FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

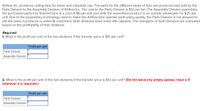

Transcribed Image Text:Airflow Inc. produces ceiling fans for home and industrial use. The parts for the different styles of fans are produced and sold by the

Parts Division to the Assembly Division of Airflow Inc. The cost to the Parts Division is $12 per fan. The Assembly Division assembles

the purchased parts into finished fans at a cost of $6 per unit and sells the assembled product to an outside wholesaler for $25 per

unit. Due to the proprietary technology used to make the Airflow fans operate particularly quietly, the Parts Division is not allowed to

sell the parts it produces to external customers. Both divisions have some idle capacity. The managers of both divisions are evaluated

based on the profitability of their divisions.

Required:

1. What is the profit per unit of the two divisions if the transfer price is $15 per unit?

Profit per unit

Parts Division

Assembly Division

2. What is the profit per unit of the two divisions if the transfer price is $12 per unit? (Do not leave any empty spaces; input a O

wherever it is required.)

Profit per unit

Parts Division

Assembly Division

Transcribed Image Text:3. If the Parts Division operates inefficiently, causing the cost of the parts to rise to $13 per unit, and that cost is used as the transfer

price, what is the profit of the two divisions? (Do not leave any empty spaces; input a O wherever it is required.)

Profit per unit

Parts Division

Assembly Division

4. Take on the role of the Assembly Division manager and evaluate the answer in (3) above. Would you agree or disagree with the $13

transfer price?

O Agree

Disagree

5. Which transfer price is best from the point of view of the company as a whole?

Transfer price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Memanarrow_forwardBoney Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in batches. A batch of sugar beets costs $53 to buy from farmers and $18 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $25 or processed further for $18 to make the end product industrial fiber that is sold for $39. The beet juice can be sold as is for $32 or processed further for $28 to make the end product refined sugar that is sold for $79. What is the financial advantage (disadvantage) for the company from processing the intermediate product beet juice into refined sugar rather than selling it as is?arrow_forwardDecorative Doors Ltd produces two types of doors: interior and exterior. The company’s costing system has two direct-cost categories (materials and labour) and one indirect-cost pool. The costing system allocates indirect costs on the basis of machine-hours. Recently, the owners of Decorative Doors have been concerned about a decline in the market share for their interior doors, usually their biggest seller. Information related to Decorative Doors production for the most recent year is as follows: Particulars Interior Exterior Units sold 3200 1800 Selling price $125 $200 Direct material cost per unit $30 $45 Direct production labour cost per hour5 $16 $16 Direct production labour-hours per unit 1.50 2.25 Production runs 40 85 Material moves 72 168 Machine set-ups 45 155 Machine-hours 5500 4500 Number of inspections 250 150 The owners have heard of other companies in the industry that are now…arrow_forward

- Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburetor to Troy Engines, Limited, for a cost of $35 per unit. To evaluate this offer, Troy Engines, Limited, has gathered the following information relating to its own cost of producing the carburetor internally: Per Unit 22,000 Units Per Year Direct materials $ 15 $ 330,000 Direct labor 8 176,000 Variable manufacturing overhead 3 66,000 Fixed manufacturing overhead, traceable 3*Footnote asterisk 66,000 Fixed manufacturing overhead, allocated 6 132,000 Total cost $ 35 $ 770,000 *Footnote asteriskOne-third supervisory salaries; two-thirds depreciation of special equipment (no resale value). Required: Assuming the company has no alternative use for the facilities that are now being used to produce the carburetors, what…arrow_forwardMuffin Factory (MF) bakes and sells muffins. MF buys materials from suppliers and bakes, frosts, and packages them for resale. Currently the firm offers 2 different types of muffins to gourmet bake shops in boxes, each containing a dozen muffins. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the baking, frosting, and packing process. MF prices its muffins at full product cost, including allocated overhead, plus a markup of 40%. Data for the current budget include factory overhead of $919,400, which has been allocated by its current costing system on the basis of each product’s direct labor cost. The budgeted direct labor cost for the current year totals $300,000. The budgeted direct costs for a one-dozen box of two of the company’s most popular muffins are as follows: Costs per one dozen Blueberry Cinnamon Activity Cost Driver Budgeted Activity Budgeted Cost Direct materials $…arrow_forwardWitt Recreation Company (WRC) makes e-bikes. The company currently manufactures two models, the Coaster and the Traveler, in one of the WRC factories. Both models require the same assembling operations. The difference between the models is the cost of materials. The following data are available for the second quarter. Number of bikes assembled Materials cost per bike Other costs: Direct labor Depreciation and lease Supervision and control Factory administration Operation cost Materials cost Total cost Unit cost Coaster 750 $626 Coaster Traveler 450 $ 1,202 Required: Witt Recreation Company uses operations costing and assigns conversion costs based on the number of units assembled. Compute the cost of each model assembled in the second quarter. Note: Do not round intermediate calculations. Round your final answers to nearest whole number. Total 1,200 Traveler $ 299,400 382,400 247,400 340,400 Totalarrow_forward

