Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

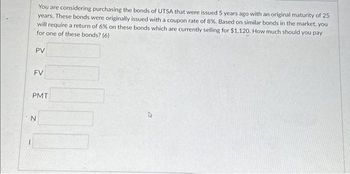

Transcribed Image Text:You are considering purchasing the bonds of UTSA that were issued 5 years ago with an original maturity of 25

years. These bonds were originally issued with a coupon rate of 8%. Based on similar bonds in the market, you

will require a return of 6% on these bonds which are currently selling for $1,120. How much should you pay

for one of these bonds? (6)

PV

FV

PMT

N

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- We would like you to take a role of a fixed income specialist and provide advice to a friend who has an investment problem. Suppose your friend has some savings and they are thinking about investing them in bonds for a period of two years. They are considering the following two bonds that are currently available on the market: four-year bond with face value $10,000, coupon rate 6%, paying coupons annually eight-year bond with face value $10,000, coupon rate 10%, paying coupons annually Assume that the term structure of interest rates is the following: r1=1%, r2=3%, r3=5%, r4=7%, r5=8%, r6=8.5%, r7=9%, r8=9.2%. Assume also that in two years there are two different possible states of the world with equal probability: all interest rates stay at the same level or all interest rates increase by 1% Your friend wants you to tell them the rate of return they could earn on each of the above two bonds over the period of two years. They also ask for advice about which bond to select for…arrow_forwardConsider two bonds, S and T. Both bonds presently are selling at their par value of $100. Bond S will mature in 5 years whereas Bond T will mature in 6 years. If interest rates change such that the yield to maturity on both bonds goes from 6% to 8%, then ____________. Group of answer choices A) Both bonds will decrease in value but bond T will decrease more than bond S B) Both bonds will decrease in value but bond S will decrease more than bond T C) Both bonds will increase in value but bond S will increase more than bond T D) Both bonds will increase in value but bond T will increase more than bond Sarrow_forwardPlease help me solve this finance question. THANK YOU!arrow_forward

- (Related to Checkpoint 9.2) (Yield to maturity) The Saleemi Corporation's $1,000 bonds pay 7 percent interest annually and have 14 years until maturity. You can purchase the bond for $915. a. What is the yield to maturity on this bond? b. Should you purchase the bond if the yield to maturity on a comparable-risk bond is 7 percent? a. The yield to maturity on the Saleemi bonds is %. (Round to two decimal places.)arrow_forwardYou wish to purchase some 25-year - maturity strip bonds with the $11,874 in cash you now have. If these strip bonds are currently priced to yield 2.125% compounded semiannually, how many $1000 denomination bonds can you purchase? a 5 bonds b 8 bonds c 6 bonds d 14 bonds e 7 bondsarrow_forwardAssume that you are choosing between 3 bonds that mature in 5 years and have a face value of $1,000. The first one pays annual coupon of $70. The second one pays $17 every three months, and the third one pays $5.5 every month. Assuming that all three bonds are selling at the same price in the market, which one would you buy? Bond 1 Bond 2 Bond 3 Blankarrow_forward

- Please solve it in excel with Formulas explanationarrow_forwardCan I get the answers to 8.1 and 8.2.arrow_forwardRay Co.’s bonds, maturing in 3 years, pay 8 percent interest on a $1,000 face value. Interest is paid once per year. If your required rate of return is 8 percent, what is the value of the bond? Now assume that the required rate of return increased to 9%. Would you recommend investors to buy the bond? What can you conclude about the relationship between bond prices and interest rates? Assume that the modified duration of this bond is 2.60 years. If the market yield changes by 2%, how much change will there be in the bond's price in %arrow_forward

- Calculate the price of a bond originally issued six years ago that pays semiannual interest at the rate of 10 percent and matures in ten years at $3,000. The market currently requires an 8 percent return for a bond of this risk. (Use a Financial calculator to arrive at the answers. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Price of a bondarrow_forwardYou are offered an 6 year bond issued by Fordson, at a price of $943.22. The bond has a coupon rate of 9% and pays the coupon semiannually. Similar bonds in the market will yield 10% today. Do you buy the bonds at the offered price? Yes the bond is offered at a premium. O No, the bond offered is worth less than $943.22. Yes, the bond offered is being sold at a discount. O There is not enough information to determine.arrow_forwardJeremy Kohn is planning to invest in a 6-year bond that pays a 12 percent coupon. The current market rate for similar bonds is 8 percent. Assume semiannual coupon payments. What is the maximum price that should be paid for this bond? (Do not round intermediate computations. Round your final answer to the nearest dollar.) O $951 O $1,000 O $1,188 O $1,056arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education