FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

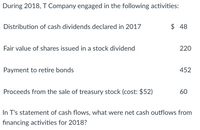

Transcribed Image Text:During 2018, T Company engaged in the following activities:

Distribution of cash dividends declared in 2017

$ 48

Fair value of shares issued in a stock dividend

220

Payment to retire bonds

452

Proceeds from the sale of treasury stock (cost: $52)

60

In T's statement of cash flows, what were net cash outflows from

financing activities for 2018?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- P5.6arrow_forwardQuestion Content Area A company reported the following information: Interest receivable, December 31, 2023: $8,000 Interest receivable, December 31, 2022: $11,500 Interest revenue for 2023: $16,000 Interest receivable, December 31, 2023 $8,000 Interest receivable, December 31, 2022 11,500 Interest revenue for 2023 16,000 How much cash was received for interest during 2023?arrow_forwardPART II - Below are 2019 FMT Company Cash flow accounts. Increase in bonds 170.0 Net income 117.5 Increase in notes payable Depreciation and amortization Additions to property, plant, and equipment 50.0 100.0 ($230.0) (200.0) Increase in inventories Increase in accrued wages and taxes 10.0 (60.0) (57.5) Increase in accounts receivable Payment of dividends to stockholders Increase in accounts payable 30.0 Net cash provided by (used in) operating activities Net cash used in investing activities Net cash provided by financing activities Net increase (decrease) in cash ? Requirements: 2. Compute for the following: Net cash provided by financing activities Net increase (decrease) in casharrow_forward

- Determining Cash Flows from Financing Activities Nichols Inc. reported the following amounts on its balance sheet at the end of 2019 and 2018 for equity: 12/31/2019 12/31/2018 Common stock $210,000 $135,000 Retained earnings 495,300 412,800 Required: Assume that Nichols did not retire any stock during 2019, it reported $105,610 of net income for 2019, and any dividends declared were paid in cash. Determine the amounts Nichols would report in the financing section of the statement of cash flows. Issuance of common stock $fill in the blank 1 Payment of dividends $fill in the blank 2arrow_forwardWhat is the firm's cash flow from financing?arrow_forwardCash received from long-term notes payable Purchase of investments Cash dividends paid Interest paid Financing Activities $ 56,000 14, 200 Compute cash flows from financing activities using the above company information. Note: Amounts to be deducted should be indicated by a minus sign. $ 45,600 22,800 0arrow_forward

- Smirnoff Corporation's net cash flows from operating activities on its cash flows statement for 2024 are? Thank you!arrow_forwardBalance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts. Receivable $5,268,485 $10,268,485 Inventory $529,062 $696,685 Current Assets $8,371,777 $13,279,842 Less $2,574,230 $2,314,672 Gross Fixed Assets $16,251,665 $20,567,330 Accum.Depreciation Total Assets $7,460,897 $10,117,819 Accounts Payable Notes. Payable Current Liabilities Calculate the net working capital in 2022. Long Termi Debt Total Liabilities, None of these options are correct $10,572,740 $5,664,675 $8,854,338 $3,946,273 Total $17,162,545 $23,729,353 Liabilities and Equity Capital Surplus Retained. Earnings 2021 2022 $1,673,992 $2,438,271 Common Net Fixed Assets $8,790,768 $10,449,511 Stock ($0.50 $1,300,000 $1,600,000 par) $1,033,110 $1,987,233 $2,707,102 $4,425,504 $9,242,830 $11,468,302 $11,949,932 $15,893,806 $1,148,120 $1,800,969 $2,764,493 $4,434,578 $17,162,545 $23,729,353arrow_forwardBy how much did Declan's Designs' Dividends Payable increase during 2022? Please do not provide the net change in Dividends Payable, but instead provide the gross annual increase to Dividends Payable. Question 8 options: $73,000 $10,000 $63,000 $20,000arrow_forward

- 12. Henry Cowper From the following information, prepare a Statement of financial position of Henry Cowper at 30 September 2019, showing the appropriate headings: Cash in hand Inventory Bank Land and buildings Capital introduced by Henry Cowper Vehicles Receivables Payables overdraft 50 27,300 8,840 99,700 148,250 26,340 12,000 8,300arrow_forwardBased on the following information,. Purchase of investments $ 434 Dividends paid 278 Interest paid 69 Additional borrowing from bank 565 The cash flows from financing activities under GAAP would $______arrow_forwardDetermining Cash Flows from Financing Activities Nichols Inc. reported the following amounts on its balance sheet for equity: Common stock Retained earnings Required: Jan. 1 $105,000 376,750 Dec. 31 $162,000 455,490 Assume that, for the current year, Nichols did not retire any stock, it reported $94,300 of net income for 2019, and any dividends declared were paid in cash. Determine the amounts Nichols would report in the financing section of the statement of cash flows. Issuance of common stock Payment of cash dividendsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education