Pedabo Invest (Pedabo) is in the business of extending loans and financing projects to organizations mainly in the agricultural industry. Pedabo has a track record of extending substantial loans to and financing agricultural projects of companies in the rural parts of the country. Pedabo was impacted in 2012 by a major economic event, which negatively impacted its ability to fund projects and extend loans by 39%. Despite the hit it took, Pedabo continues to fund some key projects and loans. Pedabo has capacity to extend one more business loan in the first quarter of 2013. Bargain’s and BBC & Company are two organizations that Pedabo is considering for the loan. Bargain’s and BBC & Company are both meat processing companies. They process meat and in turn sell to restaurants and supermarkets. As the Financial Analyst of Pedabo, you have been tasked with analyzing the financial statements (using financial ratios) of Bargain’s and BBC & Company and making a recommendation to the Senior Management of Pedabo in regards to which of the two organizations is better suited for the loan.

Required:

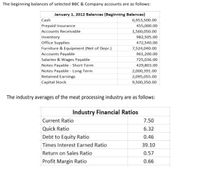

1. Compute the following ratios for Bargain’s and BBC & Company

a.

b. Quick Ratio

c. Times Interest Earned Ratio

d. Debt to Equity Ratio

e. Return on Sales Ratio

f. Return on Assets Ratio

g. Gross Profit Ratio

h. Profit Margin Ratio

2. Assuming that the current, debt to equity, times interest earned, debt to equity, return on sales and profit margin ratios are the only financial ratios that Pedabo uses in making loan or financing decisions, determine which of the two organizations is better suited for the loan. Carefully explain the rationale for your decision.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- TechSpecialist (Pty) Ltd (hereafter referred to as “TechSpecialist”) is a small to medium-sized enterprise involved in the purchase and sale of IT hardware and accessories. TechSpecialist is located around Thohoyandou industrial area. The Thulamela Municipality is their largest client, which they have obtained through the annual tender process. The entity has experienced cash flow difficulties due to the Covid 19 pandemic. TechSpecialist has enjoyed tremendous support from the Thulamela Municipality; however, as is customary with government institutions, the Thulamela Municipality have a 60- day payment policy. In other words, the Thulamela Municipality has up to 60 days to pay an invoice before they can allow their suppliers to charge them interest. The Thulamela Municipality has on certain occasions paid supplier invoices within 20 days but on other occasions, they have paid the invoices on the 60th day. On 28 July 2021, TechSpecialist delivered IT equipment to the Thulamela…arrow_forwardHarderarrow_forwardAn International company called Larsen & Toubro (L&T) on 26.3.2019 announced that it had won a contract for a coke calciner project at Sohar Industrial Estate in Oman. They did not bid for many projects in 2019 in the GCC region due to capital rationing. The reason for hard capital budgeting will not include the following Poor track record Desire for limited investment options Poor management team Industry-wide factorsarrow_forward

- Miles Ltd., a manufacturer of various car products wants to estimate its funding requirements for the coming financial year. In the recent past, the company had spare production capacity, but increased sales has raised suspicions amongst management that investment in new capacity may be required soon. In the current financial year the company achieved sales of R200 million on assets worth R2000 million and liabilities of R500 m. It's resulting net profit margin was 10% with no dividend being paid I as the company ts in a high growth phase. All assets and liabilities are considered spontaneous and increase in line with sales. It is expected tha sales will grow by 20% in the coming year. Assets are however only utilized up to 90% of total capacity and the spare capacity can be used first before new capacity is installed. a. R36 million b. R76 million C. R120 million d. R240 million Iarrow_forwardHorizon Corporation manufactures personal computers. The company began operations in 2012 and reported profits for the years 2012 through 2019. Due primarily to increased competition and price slashing in the industry, 2020’s income statement reported a loss of $20 million. Just before the end of the 2021 fiscal year, a memo from the company’s chief financial officer (CFO) to Jim Fielding, the company controller, included the following comments:If we don’t do something about the large amount of unsold computers already manufactured, our auditors will require us to record a write-down. The resulting loss for 2021 will cause a violation of our debt covenants and force the company into bankruptcy. I suggest that you ship half of our inventory to J.B. Sales, Inc., in Oklahoma City. I know the company’s president, and he will accept the inventory and acknowledge the shipment as a purchase. We can record the sale in 2021 which will boost our loss to a profit. Then J.B. Sales will simply…arrow_forwardBnB Caribbean Inc. (BnB) is a leading construction company founded in 2001 and is based in Jamaica. The company has within recent years been experiencing increases in revenues from its construction related services such as design, build, expansion and remodeling, and emergency services. It’s main line of business is from the construction of roads and commercial buildings within Jamaica and to a lesser extent a few other Caribbean countries. Since the growth of the tourism sector in the Caribbean, BnB Caribbean has become concerned about the number of other construction companies which have entered the market to provide similar services around the Caribbean region. Business overseas contributes to 40% of the company’s revenues, while the other 60% comes mainly from works done in the domestic market. The COVID-19 pandemic has caused a slowdown in overall operations leading to prolonged delays in delivery of raw materials from abroad. The CEO of the company is optimistic that there will…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education