FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

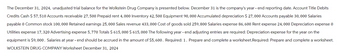

Transcribed Image Text:The December 31, 2024, unadjusted trial balance for the Wolkstein Drug Company is presented below. December 31 is the company's year - end reporting date. Account Title Debits

Credits Cash $ 57,510 Accounts receivable 27,500 Prepaid rent 4, 000 Inventory 42, 500 Equipment 90, 000 Accumulated depreciation $ 27,000 Accounts payable 30, 000 Salaries

payable 0 Common stock 100, 000 Retained earnings 25,000 Sales revenue 433,000 Cost of goods sold 259, 800 Salaries expense 86,600 Rent expense 24,000 Depreciation expense 0

Utilities expense 17, 320 Advertising expense 5, 770 Totals $ 615, 000 $ 615,000 The following year - end adjusting entries are required: Depreciation expense for the year on the

equipment is $9,000. Salaries at year - end should be accrued in the amount of $5,600. Required: 1. Prepare and complete a worksheet.Required: Prepare and complete a worksheet.

WOLKSTEIN DRUG COMPANY Worksheet December 31, 2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ent-player/index.html?launchId=5e8570d9-7885-4557-a756-8a59bb69135c#/question Question 6 of 9 View Policies Current Attempt in Progress (a1) At the end of its first year, the trial balance of Blossom Company shows Equipment $23,100 and zero balances in Accumulated Depreciation Equipment and Depreciation Expense. Depreciation for the year is estimated to be $2,700. Date Prepare the annual adjusting entry for depreciation at December 31. (List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Dec. 31 WP NWP Assessment Player Ul Ap X + Account Titles and Explanation eTextbook and Medial List of Accounts Save for Later -/15 : Debit Credit Attempts: 0 of 3 used (a2) The parts of this question must be completed in order. This part will be available when you complete the part above. (a3) The parts of this question…arrow_forward1. Use the HUWING Uaun dubut the company's dujustments to complete a to-CoIUITI WUIK STEEL a. Unrecorded depreciation on the trucks at the end of the year is $6,859. b. Total amount of accrued interest expense at year-end is $8,000. c. Cost of unused supplies still available at year-end is $1,100. 2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31. 2b. Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $260,373 on December 31 of the prior year. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Use the following information about the company's adjustments to complete a 10-column work sheet. DYLAN DELIVERY COMPANY Work Sheet For Year Ended December 31 Balance Sheet and Statement Unadjusted Trial Balance Adjustments Account Title Debit Credit Debit Credit Adjusted Trial Balance Debit Income Statement Credit Debit Credit Debit of Owner's Equity…arrow_forwardYour staff person has provided you with the following journal entry for January 20x1 depreciation. The monthly deprecation is supposed to be $100.00. What is wrong with this entry?arrow_forward

- i need the answer quicklyarrow_forwardA company purchased a truck for USD 20,000 on 2010 January 1. The truck has an estimated residual value of USD 5,000 and a useful life of five years. Adjusting entries are prepared only at year-end. The necessary adjusting entry at 2010 December 31, the company’s year-end, is: Group of answer choices Debit Depreciation expense $3,000 Credit Trucks $3,000 Debit Accumulated depreciation trucks $3,000 Credit Depreciation expense – Trucks $3,000 Debit Depreciation expense $4,000 Credit Accumulated depreciation trucks $4,000 Debit Depreciation expense $3,000 Credit Accumulated depreciation – Trucks $3,000arrow_forwardAdjustment for Depreciation Cowley Company just completed its first year of operations. The December 31 equipment account has a balance of $20,000. There is no balance in the Accumulated Depreciation-Equipment account or in the Depreciation Expense account. The accountant estimates the yearly equipment depreciation to be $4,000. Prepare the required adjustment to record the yearly depreciation for equipment. Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Stockholders Assets Liabilities Equity Revenues Expenses = Net Income 20,000 4,000 Check O Previous A Save Answersarrow_forward

- Depletion Earth's Treasures Mining Co. acquired mineral rights for $42,000,000. The mineral deposit is estimated at 40,000,000 tons. During the current year, 11,600,000 tons were mined and sold. a. Determine the depletion rate. If required, round your answer to two decimal places. b. Determine the amount of depletion expense for the current year. c. Journalize the adjusting entry on December 31 to recognize the depletion expense. If an amount box does not require an entry, leave it blank.arrow_forwardA company using the perpetual inventory system purchased inventory worth $25,000 on account with terms of 2/10, n/30. Defective inventory of $2,000 was returned 2 days later and the accounts were appropriately adjusted. If the invoice is paid within 10 days, the amount of the purchase discount that would be available to the company is OA. $500 OB. $460 OC. $540 OD. $490arrow_forward< Champion Company purchased and installed carpet in its new general offices on March 31 for a total cost of $18,000. The carpet is estimated to have a 15- year useful life and no residual value. a. Prepare the journal entries necessary for recording the purchase of the new carpet. If an amount box does not require an entry, leave it blank Mar. 311 b. Record the December 31 adjusting entry for the partial-year depreciation expense for the carpet assuming that Champion Company uses the straight-line method. If an amount box does not require an entry, leave it blank Dec. 31arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education