FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

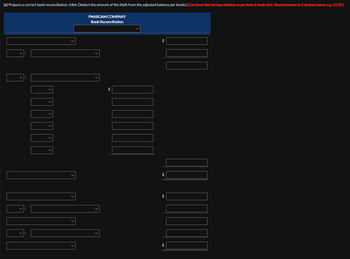

Transcribed Image Text:(a) Prepare a correct bank reconciliation. (Hint: Deduct the amount of the theft from the adjusted balance per books.) (List items that increase balance as per bank & books first. Round answers to 2 decimal places, e.g. 52.50.)

PHAROAH COMPANY

Bank Reconciliation

eeeeee

$

$

$

$

$

Transcribed Image Text:Pharoah Company is a very profitable small business. It has not, however, given much consideration to internal control. For example, in an attempt to keep clerical and office expenses to a minimum, the company has combined the jobs of cashier and bookkeeper. As a result, Bret Turrin handles all cash receipts, keeps the accounting records, and prepares the monthly bank reconciliations.

The balance per the bank statement on October 31, 2022, was $20,286.00. Outstanding checks were No. 62 for $166.00, No. 183 for $178.00, No. 284 for $291.00, No. 862 for $200.00, No. 863 for $275.00, and No. 864 for $212.00. Included with the statement was a credit memorandum of $203.00 indicating the collection of a note receivable for Pharoah Company by the bank on

October 25. This memorandum has not been recorded by Pharoah.

The company's ledger showed one Cash account with a balance of $23,744.00. The balance included undeposited cash on hand. Because of the lack of internal controls, Bret took for personal use all of the undeposited receipts in excess of $3,832.00. He then prepared the following bank reconciliation in an effort to conceal his theft of cash.

Cash balance per books, October 31

$23,744.00

Add: Outstanding checks

No. 862

No. 863

No. 864

$200.00

275.00

212.00

577.00

24,321.00

Less: Undeposited receipts

3,832.00

Unadjusted balance per bank, October 31

20,489.00

Less: Bank credit memorandum

203.00

Cash balance per bank statement, October 31

$20,286.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Hello I do not know if I am doing this Bank Reconciliation correclty. I really need help solving this problem.arrow_forwardUsing the following information, prepare a bank reconciliation. • Bank balance: $4,687 • Book balance: $5,690 • Deposits in transit: $1,546 • Outstanding checks: $956 • Interest income: $53 • NSF check: $466 Bank Reconciliation Bank Statement Balance at (date) Add: Less: Adjusted Bank Balance Book Balance at (date) Add: Less: Adjusted Book Balancearrow_forwardCurrent Attempt in Progress Identify whether each of the following items would be (a) added to the book balance, or (b) deducted from the book balance in a bank reconciliation. 1. 2 3. 4. 5. EFT transfer to a supplier. Bank service charge. Check printing charge. Error recording check # 214 which was written for $260 but recorded for $620. Collection of note and interest by the bank on the company's behalf.arrow_forward

- ssarrow_forwardThe bank reconciliation shows the following adjustments: • Deposits in transit: $882 • Notes receivable collected by bank: $1,040; interest: $35 • Outstanding checks: $580 • Error by bank: $310 • Bank charges: $40 Prepare the correcting journal entries. If an amount box does not require an entry, leave it blank. Accounts Payable Accounts Receivable Bank Service Charges Cash Interest Income II II II IIarrow_forwardIn a bank reconciliation, to adjust for the bank's deducting $980 for a company check that you wrote and booked for $890 requires A. increasing the book balance by $90 B. reducing the book balance by $90 C. increasing the bank balance by 590 D. reducing the bank balance by $90arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education