Concept explainers

Problem 9-3B Payroll expenses, withholdings, and taxes P2 P3

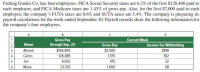

Fishing Guides Co. has four employees. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company’s FUTA taxes are 0.6% and SUTA taxes are 5.4%. The company is preparing its payroll calculations for the week ended September 30. Payroll records show the following information for the company’s four employees.

In addition to gross pay, the company must pay 60% of the $50 per employee weekly health insurance; each employee pays the remaining 40%. The company also contributes an extra 5% of each employee’s gross pay (at no cost to employees) to a pension fund.

Required

Compute the following for the week ended September 30 (round amounts to the nearest cent):

-

Employer’s FUTA taxes.

(5) $2.10

-

Employer’s SUTA taxes.

-

Each employee’s net (take-home) pay.

(7) Total net pay, $4,565.81

-

Employer’s total payroll-related expense for each employee.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 8 images

- Exercise 9- culating employee Marion Co. employed Juan Lopez in 2010. Juan earned $5,000 per month and worked the entire year. Assume the Social Security tax rate is 6 percent on the first $110,000 of earnings and the Medicare tax rate is 1.5 percent. Juan's federal income tax withholding amount is $900 per month. Use 6.2 percent for the unemployment tax rate for the first $7,000 of earnings per employee. Required a. Answer the following questions: (1) What is Juan's net pay per month? (2) What amount does Juan pay monthly in FICA payroll taxes? (3) What is the total payroll tax expense for Marion Co. for January 2010? February 2010? March 2010? December 2010? b. Assume that instead of $5,000 per month Juan earned $9,500 per month. Answer the questions in Requirement a.arrow_forwardExercise Al-9 Payment of payroll deductions LO3 Paradise Hills Berry Farm has 21 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2021. Gross Pay EI Premium Income Taxes 78,950.00 1,310.57 10,889.00 CPP 3,768.09 Medical Ins. United Way 1,475.00 1,644.00 Required: Prepare a journal entry to record payment by the employer to the Receiver General for Canada on April 15. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) View transaction list Journal entry worksheet 1 Record the remittance to the Receiver General for Canada. Note: Enter debits before credits. Date April 15 General Journal + Debit Credit View general journal Record entry Clear entryarrow_forwardEX 11-14 Urban Window Company had gross wages of $320,000 during the week ended July 15. The amount of wages subject to social security tax was $320,000, while the amount of wages subject to federal and state unemployment taxes was $40,000. Tax rates are as follows: Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.6% The total amount withheld from employee wages for federal taxes was $75,200. a. Journalize the entry to record the payroll for the week of July 15. b. Journalize the entry to record the payroll tax expense incurred for the week of July 15.arrow_forward

- Payroll 4.1 Justin Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, single or married filing separately), social security taxes, and state income tax (2%). Enter deductions beginning with a minus sign (-). Round interim amounts to two decimal places. Use these values in subsequent computations then round final answer to two decimal places. As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition, the 2020 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used.arrow_forwardonlyy need b, tnksarrow_forwardExercise 9-10 (Algo) Recording payroll LO P2, P3 The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $380,000; Office salaries, $76,000; Federal income taxes withheld, $114,000; State income taxes withheld, $25,500; Social security taxes withheld, $28,272; Medicare taxes withheld, $6,612; Medical insurance premiums, $9,000; Life insurance premiums, $6,000; Union dues deducted, $3,000; and Salaries subject to unemployment taxes, $54,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including employee deductions, and cash payment of the net payroll (salaries payable) for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and other related employment…arrow_forward

- QS 11-8 (Algo) Recording employee payroll taxes LO P2 On January 15, the end of the first pay period of the year, North Company's employees earned $28,000 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $2,100 of federal income taxes, $459 of medical insurance deductions, and $230 of union dues. No employee earned more than $7,000 in this first period. Prepare the journal entry to record North Company's January 15 salaries expense and related liabilities. No 1 Date January 15 X Answer is complete but not entirely correct. General Journal Salaries expense FICA-Social security taxes payable FICA-Medicare taxes payable Employee medical insurance payable Employee union dues payable Salaries payable Federal unemployment taxes payable × Debit 28,000 Credit 1,736 406 678 X 190 X 21,190 X 3,800 Xarrow_forward6-9B LO 3 See Example 6-5 on page 6-12, Example 6-7 on page 6-19 The following information pertains to a weekly payroll of Fanelli Fashion Company: a. The total wages earned by employees are $2,910. b. The state unemployment insurance contribution rate is 3.75%. C. The entire amount of wages is taxable under FICA, FUTA, and SUTA. d. The amount withheld from the employees' wages for federal income taxes is $491; for state income taxes. $49.10; and for group insurance, $87.10. Journalize the payment of wages, and record the payroll taxes for this payroll. JOURNAL POST. REF. DATE DESCRIPTION DEBIT CREDIT 6. 10 11 11 12 4. 6arrow_forward7arrow_forward

- Chapter 9 Homework - Payroll (Homework) Question is : A paving company has 24 employees, 15 with gross earnings of $355 per week and nine with gross earnings of $385 per week. What is the total social security and Medicare tax (in $) the company must send to the Internal Revenue Service for the first quarter of the year?arrow_forwardSexton Company uses an Excel spreadsheet to track its account balances. When the company applies overhead to production for the month of May, how will the company’s account balances be affected on that spreadsheet? multiple choice Accounts Payable will increase. Work in Process will increase. Manufacturing Overhead will increase. Retained Earnings will decrease.arrow_forward11 12 13 14 15 16 17, 18 Question 7: Hamilton, Inc. prepared the following payroll summary for the current month: Total salaries $49,500 Employee deductions: Employee income taxes withheld Hospital insurance premiums Union dues withheld 11,670 1,420 1,160 CPP is deducted at 4.95% and El is deducted at 1.73%. Hamilton contributes to a private pension plan on behalf of its employees in the amount of 8% of gross pay. A vacation pay accrual is also made in the amount of 4% of the gross pay. Required: Prepare the journal entries to record: a) The month's payroll register. b) The cost of employee benefits for CPP and EI. c) The cost of employee benefits for the private pension plan and vacation pay.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education