 decimal places, e.g.

1.25124 and the final answer to O decimal places e.g. 58,972.)

Annual rental payment $

eTextbook and Media

List of Accounts

x Your answer is incorrect.

119151

C

Present value of minimum lease payments $

Compute the value of the lease liability to the lessee. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the

final answer to O decimal places e.g. 58,972.)

Attempts: 1 of 5 used

612404

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that IBM leased equipment that was carried at a cost of $173,000 to Oriole Company. The term of the lease is 7 years December 31, 2019, with equal rental payments of $30,767 beginning December 31, 2019. The fair value of the equipment at commencement of the lease is $172,999. The equipment has a useful life of 7 years with no salvage value. The lease has an implicit interest rate of 8%, no bargain purchase option, and no transfer of title. Collectibility of lease payments for IBM is probable. Assume the sales-type lease was recorded at a present value of $172,999. Prepare IBM’s December 31, 2020, entry to record the lease transaction with Oriole Company.arrow_forwardFederated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. The lease agreement specified annual payments of $46,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. The company had the option to purchase the machine on December 30, 2026, for $55,000 when its fair value was expected to be $70,000, a sufficient difference that exercise seems reasonably certain. The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor’s implicit rate of return was 10%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Calculate the amount Federated should record as a right-of-use asset and lease liability for this finance lease. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. Prepare the…arrow_forwardClarkson Corp. enters into an agreement to lease equipment on December 31, 2023. The following information relates to this agreement. -The term of the non-cancelable lease is 10 years with no renewal or bargain purchase option. The remaining economic life of the equipment is 26 years, and it is expected to have no residual value at the end of the lease term. -The fair value of the equipment was $121,000 at commencement of the lease. - Annual payments of $9,610 are required to be made on December 31 of each year of the lease, beginning December 31, 2023. - Clarkson's incremental borrowing rate is 7%. The rate implicit in the lease is unknown. - Clarkson uses straight-line depreciation for all similar equipment. What is the value of Clarkson's right-of-use asset at December 31, 2023?arrow_forward

- Federated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. . The lease agreement specified annual payments of $34,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. . The company had the option to purchase the machine on December 30, 2026, for $43,000 when its fair value was expected to be $58,000, a sufficient difference that exercise seems reasonably certain. . The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 12%. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease llability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare…arrow_forwardAssume that IBM leased equipment that was carried at a cost of $182,000 to Sunland Company. The term of the lease is 6 years December 31, 2019, with equal rental payments of $30,044 beginning December 31, 2019. The fair value of the equipment at commencement of the lease is $146,905. The equipment has a useful life of 6 years with no salvage value. The lease has an implicit interest rate of 9%, no bargain purchase option, and no transfer of title. Collectibility of lease payments for IBM is probable.Prepare IBM’s December 31, 2019, journal entries at commencement of the lease. (Credit account titles are automatically indented when amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 0 decimal places e.g. 5,275.)Click here to view factor tables. Date Account Titles and Explanation Debit Credit December 31, 2019 enter an account title To record the lease enter a…arrow_forwardMarin Leasing Company signs an agreement on January 1, 2020, to lease equipment to Cole Company. The following information relates to this agreement. 1. The term of the non-cancelable lease is 6 years with no renewal option. The equipment has an estimated economic life of 6 years. 2. The cost of the asset to the lessor is $451,000. The fair value of the asset at January 1, 2020, is $451,000. 3. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $24,225, none of which is guaranteed. 4. The agreement requires equal annual rental payments, beginning on January 1, 2020. 5. Collectibility of the lease payments by Marin is probable. Assuming the lessor desires a 15% rate of return on its investment, prepare all of the journal entries for the lessor for 2020 and 2021 to record the lease agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessor’s annual…arrow_forward

