FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Capital Investment Analysis; Jones Excavation Company is planning an investment of $190,800 for a bulldozer. The bulldozer is expected to operate for 1,000 hours per year for five years. Customers will be charged $140 per hour for bulldozer work. The bulldozer operator costs $33 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $10,000. The bulldozer uses fuel that is expected to cost $43 per hour of bulldozer operation.

Present Value of an Annuity of $1 at Compound Interest

| Year | 6% | 10% | 12% | 15% | 20% |

| 1 | 0.943 | 0.909 | 0.893 | 0.870 | 0.833 |

| 2 | 1.833 | 1.736 | 1.690 | 1.626 | 1.528 |

| 3 | 2.673 | 2.487 | 2.402 | 2.283 | 2.106 |

| 4 | 3.465 | 3.170 | 3.037 | 2.855 | 2.589 |

| 5 | 4.212 | 3.791 | 3.605 | 3.353 | 2.991 |

| 6 | 4.917 | 4.355 | 4.111 | 3.785 | 3.326 |

| 7 | 5.582 | 4.868 | 4.564 | 4.160 | 3.605 |

| 8 | 6.210 | 5.335 | 4.968 | 4.487 | 3.837 |

| 9 | 6.802 | 5.759 | 5.328 | 4.772 | 4.031 |

| 10 | 7.360 | 6.145 | 5.650 | 5.019 | 4.192 |

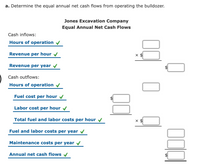

Transcribed Image Text:a. Determine the equal annual net cash flows from operating the bulldozer.

Jones Excavation Company

Equal Annual Net Cash Flows

Cash inflows:

Hours of operation

Revenue per hour V

Revenue per year

Cash outflows:

Hours of operation

Fuel cost per hour

Labor cost per hour

Total fuel and labor costs per hour

Fuel and labor costs per year

Maintenance costs per year

Annual net cash flows v

$

Transcribed Image Text:b. Determine the net present value of the investment, assuming that the desired rate of return is 12%. Use the present value of an annuity of $1 table above. Round to the nearest dollar. If required, use the

minus sign to indicate a negative net present value.

Present value of annual net cash flows

$

Amount to be invested

Net present value

$

c. Should Jones invest in the bulldozer, based on this analysis?

Yes

because the bulldozer cost is less than

the present value of the cash flows at the minimum desired rate of return of 12%.

d. Determine the number of operating hours such that the present value of cash flows equals the amount to be invested. Round interim calculations and final answer to the nearest whole number.

hours

Expert Solution

arrow_forward

Step 1

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Similar questions

- Nikularrow_forwardA Food Company is considering a project proposal for a newly formulated food product, AA. The initial fixed capital investment is GHC 18,000,000 and the working capital is GHC 2,000,000. The plant can process 72,000 kg of food in an hour, and will operate 4,000 hours per year. The expected annual expenses (excluding depreciation costs) is GHC 6,000,000 per year. The plant is expected to have a service life of ten years. The depreciation is GHC 1,500, 000. The tax rate is 25%. If the required annual rate of return after tax (hurdle rate) is 18%, calculate the minimum amount the food company should charge per customer per kilogram of food product, AA. (A) using the return on initial investment method (B) using the NPV method How would the hurdle rate change if an inflation rate of 4% is considered? The hurdle rate of 18% did not include the inflation rate of 4%.arrow_forwardManagement of Crane Home Furnishings is considering acquiring a new machine that can create customized window treatments. The equipment will cost $209,550 and will generate cash flows of $83,750 over each of the next six years. If the cost of capital is 11 percent, what is the MIRR on this project?arrow_forward

