EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

None

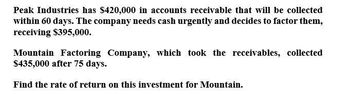

Transcribed Image Text:Peak Industries has $420,000 in accounts receivable that will be collected

within 60 days. The company needs cash urgently and decides to factor them,

receiving $395,000.

Mountain Factoring Company, which took the receivables, collected

$435,000 after 75 days.

Find the rate of return on this investment for Mountain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- find the rate of return on this investment for donne.arrow_forwardBlake Corporation has $200,000 in accounts receivable that will be collected within 80 days. Since Blake needs cash immediately, it has decided to factor them and has received $185,000. Everest Factoring Company, which took the receivables, could collect only $195,000 after 100 days. Find the rate of return on this investment for Everest.arrow_forwardPlease need answer the accounting questionarrow_forward

- Please provide this question solution general accountingarrow_forwardSuppose that LilyMac Photography has annual sales of $233,000, cost of goods sold of $168,000, average inventories of $4,800, average accounts receivable of $25,600, and an average accounts payable balance of $7,300.Assuming that all of LilyMac’s sales are on credit, what will be the firm’s cash cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardSuppose that LilyMac Photography has annual sales of $233,000, cost of goods sold of $168,000, average inventories of $4,800, average accounts receivable of $25,600, and an average accounts payable balance of $7,300. Assuming that all of LilyMac's sales are on credit, what will be the firm's cash cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.) What will be the firm's operating cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forward

- Please see image to solve question.arrow_forwardSmith Inc. currently fills mail orders from all over the country and receipts were received in its head office. The company's average accounts receivable is P3,125,000 and is financed by a bank loan with 10% interest. Smith is considering a regional lockbox system to speed up collections. This system is projected to reduce the average accounts receivable by 15%. The annual cost of the lockbox system is P25,000. What is the estimated net annual savings in implementing the lockbox system? A. 22,985 B. 28,455 C. 25,750 D. 21,875arrow_forwardParadise Retailers, Inc. (PRI) determined that $1,500,000 is needed for cash transactions made during the next year. Each time PRI deposits money in its checking account, a charge of $12.95 is assessed to cover clerical costs. If PRI can hold marketable securities that yield 4.5%, and then convert these securities to cash at a cost of only the $12.95 deposit charge, what is the optimal cash amount C* to transfer from marketable securities to the checking account according to the Baumol Model?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT