FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Help

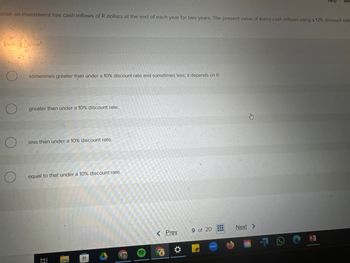

Dose an investment has cash inflows of R dollars at the end of each year for two years. The present value of these cash inflows using a 12% discount rate

Choice

sometimes greater than under a 10% discount rate and sometimes less; it depends on R.

O

greater than under a 10% discount rate.

O

less than under a 10% discount rate.

O

equal to that under a 10% discount rate.

节

< Prev

9 of 20

Next >

2009

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Question 1: Blue Bird is considering an investment of $230 000 with cash inflows of $95 000, $76 000, $71 000, $38 000 and $33 000 over the next five years respectively. Required: What is the net present value of this investment if the relevant discount rate is 12%?arrow_forwardQUESTION 6 Seaborn Co. has identified an investment project with the following cash flows. Year Cash Flow $950 1,050 1,320 1,200 1 2 3 4 If the discount rate is 10 percent, what is the present value of these cash flows? 3542.76 3578.84 3418.66 4470.00 3847.03 Click Save and Submit to save and submit. Click Save All Answers to save all answers. SEP 28 30 tv ♫ Aarrow_forwardAssuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…arrow_forward

- is 22 percent? Future Value and Multiple Cash Flows Wells, Inc., has identified an investment project with the following cash flows. If the discount rate is 8 LO 1 3. percent, what is the future value of these cash flows in Year 4? What is the future value at an interest rate of 11 percent? At 24 percent? Year Cash Flow $ 865 1,040 1,290 1,385 1 2 3 4arrow_forward8. A particular investment promises to make year-end annual payments in perpetuity. The first four annual payments will be $5. After that, future annual payments will grow at 5% per year forever. What is the present value of this investment if the discount rate is 10%? a. $98.68 b. $87.57 c. $76.46 d. $65.35 e. $54.24arrow_forwardquestion 10 What is the present value of investment A, B, and C at an annual discount rate of 22 percent round to nearest cent?arrow_forward

- Assuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…arrow_forwardAssuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of 1.391.39%, the after-tax real rate…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education