- Glassworks makes products for the sandblasting industry. One of the products they make is bags of high-grade sandblasting media that is made from a combination of quartz-sand and recycled ground-glass (cullet). Standard costs and quantities to produce one bag of sandblasting media are as follows: Quantity Cost Quartz-sand 20 kg $4.00 Cullet 5 kg $3.00 80,000 bags of sandblasting media were produced. Actual purchases and inventories were: Beginning Ending Purchases Purchases Inventory Inventory (in kg) ( in $) Quartz-sand 0 kg 0 kg 1,610,000 kg $322,161 Cullet 0 kg 120,000 kg 550,000 kg $286,000 Required: Calculate the following variances: a)Total direct material efficiency variance. b)Total direct material mix variance.…arrow_forwardCome-Clean Corporation produces a variety of cleaning compounds and solutions for both industrial and household use. While most of its products are processed independently, a few are related, such as the company’s Grit 337 and its Sparkle silver polish. Grit 337 is a coarse cleaning powder with many industrial uses. It costs $1.60 a pound to make, and it has a selling price of $6.80 a pound. A small portion of the annual production of Grit 337 is retained in the factory for further processing. It is combined with several other ingredients to form a paste that is marketed as Sparkle silver polish. The silver polish sells for $5.00 per jar. This further processing requires one-fourth pound of Grit 337 per jar of silver polish. The additional direct variable costs involved in the processing of a jar of silver polish are: Other ingredients $ 0.65 Direct labor 1.36 Total direct cost $ 2.01 Overhead costs associated with processing the silver polish are: Variable…arrow_forwardHall, Incorporated manufactures two components, Standard and Ultra, that are designed for the same function, but are made of different metals for operational performance reasons. The metal used in Standard is easy to work with and there are few quality issues or reworking required on the machines. The metal used in Ultra is more difficult to work with and often needs additional machine time and rework. Data on expected operations and direct costs for the next fiscal year follow: Account Administration Engineering Machine operation and maintenance Standard Miscellaneous Supervision Total 48,000 144,000 24,000 Ultral $ 3,384,000 2,520,000 Units produced Direct labor-hours used Machine-hours used Direct materials costs $5,163,000 Direct labor costs 855,000 The planning process team at Hall, Incorporated has estimated the following manufacturing overhead costs for the next fiscal year: 16,500 22,500 22,500 Total Amount $ 825,400 5,699,500 875,000 540,100 884,500 $8,824,500. 64,500 166,500…arrow_forward

- Nizam Company produces speaker cabinets. Recently, Nizam switched from a traditional departmental assembly line system to a manufacturing cell in order to produce the cabinets. Sup-pose that the cabinet manufacturing cell is the cost object. Assume that all or a portion of the following costs must be assigned to the cell:a. Depreciation on electric saws, sanders, and drills used to produce the cabinetsb. Power to heat and cool the plant in which the cell is locatedc. Salary of cell supervisord. Wood used to produce the cabinet housingse. Maintenance for the cell’s equipment (provided by the maintenance department)f. Labor used to cut the wood and to assemble the cabinetsg. Replacement sanding beltsh. Cost of janitorial services for the planti. Ordering costs for materials used in productionj. The salary of the industrial engineer (she spends about 20 percent of her time on work forthe cell)k. Cost of maintaining plant and grounds l. Cost of plant’s personnel officem. Depreciation on…arrow_forwardBranded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $48. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-101,000 units. The fixed costs for the Polishing Division are assumed to be $17 per pair at 101,000 units. Stitching's costs per pair of shoes are: Direct materials $11 Direct labor $9 Variable overhead $7 Division fixed costs $5 Polishing's costs per completed pair of shoes are:…arrow_forwardDineshbhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education