- Cori's Meats is looking at a new sausage system with an installed cost of $505,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $75,000. The sausage system will save the firm $185,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $34,000. If the tax rate is 25 percent and the discount rate is 8 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV $ 553,988.52arrow_forwardAssume you have been asked to evaluate an investment in capital equipment for the production of biofuels. The machine will cost $215,000 and it will last 10 years (useful and depreciation lifespans). Using straight-line depreciation, the salvage value for the investment is $0. You expect the equipment to have a terminal value of $20,000 at the end of the investment period. The machine has an annual maintenance cost of $6,000. Your marginal tax rate is 30%; remember that you get to keep (1-m) for everything other than the depreciation shield on an after-tax basis (it’s simply m * depreciation shield). Your after tax-cost of capital (discount rate) is 9.5%. Labor costs in the production of biofuels are $17,500/year. The machine will produce 25,500 units of biofuel annually that will be sold at $2.50/unit. Fill in the missing pieces (a through h) in the table below to complete the NPC analysis Item Pre-tax After-tax Time Growth Rate Discount Rate P.V. Factor Present…arrow_forwardManagers of Central Embroidery have decided to purchase a new monogram machine and are considering two alternative machines. The first machine costs $100,000 and is expected to last five years. The second machine costs $160,000 and is expected to last eight years. Assume that the opportunity cost of capital is 8 percent. Which machine should Central Embroidery purchase?arrow_forward

- A Company is considering the development of a plan. The company estimates that the plant and equipment would require an initial of $12 million and sales revenue of $3.0 million a year is expected over the project lifespan of 6 years. The plant and equipment will be fully depreciated using the straight-line method with zero salvage value. Yearly variable costs are $25,000 and fixed costs are $40,000, respectively. The project’s cost of capital is 12% and a corporate tax rate of 30%. Using NPV should this project be undertaken?arrow_forwardConsider the following project of Hand Clapper, Incorporated. The company is considering a four-year project to manufacture clap-command garage door openers. This project requires an initial investment of $14 million that will be depreciated straight- line to zero over the project's life. An initial investment in net working capital of $590,000 is required to support spare parts inventory; this cost is fully recoverable whenever the project ends. The company believes it can generate $11.6 million in pretax revenues with $4.4 million in total pretax operating costs. The tax rate is 21 percent and the discount rate is 11 percent. The market value of the equipment over the life of the project is as follows: Year Market Value (millions) a. 1 $ 11.2 9.1 234 4.9 1.3 Assuming the company operates this project for four years, what is the NPV? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.) b-1. Compute…arrow_forwardAgate Marketing Inc. intends to distribute a new product. It is expected to produce net returns of $13,000 per year for the first four years and $11,000 per year for the following three years. The facilities required to distribute the product will cost $36,000, with a disposal value of $9,600 after seven years. The facilities will require a major facelift costing $10,000 each after three years and after five years. If Agate requires a return on investment of 15%, should the company distribute the new product? If NPV is negative your answer must include the negative sign. Net Present Value (NPV) = Should the decision be Accept or Reject? Firarrow_forward

- A company is intending to invest in a capital budgeting project to manufacture a medical testing device and has projected the following sales: Year 1 Year 2 Year 3 Year 4 Year 5 50,000 66,400 81,200 68,500 54,500 The installed cost of the new assets will be $18,500,000 which will be depreciated using the 7-year MACRS schedule. The assets will have a salvage value of $3,700,000. Initial NWC requirements are $1,500,000 and additional working capital needs are estimated to be 15% of the projected sales increases for the following year. Total fixed costs are $2,000,000 per year. The medical device has a selling price of $300 per unit and variable production costs are $175. The firm has a marginal tax rate of 35% and a required rate of return of 18%. Analyze this project and give your recommendation as to whether they should invest in it or…arrow_forwardA proposed bridge on the interstate highway is being considered at the cost of 4 million dollars. It is expected that the bridge will have a life of 30 years. Construction costs will be paid by government agencies. Operation and maintenance costs are estimated to be $250,000 per year. Benefits to the public are estimated to be $900,000 per year. The building of the bridge will result in an estimated cost of $250,000 per year to the general public. The project requires a return of 5%. Determine the benefit/cost (B/C) ratio.arrow_forwardA new project will cost $40,000 to fund today, and an additional $40,000 next year. The device built will generate revenues of $17,000 starting in year 2 which increases by 4% each year until the device is sold at the end of year 12. The device’s salvage value is $10,000. $2,000 of maintenance is required every year. What is the NPV of building this device, if the interest to borrow the funds is 15%? (Round to nearest dollar)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education