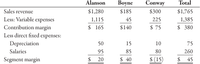

Petoskey Company produces three products: Alanson, Boyne, and Conway. A segmented income statement, with amounts given in thousands, follows:

Direct fixed expenses consist of

Refer to the information for Petoskey Company from Exercise 8-44. Assume that 20% of the Alanson customers choose to buy from Petoskey because it offers a full range of products, including Conway. If Conway were no longer available from Petoskey, these customers would go elsewhere to purchase Alanson.

Required:

-

Conceptual Connection Estimate the impact on profit that would result from dropping Conway. Explain why Petoskey should keep or drop Conway.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Urmila benarrow_forwardCan you please give answer?arrow_forwardSage Company is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $14.00 per unit. The unit cost for the business to make the part is $22.00, including fixed costs, and $11.00, excluding fixed costs. If 39,879 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease from making the part rather than purchasing it? a.$558,306 cost decrease b.$119,637 cost increase c.$319,032 cost increase d.$119,637 cost decreasearrow_forward

- Shamrock Inc. manufactures golf clubs in three models. For the year, the Beca line has a net loss of $5,700 from sales of $234,000, variable costs of $210,600, and fixed costs of $29,100. If the Beca line is eliminated, $16,500 of fixed costs will remain. Prepare an analysis showing whether the Beca line should be eliminated. (If an amount reduces the net income then enter with a negative sign preceding the number eg. -15,000 or parenthesis, e.g. (15,000).) Continue Eliminate Increase (Decrease)arrow_forwardABC Corporation manufactures a product that gives rise to a by-product called Z. The only costs associated with Z are selling costs of P1 for each unit sold. ABC accounts for Z sales first b deducting its separable costs from such sales and then by deducting this net amount from cost of sales of the major product. This year, 1,000 units of Z were sold at P4 each. If ABC changes its method of accounting for Z sales by showing the net amount as additional sales revenue, ABC's gross margin would*a. decrease by P3,000b. increase by P4,000c. increase by P3,000d. be unaffectedarrow_forwardDeluxe Homes is a residential Home Builder. Based on their current production of 300 homes per year, they currently make a profit of $20,000 per unit, based on the following costs per unit: Direct labor $ 20,000 Direct materials 200,000 Variable overhead 30,000 Fixed overhead 40,000 Variable selling costs 10,000 Fixed selling costs 10,000 Total costs per unit $310,000 Required Each of these are separate situations: A. Prepare an income statement based on the information provided. B. What is the profit and cost per unit if production is increased to 400 homes per year, and there is an increase of $1.50 million in total fixed overhead costs?arrow_forward

- Sheridan Corporation manufactures several types of accessories. For the year, the gloves and mittens line had sales of $480,000. variable expenses of $363,000, and fixed expenses of $144,000. Therefore, the gloves and mittens line had a net loss of $27,000. If Sheridan eliminates the line, $36,000 of fixed costs will remain. Prepare an analysis showing whether the company should eliminate the gloves and mittens line. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45))arrow_forwardA manufacturing company decides which of three mutually exclusive products to make in its factory on the basis of maximising the company's throughput accounting ratio. Current data for the three products is shown in the following table: Product X Product Y Product Z $20 Selling price per unit $60 $40 Direct material cost per unit $40 $10 $16 Machine hours per unit 10 20 2.5 Total factory costs (excluding direct materials) are $150,000. The company cannot make enough of any of the products to satisfy external demand entirely as machine hours are restricted. Which of the following actions would improve the company's existing throughput accounting ratio? Increase the selling price of product Z by 10% Increase the selling price of product Y by 10% Reduce the material cost of product Z by 5% O Reduce the material cost of product Y by 5%arrow_forwardSage Company is operating at 90% of capacity and is currently purchasing a part used in its manufacturing operations for $13.00 per unit. The unit cost for the business to make the part is $21.00, including fixed costs and $11.00, excluding fixed costs. If 37,870 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of differential cost increase or decrease from making the part rather than purchasing it? Oa. $302,960 cost increase Ob. $492,310 cost decrease Oc. $75,740 cost increase Od. $75,740 cost decreasearrow_forward

- [The following information applies to the questions displayed below.] Henna Company produces and sells two products, Carvings and Mementos. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 42,000 units of each product. Income statements for each product follow. Sales Variable costs Contribution margin Fixed costs Income Problem 18-4A (Algo) Part 1 Required: 1. Compute the break-even point in dollar sales for each product. (Enter CM ratlo as percentage rounded to 2 decimal places.) Contribution Margin Ratio Numerator: Break-Even Point in Dollars Numerator: Contribution Margin Ratio Break-Even Point in Dollars 1 1 1 1 Carvings $ 747,600 523,320 224,280 Mementos $ 747,600 149,520 598,080 108,280 482,080 $ 116,000 $ 116,000 1 PRODUCT CARVINGS Denominator: Denominator: PRODUCT MEMENTOS = IL 11 Contribution margin ratio Break-even point in dollars Contribution margin ratio Break-even point…arrow_forwardEaston Company makes and sells scooters. Easton incurred the following costs in its most recent fiscal year: Cost Items Appearing on the Income Statement Materials cost ($10 per unit) Company president's salary Depreciation on manufacturing equipment Salaries of administrative personnel Labor cost ($4 per unit) Advertising costs (150,000 per year) Shipping and handling ($500 per year) Research and development costs Real estate taxes on factory Inspection costs Easton can currently purchase the scooters it makes from Weston Company. If the company purchases the scooters, Easton would still continue to use its own logo, sales staff, and advertising programs. If Easton outsources the scooters to Weston, which of the following costs would be relevant to the outsourcing decision? Multiple Choice X Materials cost Shipping and handling Inspection costs All of these answers are correct.arrow_forwardAnstell Corporation operates a Manufacturing Division and a Marketing Division. Both divisions are evaluated as profit centers. Marketing buys products from Manufacturing and packages them for sale. Manufacturing sells many components to third parties in addition to Marketing. Selected data from the two operations follow: Capacity (units) Sales price* Variable costs + Fixed costs Manufacturing 250,000 $ 280 $ 112 $ 100,000 a. Transfer price b. Transfer price Marketing 125,000 $910 For Manufacturing, this is the price to third parties. t For Marketing, this does not include the transfer price paid to Manufacturing. per unit per unit $ 336 $ 720,000 Required: a. Current output in Manufacturing is 125,000 units. Marketing requests an additional 25,000 units to produce a special order. What transfer price would you recommend? b. Suppose Manufacturing is operating at full capacity. What transfer price would you recommend? c. Suppose Manufacturing is operating at 230,000 units. What transfer…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education