FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

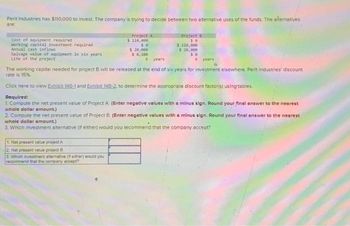

Transcribed Image Text:Perit Industries has $110,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives

are:

Cost of equipment required

working capital investment required

Annual cash inflows

Salvage value of equipment in six years

Life of the project

Project A

$ 110,000

se

$ 20,000

$ 8,100

1. Net present value project A

2. Net present value project B

3. Which investment alternative (feither) would you

recommend that the company accept?

6 years

Project 8

50

$ 110,000

$ 28,000

30

6 years

The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries' discount

rate is 15%

Click here to view Exhibit 148-1 and Exhibit 148-2. to determine the appropriate discount factor(s) using tables.

Required:

1. Compute the net present value of Project A. (Enter negative values with a minus sign. Round your final answer to the nearest

whole dollar amount.)

2. Compute the net present value of Project B. (Enter negative values with a minus sign. Round your final answer to the nearest

whole dollar amount.)

3. Which investment alternative (if either) would you recommend that the company accept?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Darnell Limited has capital project opportunities each of which would require an initial investment of $250,000. Details for each opportunity are shown below: Investment 1 Investment 2 Investment in robotic equipment $ 250,000 Investment in working capital $ 250,000 Net annual cash inflows $ 40,000 $ 40,000 Life of the project 15 Years 15 Years CCA 20 % The robotic equipment would have a salvage value of $25,000 in 15 years. The equipment would be depreciated over 15 years. At the end of 15 years, the investment in working capital would be released for use elsewhere. The company requires an after-tax return of 10% on all investments. The tax rate is 30%. Required:Compute the net present value of each investment project. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Do not round intermediate calculations. Round your PV factor to 3 decimal places and round the final answers to the nearest whole dollar.)arrow_forwardte.7arrow_forwardA project will cost $100,000 and will last 5 years with no salvage value: Revenues Sales Operating Expenses: Rent Expense Depreciation Expense Miscellaneous Expense Total Expenses Net Income $70,000 $30,000 10,000 8,000 48,000 $22,000 Instructions a. Calculate the expected annual rate of return on this project showing calculations to support your answer. b. Calculate the cash payback on this project showing calculations to support your answer.arrow_forward

- Perit Industries has $155,000 to invest. The company is trying to decide between two alternative uses of the funds. The alternatives are: Cost of equipment required Working capital investment required Annual cash inflows Salvage value of equipment in six years Life of the project $ 155,000 Project A $ 0 Project B $ 0 $ 155,000 $ 25,000 $ 8,600 $ 40,000 6 years $ 0 6 years The working capital needed for project B will be released at the end of six years for investment elsewhere. Perit Industries' discount rate is 14%. Click here to view Exhibit 12B-1 and Exhibit 12B-2. to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project A. (Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.) 2 Compute the net present value of Project B. (Enter negative values with a minus sign. Round your final answer to the nearest whole dollar amount.) 3. Which investment alternative (if either) would you…arrow_forwardGive typing answer with explanation and conclusionarrow_forwardThe management of Ortega Manufacturing has three different proposals under consideration. The Accounting Department has prepared the following information: Proposal B $ 2,450,000 Proposal C $ 2,055,000 Initial investment Useful life of equipment Estimated salvage value Payback period Net present value discounted at 15%* Which of the above proposals generates the greatest annual cash flow? Multiple Choice Proposal A Proposal B Proposal C Proposal A $ 3,100,000 Cannot be determined with the given information 7 Years $0 4.2 Years $ (30,000) 7 Years $ 400,000 4.4 Years $ 21,600 7 Years $ 100,000 4 Years $ 15,800arrow_forward

- A tunnel to transport water initially cost $1,000,000 and has expected maintenance costs that will occur in a 6-year cycle as shown below, assume MARR is 5% per year. End of Year: 2 4 6. Maintenance: $35,000 $35,000 $35,000 $45,000 $45,000 $60,000 Compute the Equivalent Annual Cost of the maintenance. Hint: Don't insert the negative sign Compute the Capitalized Cost? Hint: Don't insert the negative signarrow_forwardSubject- accountarrow_forwardNonearrow_forward

- Please help mearrow_forwardProject Phoenix costs $1.25 million and yields annual cost savings of $300,000 for seven years. The assets involved in the project can be salvaged for $100,000 at the end of the project. Ignoring taxes, what is the payback period for Project Phoenix? Select one: a. 4 years b. 4 years and 1.7 months c. 4 years and 2 months d. 4 years and 3 months e. 5 yearsarrow_forwardPat Inc, is considering a project that would have a ten-year life and would require a $1,000,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.): Sales $2,000,000 variable expenses $1,400,000 contribution margin $600,000 fixed expenses: fixed out-of-pocket cash expenses $300,000 depreciation $100,000 $400,000 net operating income $200,000 All of the above items, except for depreciation, represent cash flows. The company's required rate of return is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education