Concept explainers

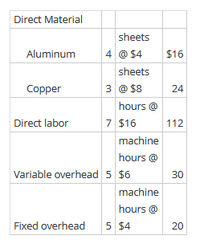

Piedmont Manufacturing produces metal products with the following standard quantity and cost information:

During November, the company produced only 510 units because of a labor strike, which occurred during union contract negotiations. After the dispute was settled, the company scheduled overtime to try to meet regular production levels.

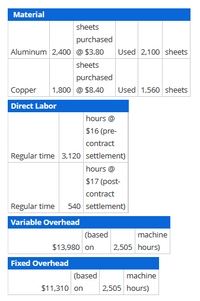

The following costs were incurred in November:

a. Total material price variance $______ Unfavorable

b. Total material usage (quantity) variance $______ Unfavorable

c. Labor rate variance $540 Unfavorable

d. Labor efficiency variance $______ Unfavorable

e. Variable overhead spending variance $______ Favorable

f. Variable overhead efficiency variance $______ Favorable

g. Fixed overhead spending variance $______ Favorable

h. Volume variance $______ Unfavorable

i.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 6 images

- Lamp Light Limited (LLL) manufactures lampshades. It applies variable overhead on the basis of direct labor hours. Information from LLL’s standard cost card follows: Standard Quantity Standard Rate Standard Unit Cost Variable manufacturing overhead 0.6 $0.80 $0.48 During August, LLL had the following actual results: Units produced and sold 26,300 Actual variable overhead $ 9,590 Actual direct labor hours 17,000 Required:Compute LLL’s variable overhead rate variance, variable overhead efficiency variance, and over- or underapplied variable overhead. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).) How do I figure out the variable overhead rate variance? I thought it's AH*(SR-AR) 17,000 * (.80- 9,590/17000=.56) 17000 * (.80-.56)= 4,080?? It says not correct?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardA manufacturing company that has only one product has established the following standards for its variable manufacturing overhead. The company bases its variable manufacturing overhead standards on direct labor-hours. Standard hours per unit of output 3.90 direct labor-hours Standard variable overhead rate $11.25 per direct labor-hour The following data pertain to operations for the last month: Actual direct labor-hours 8,800 direct labor-hours Actual total variable manufacturing overhead cost $ 95,850 Actual output 2,200 units What is the variable overhead rate variance for the month?arrow_forward

- Bonnie Company applies overhead based on machine hours. The variable overhead standard is 24 hours at $19.00 per hour. During March, Bonnie spent $314,150 for variable overhead, and 13,280 machine hours were used to produce 60 units. What is the variable overhead rate variance? Note: Do not round intermediate calculation. Multiple Choice O $15.600 unfavorable $61,830 unfavorable $12.800 unfavorable $61.830 favorablearrow_forwardManufacturing overhead data for the production of Product H by Kingbird Company, assuming the company uses a standard cost system, are as follows. Overhead incurred for 46,100 actual direct labor hours worked $281,880 Overhead rate (variable $5; fixed $1) at normal capacity of 58,300 direct labor hours $6 Standard hours allowed for work done $47,180 Compute the total overhead variancearrow_forwardDream Makers is a small manufacturer of gold and platinum jewelry. It uses a job costing system that applies overhead on the basis of direct labor hours. Budgeted factory overhead for the year was $476,100, and management budgeted 34,500 direct labor-hours. The company had no Materials, Work-in-Process, or Finished Goods Inventory at the beginning of April. These transactions were recorded during April: April insurance cost for the manufacturing property and equipment was $1,900. The premium had been paid in January. Recorded $1,095 depreciation on an administrative asset. Purchased 21 pounds of high-grade polishing materials at $16 per pound (indirect materials). The purchase was on credit. Paid factory utility bill, $6,590, in cash. Incurred 4,000 hours and paid payroll costs of $160,000. Of this amount, 1,000 hours and $20,000 were indirect labor costs. Incurred and paid other factory overhead costs, $6,330. Purchased $25,500 of materials. Direct materials included unpolished…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education