FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Ashvin

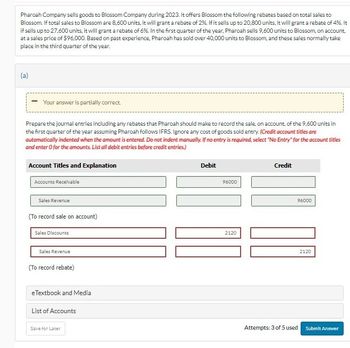

Transcribed Image Text:Pharoah Company sells goods to Blossom Company during 2023. It offers Blossom the following rebates based on total sales to

Blossom. If total sales to Blossom are 8,600 units, it will grant a rebate of 2%. If it sells up to 20,800 units, it will grant a rebate of 4%. It

if sells up to 27,600 units, it will grant a rebate of 6%. In the first quarter of the year, Pharoah sells 9,600 units to Blossom, on account,

at a sales price of $96,000. Based on past experience, Pharoah has sold over 40,000 units to Blossom, and these sales normally take

place in the third quarter of the year.

(a)

- Your answer is partially correct.

Prepare the journal entries including any rebates that Pharoah should make to record the sale, on account, of the 9,600 units in

the first quarter of the year assuming Pharoah follows IFRS. Ignore any cost of goods sold entry. (Credit account titles are

automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles

and enter o for the amounts. List all debit entries before credit entries.)

Account Titles and Explanation

Accounts Receivable

Sales Revenue

(To record sale on account)

Sales Discounts

Sales Revenue

(To record rebate)

e Textbook and Media

List of Accounts

Save for Later

Debit

96000

2120

Credit

96000

100

Attempts: 3 of 5 used

2120

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sandhill Company sells goods to Blossom Company during 2025. It offers Blossom the following rebates based on total sales to Blossom. If total sales to Blossom are 9,300 units, it will grant a rebate of 2%. If it sells up to 20,600 units, it will grant a rebate of 4%. If it sells up to 28,000 units, it will grant a rebate of 6%. In the first quarter of the year, Sandhill sells 10,100 units to Blossom at a sales price of $90,900. Sandhill, based on past experience, has sold over 39,000 units to Blossom, and these sales normally take place in the third quarter of the year. What amount of revenue should Sandhill report for the sale of the 10,100 units in the first quarter of the year? Revenue $arrow_forwardas show in the picarrow_forwardIvanhoe Company sells goods to Pharoah Company during 2025. It offers Pharoah the following rebates based on total sales to Pharoah. If total sales to Pharoah are 10,900 units, it will grant a rebate of 3%. If it sells up to 18,800 units, it will grant a rebate of 5%. If it sells up to 30,900 units, it will grant a rebate of 6%. In the first quarter of the year, Ivanhoe sells 11,800 units to Pharoah at a sales price of $129,800. Ivanhoe, based on past experience, has sold over 42,400 units to Pharoah, and these sales normally take place in the third quarter of the year. What amount of revenue should Ivanhoe report for the sale of the 11,800 units in the first quarter of the year? Revenue $arrow_forward

- Carla Vista Company sells goods to Pearl Company during 2020. It offers Pearl the following rebates based on total sales to Pearl. If total sales to Pearl are 11,200 units, it will grant a rebate of 2%. If it sells up to 19,600 units, it will grant a rebate of 4%. It if sells up to 29,200 units, it will grant a rebate of 6%. In the first quarter of the year, Carla Vista sells 9,000 units to Pearl at a sales price of $90,000. Based on past experience, Carla Vista has sold over 40,000 units to Pearl, and these sales normally take place in the third quarter of the year.arrow_forwardTeal Company sells goods to Flint Company during 2020. It offers Flint the following rebates based on total sales to Flint. If total sales to Flint are 10,900 units, it will grant a rebate of 3%. If it sells up to 18,800 units, it will grant a rebate of 5%. If it sells up to 30,900 units, it will grant a rebate of 6%. In the first quarter of the year, Teal sells 11,800 units to Flint at a sales price of $129,800. Teal, based on past experience, has sold over 42,400 units to Flint, and these sales normally take place in the third quarter of the year.What amount of revenue should Teal report for the sale of the 11,800 units in the first quarter of the year. Revenuearrow_forwardSplish Company sells goods to Blossom Company during 2020. It offers Blossom the following rebates based on total sales to Blossom. If total sales to Blossom are 10,500 units, it will grant a rebate of 2%. If it sells up to 21,200 units, it will grant a rebate of 5%. If it sells up to 30,800 units, it will grant a rebate of 6%. In the first quarter of the year, Splish sells 10,600 units to Blossom at a sales price of $106,000. Splish, based on past experience, has sold over 37,600 units to Blossom, and these sales normally take place in the third quarter of the year.What amount of revenue should Splish report for the sale of the 10,600 units in the first quarter of the year. Revenue $arrow_forward

- Cullumber Company sells goods to Riverbed Company during 2020. It offers Riverbed the following rebates based on total sales to Riverbed. If total sales to Riverbed are 9,000 units, it will grant arebate of 3%. If it sells up to 21.100 units, it will grant a rebate of 5%. If it sells up to 32,200 units, it will grant a rebate of 6%, In the first quarter of the year. Culumber sells 9,900 units to Riverbed at a sales price of $99,000. Cullumber, based on past experience, has sold over 36,200 units to Riverbed, and these sales normally take place in the third quarter of the year. What amount of revenue should Cullumber report for the sale of the 9,900 units in the first quarter of the year. Reverue eTextbook and Media List of Accounts Attempts: 0 of 3 used Submit Arawer Savefor Laterarrow_forwardPlease help me understand how to get to the answer here.arrow_forwardHeadland Company sells goods to Sage Company during 2017. It offers Sage the following rebates based on total sales to Sage. If total sales to Sage are 10,500 units, it will grant a rebate of 3%. If it sells up to 18,600 units, it will grant a rebate of 4%. If it sells up to 29,200 units, it will grant a rebate of 7%. In the first quarter of the year, Headland sells 10,400 units to Sage at a sales price of $104,000. Headland, based on past experience, has sold over 42,900 units to Sage, and these sales normally take place in the third quarter of the year.What amount of revenue should Headland report for the sale of the 10,400 units in the first quarter of the year. Revenue $arrow_forward

- Current Attempt in Progress Sunland Company sells goods to Sandhill Company during 2025. It offers Sandhill the following rebates based on total sales to Sandhill. If total sales to Sandhill are 10,500 units, it will grant a rebate of 3%. If it sells up to 18,300 units, it will grant a rebate of 5%. If it sells up to 30,800 units, it will grant a rebate of 6%. In the first quarter of the year, Sunland sells 10,800 units to Sandhill at a sales price of $118,800. Sunland, based on past experience, has sold over 37,800 units to Sandhill, and these sales normally take place in the third quarter of the year. What amount of revenue should Sunland report for the sale of the 10,800 units in the first quarter of the year? Revenue $arrow_forwardpls answer the question thanksarrow_forwardCullumber Bakery began selling gift cards in 2025. Based on industry norms, they expect that 40% of the gift cards will not be redeemed. In 2025, the bakery sold gift cards with a value of $1000. During that period, gift cards with a value of $250 were redeemed. The amount of revenue that Cullumber will recognize in 2025 with regard to the gift cards isarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education