ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

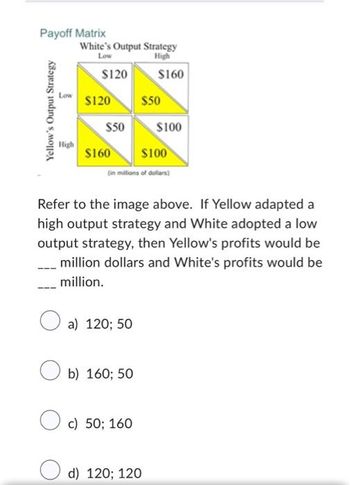

Transcribed Image Text:Payoff Matrix

Yellow's Output Strategy

Low

High

White's Output Strategy

Low

High

$120

$120

$50

$160

$100

(in millions of dollars)

a) 120; 50

$160

$50

Ob) 160; 50

Oc) 50; 160

Refer to the image above. If Yellow adapted a

high output strategy and White adopted a low

output strategy, then Yellow's profits would be

million dollars and White's profits would be

million.

$100

d) 120; 120

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Two rival companies competing in the same market need to decide their plans for future expansion of their stores. The Table below shows the possible outcomes of their mutually interdependent actions (payoffs are profits in £m) Giga Company Titanic Conglomerate No Change Refurbishment of existing stores Large Expansion No Change 30, 40 25, 35 15, 24 Refurbishment of existing stores 35, 30 28, 32 18, 33 Large Expansion 12, 22 18, 20 20, 25 The Nash equilibrium: (A) does not exist. (B) occurs when both firms choose Refurbishment of existing stores. (C) occurs when both firms choose Large Expansion. (D) occurs when both firms choose No Change.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardQuestion 6 What is the equilibrium payoff for player 1? PLAYER 1 Up Down PLAYER 2 Left 42, 42 13, 3 Right 3, 13 42, 42arrow_forward

- Table 8. This table shows a game played between two players, A and B. The payoffs are given in the table as (Payoff to A, Payoff to B). A Select one: Up Middle Down Left (4,2) a. Middle-Center O b. Down-Center (3, 1) (1,3) B Center (2,5) (5, 3) (4,4) Refer to Table 8. This table shows a game played between two players, A and B. The payoffs in the table are shown as (Payoff to A, Payoff to B). Which of the following outcomes represents a Nash equilibrium in the game? Right (3, 3) (5,2) (6, 1) O c. Up-Left O d. More than one of the above is a Nash equilibrium in this game.arrow_forward4) Consider the following payoff matrix: Player 1 Strategy A Strategy B c) Is the payoff matrix symmetric? Player 2 Strategy A Strategy B (0,0) (7,4) (2,2) (3,3) a) Does either player have a dominant strategy? b) Is there one or more Nash Equilibrium? 1arrow_forwardIf a strategy profile is a Nash equilibrium, there is at least one player that could achieve higher payoffs by deviating.(a) True. (b) False.arrow_forward

- Construct the normal representation and the fully reduced normal representation of the game shown in Figure 1. 0 (0.5) (0.5) 1.r 1.s W1 X1 y1 Z1 0,0 2.t 2.t 0,4 a2 b2 a2 b2 Figure 1: Extensive-form game 2,-2 -2,2 -2, 2 2,-2arrow_forwardExplain the nature of game theory. What current issue could this be applied to?arrow_forwardRefer to the following payoff table: Firm A's Advertising Budget Low Multiple Choice Medium High A D G $900, $900 Low $1,000, $800 Firm A High; Firm B Low Firm A Low; Firm B Low Firm B's Advertising Budget Medium B E H $820, $1,220 $950, $1,025 с F 1 High $875, $920 $800, $875 $1,025, $1,175 Using the method of successive elimination of dominated strategies, which strategies, if any, are eliminated after the first round? $1,060, $1,100 $1,040, $1,000arrow_forward

- Dizz Cut price Maintain price Perlis Cut price (-1,-1) A (2,-2) B Maintain price (-2,2) (1,1) D Figure 12 Payoff matrix for two firms in oligopoly Two firms, Perlis and Dizz, produce washing powder in a market characterised by oligopoly. Each firm can increase its market share and profits by cutting its price relative to its rival. However if both firms cut prices they both suffer a fall in profit. This situation may be characterised as a game and Figure 12 shows the payoff matrix for this game. Figure 12 also labels each cell in the payoff matrix with a letter, A, B, C or D. Based on the information in the payoff matrix, decide which cells, if any, correspond to a Nash equilibrium. Select one answer. Select one: O There is no Nash equilibrium O D O A O A and Darrow_forwardStarbucks and Krispy Kreme are trying to decide whether or not to open a shop in the new Mall of Africa. They both prefer if the other firm opens a shop because they can draw bigger crowds but neither wants to be the only American-branded coffee shop in the Mall. The payoff matrix for this dilemma is below. Krispy Kreme Open Don't Open Starbucks Open (i) (ii) 5.5 2,6 Don't open (iii) (iii) 6,2 3.3 MCQ question 4 Find the Nash Equilibrium (Starbucks, Krispy Kreme) for the payoff matrix when the game is played simultaneously. A. (5;5) only. OB. (6,2) only. OC. (2,6) only OD. (3,3) only O E. There is no stable Nash Equilibrium.arrow_forwardA strategy is called a pure strategy if it involves choosing ________. a. an action that yields a higher payoff to the opponent b. one particular action for a situation c. an action that yields a zero payoff to the player d. different combinations of actions for a situationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education