Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

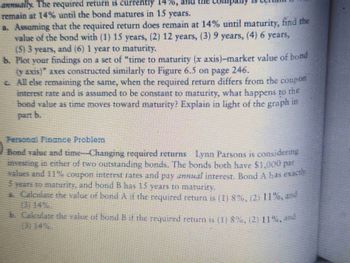

Transcribed Image Text:annually. The required return is currently 1470, and the company is

remain at 14% until the bond matures in 15 years.

a. Assuming that the required return does remain at 14% until maturity, find the

value of the bond with (1) 15 years, (2) 12 years, (3) 9 years, (4) 6 years,

(5) 3 years, and (6) 1 year to maturity,

b. Plot your findings on a set of "time to maturity (x axis)-market value of bond

(y axis)" axes constructed similarly to Figure 6.5 on page 246.

c.

All else remaining the same, when the required return differs from the coupon

interest rate and is assumed to be constant to maturity, what happens to the

hond value as time moves toward maturity? Explain in light of the graph i

in

Bond value and time-Changing required returns Lynn Parsons is considering

investing in either of two outstanding bonds. The bonds both have 51,000 par

values and 11% coupon interest rates and pay anal interest. Bond A has exact

5 years to maturity, and bond B has 15 years to maturity.

. Calculate the value of bond A if the required return is (1) 8%, (2) 11%. --

b. Calculate the value of bond B if the required return is (1) 8%, (2) 11%, ª-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

can you show formula used?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

can you show formula used?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Bond value and changing required returns Midland Utilities has a bond issue outstanding that will mature to its $1,000 par value in 15 years. The bond has a coupon interest rate of 13% and pays interest annually. a. Find the bond value if the required return is (1) 13%, (2) 17%, and (3) 10%. b. Use your finding in part a and the graph here, to discuss the relationship between the coupon rate, the required return and the market value of the bond relative to its par value. c. What two possible reasons could cause the required return to differ from the coupon interest rate? a. (1) The value of the bond, if the required return is 13%, is $ (Round to the nearest cent.)arrow_forwardBond Valuation and Interest Rate Risk The Garraty Company has two bond issues outstanding. Both bonds pay $100 annual interest plus $1,000 at maturity. Bond L has a maturity of 15 years, and Bond S has a maturity of 1 year. What will be the value of each of these bonds when the going rate of interest is 4%? Assume that there is only one more interest payment to be made on Bond S. Round your answers to the nearest cent. Bond L $ Bond S $ What will be the value of each of these bonds when the going rate of interest is 7%? Assume that there is only one more interest payment to be made on Bond S. Round your answers to the nearest cent. Bond L _______$ Bond S ________$ What will be the value of each of these bonds when the going rate of interest is 13%? Assume that there is only one more interest payment to be made on Bond S. Round your answers to the nearest cent. Bond L _______$ Bond S _______$ Why does the longer-term (15-year) bond fluctuate more when…arrow_forwardBond valuation and yield to maturity Personal Finance Problem Mark Goldsmith's broker has shown him two bonds issued by different companies. Each has a maturity of 5 years, a par value of $1,000, and a yield to maturity of 7.90%. The first bond is issued by Crabbe Waste Disposal and has a coupon interest rate of 6.324% paid annually. The second bond, issued by Malfoy Enterprises, has a coupon interest rate of 8.90% paid annually. a. Calculate the selling price for each of the bonds. b. Mark has $19,000 to invest. If he wants to invest only in bonds issued by Crabbe Waste Disposal, how many of those bonds could he buy? What if he wants to invest only in bonds issued by Malfoy Enterprises? c. What is the total interest income that Mark could earn each year if he invested only in Crabbe bonds? How much interest would he earn each year if he invested only in Malfoy bonds? d. Assume that Mark will reinvest all the interest he receives as it is paid and that his rate of…arrow_forward

- Bond value and time Changing required returns Personal Finance Problem Lymn Parsons is considering investing in either of two outstanding bonds. The bonds both have $1,000 par values and 12% coupon interest rates and pay annual interest. Bond A has exactly 6 years to maturity, and bond 8 has 16 years to maturity a. Calculate the present value of bond A if the required rate of return is (1) 9%, (2) 12 %, and (3) 15%. b. Calculate the present value of bond 8 if the required rate of retum is: (1) 9%, (2) 12%, and (3) 15% c. From your findings in parts a and b, discuss the relationship between time to maturity and changing required retums d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? CO a (1) The value of bond A, if the required retum is 916, is $ (Round to the nearest cont.)arrow_forwardBond value and time-Changing required returns Personal Finance Problem Lynn Parsons is considering investing in either of two outstanding bonds. The bonds both have $1,000 par values and 8% coupon interest rates and pay annual interest. Bond A has exactly 5 years to maturity, and bond B has 15 years to maturity. a. Calculate the present value of bond A if the required rate of return is: (1) 5%, (2) 8%, and (3) 11%. b. Calculate the present value of bond B if the required rate of return is: (1) 5%, (2) 8%, and (3) 11%. c. From your findings in parts a and b, discuss the relationship between time to maturity and changing required returns. d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? ... a. (1) The value of bond A, if the required return is 5%, is $ (Round to the nearest cent.)arrow_forwardBond value and changing required returns Midland Utilities has a bond issue out-standing that will mature to its $1,000 par value in 12 years. The bond has a cou-pon rate of 11% and pays interest annually. a. Find the value of the bond if the required return is (1) 11%, (2) 15%, and (3) 8%.b. Plot your findings in part a on a set of “required return (x-axis)–market value of bond (y-axis)” axes.c. Use your findings in parts a and b to discuss the relationship between the coupon rate on a bond and the required return and the market value of the bond relative to its par value.d. What two possible reasons could cause the required return to differ from the coupon ratearrow_forward

- Bond value and time—Changing required returns Personal Finance Problem Lynn Parsons is considering investing in either of two outstanding bonds. The bonds both have $1,000 par values and 9% coupon interest rates and pay annual interest. Bond A has exactly 7 years to maturity, and bond B has 17 years to maturity. a. Calculate the present value of bond A if the required rate of return is: (1) 6%, (2) 9%, and (3) 12%. b. Calculate the present value of bond B if the required rate of return is: (1) 6%, (2) 9%, and (3) 12%. From your findings in parts a and b, discuss the relationship between time to maturity and changing required returns. d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why?arrow_forward6. You are obligated to pay $10,000 in a year. There are two bonds with the following information Bond A Bond B Time to maturity 2 years 0.5 year Coupon rate 7% 5% Price $101.86 $99.51 The yields for both bonds are 6%. Construct a portfolio of bonds A and B using the immunization technique.arrow_forwardPlease answer with explanation Thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education