FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

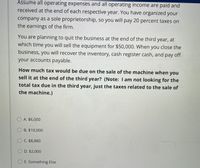

Transcribed Image Text:Assume all operating expenses and all operating income are paid and

received at the end of each respective year. You have organized your

company as a sole proprietorship, so you will pay 20 percent taxes on

the earnings of the firm.

You are planning to quit the business at the end of the third year, at

which time you will sell the equipment for $50,000. When you close the

business, you will recover the inventory, cash register cash, and pay off

your accounts payable.

How much tax would be due on the sale of the machine when you

sell it at the end of the third year? (Note: I am not looking for the

total tax due in the third year, just the taxes related to the sale of

the machine.)

O A. $6,000

O B. $10,000

O C. $8,880

O D. $2,000

O E. Something Else

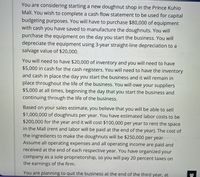

Transcribed Image Text:You are considering starting a new doughnut shop in the Prince Kuhio

Mall. You wish to complete a cash flow statement to be used for capital

budgeting purposes. You will have to purchase $80,000 of equipment

with cash you have saved to manufacture the doughnuts. You will

purchase the equipment on the day you start the business. You will

depreciate the equipment using 3-year straight-line depreciation to a

salvage value of $20,000.

You will need to have $20,000 of inventory and you will need to have

$5,000 in cash for the cash registers. You will need to have the inventory

and cash in place the day you start the business and it will remain in

place throughout the life of the business. You will owe your suppliers

$5,000 at all times, beginning the day that you start the business and

continuing through the life of the business.

Based on your sales estimate, you believe that you will be able to sell

$1,000,000 of doughnuts per year. You have estimated labor costs to be

$200,000 for the year and it will cost $100,000 per year to rent the space

in the Mall (rent and labor will be paid at the end of the year). The cost of

the ingredients to make the doughnuts will be $250,000 per year.

Assume all operating expenses and all operating income are paid and

received at the end of each respective year. You have organized your

company as a sole proprietorship, so you will pay 20 percent taxes on

the earnings of the firm.

You are planning to quit the business at the end of the third year, at

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 5. Understanding marginal and average tax rates Consider the economy of Cocoland, where citizens consume only coconuts. Assume that coconuts are priced at $1 each. The government has devised the following tax plans: Plan A Plan B • Consumption up to 1,000 coconuts is taxed at 50%. • Consumption up to 2,000 coconuts is taxed at 15%. • Consumption higher than 1,000 coconuts is taxed at 20%. • Consumption higher than 2,000 coconuts is taxed at 60%. Use the Plan A and Plan B tax schemes to complete the following table by deriving the marginal and average tax rates under each tax plan at the consumption levels of 300 coconuts, 1,200 coconuts, and 3,000 coconuts, respectively. Consumption Level Plan A Plan B (Quantity of coconuts) Marginal Tax Rate Average Tax Rate Marginal Tax Rate Average Tax Rate (Percent) (Percent) (Percent) (Percent) 300 1,200 3,000arrow_forwardquestion 5 You have a depreciation expense of $459,000 and a tax rate of25%. What is your depreciation tax shield? The depreciation tax shield will be $________. (Round to the nearest dollar.)arrow_forwardRobert, the owner of a local poster shop, comes to you for help. "We've only been breaking even the past two years, and I'm getting very frustrated! I don't know what to do because I feel like I've already tried to improve our processes as much as possible, but we still haven't been able to generate a profit. Do you have any suggestions as to how we can turn things around? I just don't think we can even consider moving forward with this business unless we can earn $9,000 in operating income next year. Even then, we'll have to think long and hard about what the future holds." Robert shares the following information with you, as you ponder different scenarios to help your friend. Selling price Cost for paper, per unit Cost for printing, per unit Cost for film, per unit Staff salaries Other operating costs 1. 2. 3. $6.80 4. 0.75 After thinking about it for a while, you suggest the following possibilities to help him turn things around. 0.90 0.50 47,000 14,380 Lower the selling price by…arrow_forward

- Suppose you sell a fixed asset for $109,000 when its book value is $129,000. If your company’s marginal tax rate is 39 percent, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)? (Enter your answer as a whole number.)arrow_forwardSuppose Hampton Corporation sells land for $8,000,000. Hampton paid $5,000,000 for the land several years ago. Assuming a marginal tax rate of 34%, calculate the after-tax cash flow resulting from the land sale.arrow_forwardround to nearest dollararrow_forward

- 20. Karen Corp has an asset they would like to sell. The asset has an original cost of $170,000 and accumulated depreciation of $109,000. The asset would be sold for $50,000 cash. Karen's tax rate is 40%. Calculate the after-tax cash inflow from the sale of this asset. a. $45,600 b. $54,400 c. $39,000 d. $43,400 e. $50,000 f. $30,000 g. $65,400 h. None of the abovearrow_forwardQuestion 3: Property tax Aamir owns property with an assessed value of $500,000. Khaled’s property has an assessed value of $1.5 million. Property tax has the following tax brackets:2% for value less than $1million and 1% for value in excess of $1 million. Calculate the amount of Property Tax payable to the government by Aamir and Khaled? Explain the type of taxation system applicable in this situation. Is this system of taxation fair? Explain why this system is being criticised?arrow_forwardSuppose you sell a fixed asset for $312,000 when its book value is $102,000. If your company’s marginal tax rate is 35 percent, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education