Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

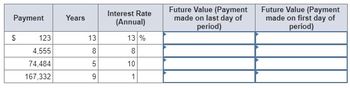

Transcribed Image Text:Payment

$

123

4,555

74,484

167,332

Years

13

8

5

9

Interest Rate

(Annual)

13 %

8

10

1

Future Value (Payment

made on last day of

period)

Future Value (Payment

made on first day of

period)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to rounding of percents in table lookup.). (Use 13% for table lookup.). (Use the loan amortization table) Note: Round your answers to the nearest cent. Purchase price of a used car $5,633 By table By formula Down payment $1,203 Monthly Payment Number of monthly payments 48 Amount financed $4,430 Total of monthly payments $5,689.76 Total finance charge $1,259.76 APR 13%arrow_forwardGrove Media plans to acquire production equipment for $845,000 that will be depreciated for tax purposes as follows: year 1, $329,000; year 2, $189,000; and in each of years 3 through 5, $109,000 per year. A 10 percent discount rate is appropriate for this asset, and the company's tax rate is 20 percent. Use Exhibit A.8 and Exhibit A.9. Required: a. Compute the present value of the tax shield resulting from depreciation. b. Compute the present value of the tax shield from depreciation assuming straight-line depreciation ($169,000 per year). Complete this question by entering your answers in the tabs below. Required A Required B Compute the present value of the tax shield resulting from depreciation. Note: Round PV factor to 3 decimal places. Present value of the tax shieldarrow_forwardWinett Corporation is considering an investment in special-purpose equipment to enable the company to obtain a four-year municipal contract. The equipment costs $222,000 and would have no salvage value when the contract expires at the end of four years. Estimated annual operating results of the project are as follows. Revenue from contract sales. Expenses other than depreciation Depreciation (straight-line basis) Increase in net income from contract work $211,000 55,500 All revenue and all expenses other than depreciation will be received or paid in cash in the same period as recognized for accounting purposes. Compute the following for Winett's proposal to undertake this contract. a. Payback period b. C. a. Payback period. b. Return on average investment. (Round your percentage answer to 1 decimal place (i.e., 0.123 to be entered as 12.3).) c. Net present value of the proposal to undertake contract work, discounted at an annual rate of 10 percent. (Refer to the annuity table in…arrow_forward

- Price $925.93 YTM 8.00% 853.39 8.25 782.92 8.50 15.00 8.75 650.00 9.00 a. Calculate the forward rate of interest for each year. b. What is the 2-year forward rate beginning in year 3? Maturity (years) 1 2345arrow_forwardTait is entering high school and is determined to save money for college. Tait feels he can save $2,500 each year for the next four years from his part-time job. If Tait is able to invest at 6%, how much will he have when he starts college? (Click the icon to view Present Value of $1 table.) E (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) E (Click the icon to view Future Value of Ordinary Annuity of $1 table.) - X Reference (Round your answer to the nearest dollar.) Reference When Tait starts college he will have Present Value of $1 Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Future Value of $1 0.990 0.980 0.971 0.962 0.952 0.943 0.980 0.961 0.943 0.925 0.907 0.971 0.942 0.915 0.889 0.864 0.840 0.961 0.924 0.888 0.855 0.823 0.792 0.951 0.906 0.863 0.822 0.784 0.747 0.917 0.909 0.893 | 0.877 0.870 0.862 0.847 0.833 0.826 0.797 0.769 0.756 0.743…arrow_forwardWhat is the interest rate?arrow_forward

- Bank 3 Liabilities (millions) 9. 17 Assets (millions) Maturities 1 day +1 day-3mos +3 mos-6 mos +6 mos-12 mos +l year- 5 years 6. 11 10 43 15 52 90 11 Use the Repricing Model. If interest rates rise by 56 basis points for assets and 142 basis points for liabilities over the next year, then how will impact the interest income of Bank 3 over the next year? O Bank 3 will experience a loss of $1,483,000 O Bank 3 will experience a gain of $679,400 Bank 3 will experience a loss of $679,400 Bank 3 will experience a gain of $1,953,400arrow_forwardFace value (principal) $ TABLE 7-1 50,400 Day of month 1 2 3 4 Rate of interest 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 31 Jan. 9% 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Exact days-in-a-year calendar (excluding leap year)" Length of note 90 days 28 Feb. 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 31 Mar. 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 30 Apr. Maturity value 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 31 May 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 30 31 31 30 June July Aug. Sept. 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 Date of note January 12 189 190 191…arrow_forwardWhat is the period in years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education