FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

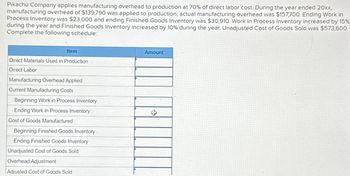

Transcribed Image Text:Pikachu Company applies manufacturing overhead to production at 70% of direct labor cost. During the year ended 20xx,

manufacturing overhead of $139,790 was applied to production; actual manufacturing overhead was $157,700. Ending Work in

Process Inventory was $23,000 and ending Finished Goods Inventory was $30,910. Work in Process Inventory increased by 15%

during the year and Finished Goods Inventory increased by 10% during the year. Unadjusted Cost of Goods Sold was $573,600.

Complete the following schedule:

Item

Direct Materials Used in Production

Direct Labor

Manufacturing Overhead Applied

Current Manufacturing Costs

Beginning Work in Process Inventory

Ending Work in Process Inventory

Cost of Goods Manufactured

Beginning Finished Goods Inventory

Ending Finished Goods Inventory

Unadjusted Cost of Goods Sold

Overhead Adjustment

Adjusted Cost of Goods Sold

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dion Company reports the absorption costing income statement below for May. The company began the month with no finished goods inventory. Dion produced 21,800 units, and 2,900 units remain in ending finished goods inventory for May. Fixed overhead was $43,600. Variable selling and administration expenses were $39,000 and fixed selling and administrative expenses were $19,400. Sales (18,900 units) $ 378,000 Cost of goods sold 294,000 Gross profit 84,000 Selling and administrative expenses 58,400 Income $ 25,600 Prepare an income statement using variable costing.arrow_forwardThe following data pertain to the operations of Deci, Inc. in the most recent month for the production of its only product, which sells for $297: Beginning inventory: 4, 000 Units Produced: 46,000 Units Sold: 47,000 Variable Costs per unit: Direct materials: $84 Direct Labor: $93 Manufacturing Overhead: $18 Selling and Administrative: $30 Fixed Costs: Manufacturing overhead: $1,912, 680 Selling and administrative: $1,954, 260 What is the variable costing unit product cost?arrow_forward1. For The period just ended, the gross margin of Robin Company was P 3,840,000, the cost of goods manufactured was P 13,6000,000; the work in process inventory increased by P400,000 and finished goods ending inventories increased by P400,000 during the year, but the materials inventories decreased by P 120,000. Assuming that factory overhead is applied to production at 150% of direct labor cost but only 45% of material cost, how much is the total factory overhead applied to production? 2. A machine shop manufactures a stainless-steel part that is used in an assembled product. Materials charged to a particular job amounted to P6,000. At the point of final inspection, it was discovered that the material used was inferior to the specifications required by the engineering department; therefore, all units had to be scrapped. The revenue received for scrap is to be treated as a reduction in manufacturing cost but cannot be identified with a specific job. A firm price is not determinable for…arrow_forward

- At the end of the first year of operations, 5,600 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows: Direct materials $29.10 Direct labor 13.20 Fixed factory overhead 4.80 Variable factory overhead 4.20 Determine the cost of the finished goods inventory reported on the balance sheet under (a) the absorption costing concept and (b) the variable costing concept. Absorption costing $ Variable costing $arrow_forwardDuring March of the current year, Rolly Company purchased P3,500,000 raw materials. During the month, Reyes incurred P2,040,000 direct labor cost and applied 80% of direct labor cost. During the same month, there were changes in inventories as follows: Increase in raw materials P100,000; Decrease in work in process P150,000 and decrease in finished goods 75,000. If the goods available for sale is P7,500,000, what is the amount of finished goods at March 1? a.P203,000 b.P278,000 c.P 0 d.P 75,000arrow_forwardMahoko PLC's planned production for the year just ended was 18,400 units. This production level was achieved, and 21,200 units were sold. Other data follow: Direct material used $ 552,000 Direct labor incurred 259,440 Fixed manufacturing overhead 390,080 Variable manufacturing overhead 198,720 Fixed selling and administrative expenses 329,360 Variable selling and administrative expenses 100,280 Finished-goods inventory, January 1 3,500 units The cost per unit remained the same in the current year as in the previous year. There were no work-in-process inventories at the beginning or end of the year. Required: 1. What would be Mahoko PLC’s finished-goods inventory cost on December 31 under the variable-costing method? Note: Do not round intermediate calculations. 2-a. Which costing method, absorption or variable costing, would show a higher operating income for the year? 2-b. By what amount?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education