FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

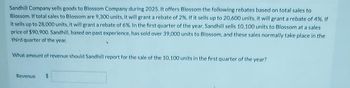

Transcribed Image Text:Sandhill Company sells goods to Blossom Company during 2025. It offers Blossom the following rebates based on total sales to

Blossom. If total sales to Blossom are 9,300 units, it will grant a rebate of 2%. If it sells up to 20,600 units, it will grant a rebate of 4%. If

it sells up to 28,000 units, it will grant a rebate of 6%. In the first quarter of the year, Sandhill sells 10,100 units to Blossom at a sales

price of $90,900. Sandhill, based on past experience, has sold over 39,000 units to Blossom, and these sales normally take place in the

third quarter of the year.

What amount of revenue should Sandhill report for the sale of the 10,100 units in the first quarter of the year?

Revenue $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company M uses the cost recovery method. During 19A, it sells goods with a cost of $15,000 for $25,000, payable in installments of $10,000, $10,000 and $5,000, respectively, beginning in 19A. How much profit should be recognized each year?arrow_forwardWaterway Company offers a set of building blocks to customers who send in 3 UPC codes from Waterway cereal, along with 50¢. The block sets cost Waterway $1.00 each to purchase and 60¢ each to mail to customers. During 2025, Waterway sold 960,000 boxes of cereal. The company expects 30% of the UPC codes to be sent in. During 2025, 96,000 UPC codes were redeemed. Prepare Waterway's December 31, 2025, adjusting entry. (If no entry is required, select "No Entry for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Credit Account Titles and Explanation Premium Expense Premium Liability Debit 105600 105600arrow_forwardPresented below are two independent revenue arrangements for Pharoah Company. Respond to the requirements related to each revenue arrangement. Click here to view factor table. Pharoah sells 3D printer systems. Recently, Pharoah provided a special promotion of zero-interest financing for 2 years on any new 3D printer system. Assume that Pharoah sells University co-op a 3D system, receiving a $5,100 zero-interest-bearing note on March 1, 2020. The cost of the 3D printer system is $3,060. Pharoah imputes a 8% interest rate on this zero-interest note transaction. Prepare the journal entry to record the sale on March 1, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places, eg. 58,971.) Account Titles and Explanation Debit Credit…arrow_forward

- Hw.73.arrow_forwardMoon Co. sells food blenders. During 2019, Moon made 37,000 blenders at an average cost of $80. It sold out 25,000 food blenders at an average price of $130. Moon provides a 2-year warranty for each blender sold and estimates 9% of blenders will be returned for warranty with an estimated cost of $36 each. By the end of 2019, Moon has spent $44,000 servicing the warranty repairs. All the above transactions have been settled in cash. During 2019, Moon has 50 employees who work 5-day per week and get paid each other Friday. Salaries of $324,000 and payroll expense of $37,000 have been paid until December 22. Since the business grows quickly, Moon needs cash to expand. By the end of 2018, the Board of Directors authorized the management to issue 10-year bonds with a par value of $3,000,000, annual contract interest rate of 8% and semi-annual interest payments. Moon chose to use the straight-line method to amortize discount or premium on its bonds. On January 1, 2019, management…arrow_forwardfdfcgarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education