FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

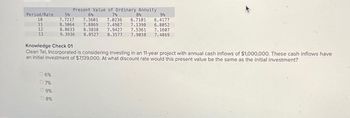

Transcribed Image Text:Period/Rate

10

11

12

13

Knowledge Check 01

Clean Tel, Incorporated is considering investing in an 11-year project with annual cash inflows of $1,000,000. These cash inflows have

an initial investment of $7,139,000. At what discount rate would this present value be the same as the initial investment?

0000

6%

7%

Present Value of Ordinary Annuity

6%

7%

8%

5%

9%

7.7217 7.3601 7.0236 6.7101 6.4177

8.3064 7.8869 7.4987 7.1390 6.8052

8.8633 8.3838 7.9427 7.5361 7.1607

9.3936 8.8527 8.3577 7.9038 7.4869

9%

8%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 17. Problem 11.20 (NPV) eBook A project has annual cash flows of $6,000 for the next 10 years and then $10,500 each year for the following 10 years. The IRR of this 20-year project is 11.42%. If the firm's WACC is 8%, what is the project's NPV? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardi will 10 upvotes urgent Suppose your firm is seeking an eight-year, amortizing $750,000 loan with annual payments and your bank is offering you the choice between a $795,000 loan with a $45,000 compensating balance and a $750,000 loan without a compensating balance. The interest rate on the $750,000 loan is 8.5 percent. How low would the interest rate on the loan with the compensating balance have to be for you to choose it?(Do not round intermediate calculations and round your final answer to 2 decimal places.) Interest rate%arrow_forwardQuestion content area top Part 1 (Present value of a growing perpetuity) Your firm has taken on cost saving measures that will provide a benefit of $10,000 in the first year. These cost savings will decrease each year at a rate of 4 percent forever. If the appropriate interest rate is 6 percent, what is the present value of these savings? Question content area bottom Part 1 The present value of these cost savings is $enter your response here. (Round to the nearest cent.)arrow_forward

- Incorrect Question 13 Suppose you invest $2,500 in a fund earning 15% simple interest. Further suppose that you have the option at any time of closing this account and opening an account earning compound interest at an annual effective interest rate of 9%. At what instant should you do so in order to maximize your accumulation at the end of five years? (Round your answer to two decimal places.) 4.53 years How about if you wish to maximize the accumulation at the end of ten years? (Round your answer to two decimal places.) 4.53 yearsarrow_forwardChapter 10 Discussion Q1 A property is sold for $200,000. Typical financing terms are an 85 percent loan with a 10 percent interest rate over 15 years. If the gross income per year is $30,000, what is the overall capitalization rate?arrow_forwardAccountarrow_forward

- Question 9 of 13 How much would a business have to invest in a high-growth fund to receive $24,000 every month for 5 years, receiving the first payment 4 years from now. The investment earns interest at 7.25% compounded monthly. 2$ Round to the nearest centarrow_forwardint rences 8 00 Gook Suppose you are 35 and have a $90,000 face amount, 15-year, limited-payment, participating policy (dividends will be used to build up the cash value of the policy). Your annual premium is $810. The cash value of the policy is expected to be $3,600 in 15 years. Using time value of money and assuming you could invest your money elsewhere for a 8 percent annual yield, calculate the net cost of insurance. Use (Exhibit 1-A, Exhibit 1-B, Exhibit 1-C, Exhibit 1-D) Note: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round time value factor to 3 decimal places and final answer to the nearest whole number. Net cost of insurance Darrow_forwardAsap plz handwritten solution acceptable Need urgently will definitely ratearrow_forward

- Previous Problem Problem List Next Problem HW 20 Simple and Compound Interest: Problem 7 (3 points) Find the total amount of money accumulated for an initial investment $1,050 at 8% compounded quarterly after 10 years. Amount: Preview My Answers Submit Answers You have attempted this problem 0 times. You have unlimited attempts remaining.arrow_forward9. Problem 12.17 (Equivalent Annual Annuity) eBook A firm has two mutually exclusive investment projects to evaluate. The projects have the following cash flows: TimeAfter-tax Cash Flow XAfter-tax Cash Flow Y -$80,000 -$80,000 40,000 30,000 55,000 30,000 60,000 D 1 2 3 4 5 30,000 30,000 5,000 Projects X and Y are equally risky and may be repeated indefinitely. If the firm's WACC is 15%, what is the EAA of the project that adds the most value to the firm? Do not round intermediate calculations. Round your answer to the nearest dollar. Choose Project -Select , whose EAA-Sarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education