- 3. On January 1, 2022, Verlander Corp. signs a 5-year noncancelable lease agreement to lease a backhoe from Scherzer Equipment, Inc. The following information pertains to this lease agreement. 1. The agreement requires equal rental payments of $3,310 beginning on January 1, 2022. 2. The fair value of the backhoe on January 1, 2022, is $14,000. 3. The backhoe has an estimated economic life of 6 years, with an unguaranteed residual value of $1,500. Verlander depreciates similar equipment using the straight-line method. 4. The lease is nonrenewable. At the termination of the lease, the backhoe reverts to the lessor. 5. Verlander's incremental borrowing rate is 12% per year. The lessor's implicit rate is 9% and is not known by Verlander. 6. The yearly rental payment includes $450 of executory costs related to insurance on the backhoe. Prepare the journal entries on the lessee's books to reflect the signing of the lease agreement and to record the payments and expenses related to this lease…arrow_forwardOn July 1, 2023, Crane Corp., which uses IFRS, signs a 4-year, non-cancellable lease agreement to lease a equipment from Blossom Ltd. The following information concerns the lease agreement. 1. The equipment's fair value on July 1, 2023 is $259,000. نه 3. The agreement requires equal rental payments of $58,000.00 beginning on July 1, 2023. The equipment has an estimated economic life of 5 years, with an unguaranteed residual value of $93,000. Crane Corp. depreciates similar equipment using the straight-line method, with no residual value. 4. The lease is non-renewable. At the termination of the lease, the equipment reverts to Blossom. 5. 6. Crane's incremental borrowing rate is 6% per year. The lessor's implicit rate is not known by Crane Corp. The yearly rental payment includes $6,543.59 of executory costs related to insurance on the equipment. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE.arrow_forwardAlfredo Ltd (lessor) entered into an agreement on 1 July 2022 to lease a processing plant to Fatimah Ltd (lessee). Alfredo considers this lease contract as a manufacturer-type lease. The cost of the plant to Alfredo is $85411. The terms of the lease agreement were: Lease term: 3 years; Economic life of plant: 5 years; • Annual rental payment, in arrears (commencing 30/6/2020): $165,000; Residual value guaranteed by Fatimah Ltd: $60,000; Interest rate implicit in the lease: 8%; •The lease is cancellable, but only with the permission of the lessor; and At the end of the lease term, the plant is to be returned to Alfredo Ltd. In setting up the lease agreement, Alfredo Ltd incurred $9851 in legal fees and stamp duty costs. The annual rental payment of $165,000 includes $15,000 to reimburse Alfredo Ltd for maintenance costs incurred on behalf of Fatimah Ltd. The net profit recognised by Alfredo on 1 July 2022 on the day of the lease inception is? PLEASE ENTER YOUR ANSWER IN WHOLE NUMBERS NO…arrow_forward

- Federated Fabrications leased a tooling machine on January 1, 2024, for a three-year period ending December 31, 2026. • The lease agreement specified annual payments of $44,000 beginning with the first payment at the beginning of the lease, and each December 31 through 2025. • The company had the option to purchase the machine on December 30, 2026, for $53,000 when its fair value was expected to be $68,000, a sufficient difference that exercise seems reasonably certain. • The machine's estimated useful life was six years with no salvage value. Federated was aware that the lessor's implicit rate of return was 9%. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. Calculate the amount Federated should record as a right-of-use asset and lease liability for this finance lease. 2. Prepare an amortization schedule that describes the pattern of interest expense for Federated over the lease term. 3. Prepare the…arrow_forwardDelray Leasing Company signs an agreement on January 1, 2025, to lease equipment to Sheridan Company. The following information relates to this agreement. Assume that the expected residual value at the end of the lease is $27,400, such that the payments are $22,227.36. 1. 2. 3. 4. 5. 6. The term of the non-cancelable lease is 4 years with no renewal option. The equipment has an estimated economic life of 6 years. The fair value of the asset at January 1, 2025, is $105,300. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $27,400, none of which is guaranteed. The agreement requires equal annual rental payments of $22,227.36 to the lessor, beginning on January 1, 2025. The lessee's incremental borrowing rate is 6%. The lessor's implicit rate is 5% and is unknown to the lessee. Sheridan uses the straight-line depreciation method for all equipment. Date Account Titles and Explanation (To record the lease) (To…arrow_forwardLeewin Brokerage enters into a lease agreement with Bumble Motors to lease an automobile with a fair value of $78,000 under a 5-year lease on December 20, 2022. The lease commences on January 1, 2023, and Leewin will return the automobile to Bumble on December 31, 2027. The automobile has an estimated useful life of 7 years. Leewin made a lease payment of $10,700 on December 20, 2022. In addition, the lease agreement stipulates annual payments of $10,700, due on January 1 of 2023, 2024, 2025, 2026, and 2027. The implicit rate of the lease is 4% and is known by Leewin. There is no purchase option, no lease incentives, no residual value guarantees, and no transfer of ownership. Leewin incurs initial direct costs of $2000.Assuming that this is classified as an operating lease, how much interest expense is recorded in 2023? Group of answer choices $1554 $2140 $0 $1982arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education