Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:&

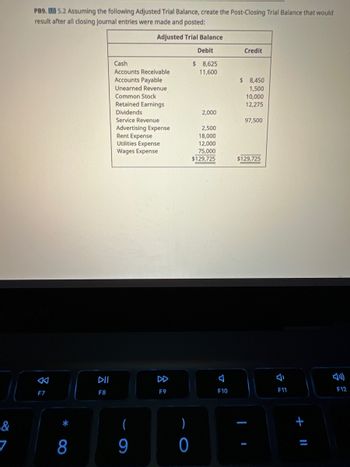

PB9. LO 5.2 Assuming the following Adjusted Trial Balance, create the Post-Closing Trial Balance that would

result after all closing journal entries were made and posted:

Adjusted Trial Balance

Debit

Credit

Cash

$8,625

Accounts Receivable

11,600

Accounts Payable

$ 8,450

Unearned Revenue

1,500

Common Stock

10,000

Retained Earnings

12,275

Dividends

2,000

Service Revenue

97,500

Advertising Expense

2,500

18,000

Rent Expense

Utilities Expense

12,000

Wages Expense

75,000

$129,725

$129,725

F7

8

F8

(

9

A

F9

)

0

F10

I

F11

+ 11

I

F12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hh1. Accountarrow_forward9. The adjusting journal entry to adjust the allowance for doubtful accounts as of December 31, 2020 will include a debit to doubtful accounts expense of:arrow_forwardTER 8-UTS-The Political S A M7: Assignment No.1 AE CABA. e Home Edmodo e Spoliarium by Juan. W You searched for Re... W Operating Performa. in No 1 Qtn.docCx 5. 6. 7. 8. 9. 10. Open with - The balances for the accounts listed below appeared in the Adjusted Trial Balance columns of the work sheet. Indicate whether each balance should be extended to (a) the Income Statement columns or (b) the Balance Sheet columns. 2. (1) Salaries Payable (2) Fees Eamed (3) Accounts Payable (4) Felipe Ramos, Capital (5) Supplies Expense (6) Unearned Rent Felipe Ramos, Drawing Equipment (7) (8) (9) (10) (11) (12) Accounts Receivable Accumulated Depreciation Salary Expense Depreciation Expense Page Ps 25°C 99 LGarrow_forward

- #3arrow_forwardWorkings required for the image attcahed.arrow_forward3. Determine the expected net realizable value of the accounts receivable as of December 31 (after all of the adjustments and the adjusting entry).$fill in the blank c1967008e049075_1 4. Assuming that instead of basing the provision for uncollectible accounts on an analysis of receivables, the adjusting entry on December 31 had been based on an estimated expense of ½ of 1% of the sales of $8,760,000 for the year, determine the following: a. Bad debt expense for the year. b. Balance in the allowance account after the adjustment of December 31. c. Expected net realizable value of the accounts receivable as of Decemberarrow_forward

- Ss.112.arrow_forwardMore info - X December 1 Ritchie sold 14 go-karts on account. The selling price of each go-kart was $1,900; the cost of goods sold for each was $400. December 5 Ritchie received notice of a class-action lawsuit being filed against it. The lawsuit claims that Ritchie's go-karts have engine defects that appear after the warranty period expires. The plaintiffs,want Ritchie to replace the defective engines and pay damages for the owners' losé of use. The cost of replacing the engines would be approximately $380,000 (not including any damages). Ritchie's attorney believes that it is reasonably possible that Ritchie will lose the case, but the attorney cannot provide a dollar estimate of the potential loss amount. December 20 Ritchie performed repairs due to product warranty complaints for two go-karts sold earlier in the year. Ritchie's cost of the repairs, paid in cash, was $850. December 22 An individual claims that he suffered emotional distress from a high-speed ride on a Ritchie…arrow_forwardm - Aug 28 X + nd.vst.idref%3DP7001016677000000000000000003B8F]!/4/2[P700101667700000000000... 2 ☆ S4-2 At December 31, 2020, before any year-end adjustments are made, White Corporation had a $50 balance in Accounts Receivable and a $0.6 debit balance in the Allowance for Uncollectible Accounts. Requirements O 1. What is the normal balance in the Allowance for Uncollectible Accounts? What would cause this account to have a debit balance? 2. How does management determine the amount of uncollectible accounts? 3. The aging of receivables indicates that White Corporation will not collect $1.5 million of its accounts receivables. Prepare the journal entry to record the bad debt expense for 2020. PUCE a 209arrow_forward

- TB MC Qu. 6-34 (Algo) For Case (B) above, what is the... Case (A) Case (B) Case (C) Beginning Balance (BB) $ 53,520 $ 32,100 $ 22,600 Ending Balance (EB) ? 28,400 29,200 Transferred In (TI) 183,200 ? 87,100 Transferred Out (TO) 181,400 110,200 ? For Case (B) above, what is the Transferred-In (TI)? Multiple Choice A) $106,500. B) $49,700. C) $170,700. D) $113,900.arrow_forwardQuestion is attached in the screesnhot thanks for the hlep l13pyl32yp42okp2ojhtihjlidgn qgoiqyh90yh1391h3teq g lolarrow_forwardam. 114.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning