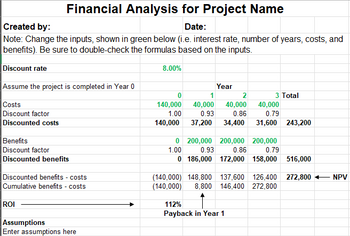

Perform a financial analysis for a project using the format provided in Figure 4-5. Assume that the projected costs and benefits for this project are spread over four years as follows: Estimated costs are $300,000 in Year 1 and $40,000 each year in Years 2, 3, and 4. Estimated benefits are $0 in Year 1 and $120,000 each year in Years 2, 3, and 4. Use a 7 percent discount rate, and round the discount factors to two decimal places. Create a spreadsheet or use the business case financials template on the Companion website to calculate and clearly display the

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- You are responsible to manage an IS project with a 4-year horizon. The annal cost of the project is estimated at $40,000 per year, and a one-time costs of $120,000. The annual monetary benefit of the project is estimated at $96,000 per year with a discount rate of 6 percent. a. Calculate the overall return on investment (ROI) of the project. b. Perform a break-even analysis (BEA). At what year does break-even occur?arrow_forwardDetermine the average rate of return for a project that is estimated to yield total income of $386,400 over four years, has a cost of $579,600, and has a $64,400 residual value.arrow_forwardA project with an initial outlay of $400 has an economic life of 5 years. The project after-tax cash flows are $150 in Years 1 & 2, then after-tax cash flows of $100 in Years 3 through 5. Calculate the internal rate of return, net present value and profitability index using an interest rate of 12%.arrow_forward

- Determine the average rate of return for a project that is estimated to yield total income of $220,800 over 4 years, cost $419,000, and has a $41,000 residual value.arrow_forwardAn investment project costs $12,600 and has annual cash flows of $3,100 for six years Required: (a) What is the discounted payback period if the discount rate is zero percent? (Click to select) (b) What is the discounted payback period if the discount rate is 3 percent? (Click to select) (c) What is the discounted payback period if the discount rate is 20 percent? (Click to select) eBook & Resources eBook: 9.3. The Discounted Paybackarrow_forwardDetermine the average rate of return for a project that is estimated to yield total income of $484,440 over 4 years, costs $668,000, and has a $66,000 residual value.arrow_forward

- The conventional B/C ratio for a flood control project along the Mississippi River was calculated to be 1.3. The benefits were $500,000 per year and the maintenance costs were $200,000 per year. What was the initial cost of the project if a discount rate of 7% per year was used and the project was assumed to have a 50-year life?arrow_forwardYou are evaluating two different systems: System A costs $45,000, has a three year life and costs $5,000 per year to operate. System B costs $65,000, has a five year life and costs $4,000 per year to operate. If the required rate of return is 8%, which system would you prefer? I Next Slidearrow_forwardA project requires an up- front investment of $20,000 and provides cost savings of $3000 after two years, and then $3000 each year thereafter. Find the discounted payback period when the MARR = 10%.arrow_forward

- Find the present value of an investment that will pay $9,000 at the end of Years 10, 11, and 12. Use a discount rate of 10 percent.arrow_forwardTwo roadway design are under consideration. Design 1A will cost $3 million to build and $100,000 per year to maintain. Design 1B will cost $3.5 million to build and $40,000 per year to maintain. Both designs are assumed to be permanent. Use an AW based rate of return equation to determine (a) the breakeven ROR, and (b) which design is preferred at a MARR of 10% per yeararrow_forwardAn investment project costs $15,600 and has annual cash flows of $3,900 for six years. a. What is the discounted payback period if the discount rate is zero percent? Discounted payback period b. What is the discounted payback period if the discount rate is 6 percent? Discounted payback periodarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education