Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

MCQ

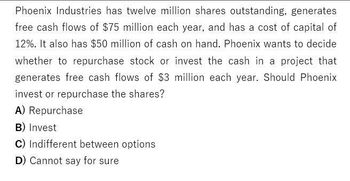

Transcribed Image Text:Phoenix Industries has twelve million shares outstanding, generates

free cash flows of $75 million each year, and has a cost of capital of

12%. It also has $50 million of cash on hand. Phoenix wants to decide

whether to repurchase stock or invest the cash in a project that

generates free cash flows of $3 million each year. Should Phoenix

invest or repurchase the shares?

A) Repurchase

B) Invest

C) Indifferent between options

D) Cannot say for sure

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Phoenix Industries has twelve million shares outstanding, generates free cash flows of $75 million each year, and has a cost of capital of 12%. It also has $50 million of cash on hand. Phoenix wants to decide whether to repurchase stock or invest the cash in a project that generates free cash flows of $3 million each year. Should Phoenix invest or repurchase the shares? A) Repurchase B) Invest C) Indifferent between options D) Cannot say for surearrow_forwardPhoenix Industries has twelve million shares outstanding, generates free cash flows of $75 million each year, and has a cost of capital of 12%. It also has $50 million of cash on hand. Phoenix wants to decide whether to repurchase stock or invest the cash in a project that generates free cash flows of $3 million each year. Should Phoenix invest or repurchase the shares? A) Repurchase B) Invest C) Indifferent between options D) Cannot say for sure provide answerarrow_forwardStep by step answerarrow_forward

- The management of LTTP Corp. is preparing for issuing equity to fund a new project. Rights offeris used. The company has determined that the ex-rights price would be $53. The current price is $58per share, and there are 10 million shares outstanding. The rights offer would raise a total of $45million. What is the subscription price?arrow_forwardKohwe Corporation plans to issue equity to raise $50 million to finance a new investment. After making the investment, Kohwe expects to earn free cash flows of $10 million each year. Kohwe currently has 5 million shares outstanding, and has no other assets or opportunities. Suppose the appropriate discount rate for Kohwe's future free cash flows is 8%, and the only capital market imperfections are corporate taxes and financial distress costs. a. What is the NPV of Kohwe's investment? b. What is Kohwe's share price today? Suppose Kohwe borrows the $50 million instead. The finn will pay interest only on this loan each year, and maintain an outstanding balance of $40 million on the loan. Suppose that Kohwe's corporate tax rate is 35%, and expected free cash flows are still $9 million each year. c. What is Kohwe's share price today if the investment is financed with debt? Now suppose that with leverage, Kohwe's expected free cash flows wiH decline to $8 million per year due…arrow_forwardThe management of LTTP Corp. is preparing for issuing equity to fund a new project. Rights offeris used. The company has determined that the ex-rights price would be $53. The current price is $58per share, and there are 10 million shares outstanding. The rights offer would raise a total of $45million. What is the subscription price? can you handwrite it pleasearrow_forward

- Subject: accountingarrow_forwardTransco is considering acquiring Tenco. Tenco's current stock price is $23. What is the maximum price per share that Transco should offer based on the following data for Tenco: PV of future cash flows $200 million, 20 million outstanding shares, no debt, and discount rate of 12%?arrow_forwardYour PE firm is considering acquiring a publicly traded digital advertising company, Star Dust Enterprises (SDE). The following are some key statistics of the stock of SDE today (t = 0). SDE is 100% equity financed. Its cost of capital (apply this to all cash flows) is 11.2% and the payout ratio is 79%. Expected earnings per share of SDE at next year (t = 1) are $6.6. Assume that without new investments, expected earnings of SDE would remain at their time-1 level in perpetuity. All future investments are expected to generate $0.2 in incremental earnings for each $1 of investment. For an investment made at time t, incremental cash flows are generated starting in year t + 1. (a) Compute expected dividend per share of SDE next year (t = 1): $ (b) Compute expected dividend per share of SDE two years from now (t = 2): $ (c) What is the present value of growth opportunities (PVGO) of SDE today? $arrow_forward

- Farah’s Fine Fashions (FFF) is considering raising money through a rights offering. FFF currently has 10 million shares outstanding selling for $22 per share. Current shareholders will receive one right per share. Five rights are required to buy one share for $20. Will the rights be exercised and if so, what is FFF’s new market value if all rights are exercised? Select one: a. The rights will not be exercised. b. $220 million c. $260 million d. $321 million e. None of the above.arrow_forwardZang Industries has hired the investment banking firm of Eric, Schwartz, & Mann (ESM) to help it go public. Zang and ESM agree that Zang’s current value of equity is $60 million. Zang currently has 4 million shares outstanding and will issue 1 million new shares. ESM charges a 7% spread. What is the correctly valued offer price, rounded to the nearest penny? How much cash will Zang raise net of the spread (use the rounded offer price)?arrow_forwardThe Tennis Shoe Company has concluded that additional equity financing will be needed to expand operations and that the needed funds will be best obtained through a rights offering. It has correctly determined that as a result of the rights offering, the share price will fall from $56 to $54.30 ($56 is the rights-on price; $54.30 is the ex-rights price, also known as the when-issued price). The company is seeking $17.5 million in additional funds with a per-share subscription price equal to $41. How many shares are there currently, before the offering? (Assume that the increment to the market value of the equity equals the gross proceeds from the offering.) (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT