FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

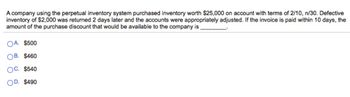

Transcribed Image Text:A company using the perpetual inventory system purchased inventory worth $25,000 on account with terms of 2/10, n/30. Defective

inventory of $2,000 was returned 2 days later and the accounts were appropriately adjusted. If the invoice is paid within 10 days, the

amount of the purchase discount that would be available to the company is

OA. $500

OB. $460

OC. $540

OD. $490

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jan. 2 Purchased merchandise on account from Nunez Company, $27,600, terms 3/10, n/30. (Wildhorse uses the perpetual inventory system.) 1 Issued a 9%, 2-month, $27,600 note to Nunez in payment of account. Feb. Mar. 31 Accrued interest for 2 months on Nunez note. Apr. 1 Paid face value and interest on Nunez note. July 1 Purchased equipment from Marson Equipment paying $10,200 in cash and signing a 10%, 3-month, $68,400 note. Sept. 30 Accrued interest for 3 months on Marson note. Oct. 1 Paid face value and interest on Marson note. Dec. 1 Borrowed $27,600 from the Paola Bank by issuing a 3-month, 8% note with a face value of $27,600. Dec. 31 Recognized interest expense for 1 month on Paola Bank note. Prepare Journal entries for the listed transactions and events. Post the accounts Notes Payable, Interest payable, and Interest Expense. Show the balance sheet presentation of notes and interest payable at December 31. What is the total interest expense for the year?arrow_forwardCurrent Attempt in Progress Bramble Ltd. had beginning inventory of 54 units that cost $105 each. During September, the company purchased 206 units on account at $105 each, returned 6 units for credit, and sold on account 153 units at $201 each. Prepare journal entries for the September transactions, assuming that Bramble uses a periodic inventory system. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit (To record purchase on account) (To record purchase return) Preparjalneries for the Sopomber tramming that perdicimentary titles are automatically indented whes the amount is entered De not indest manually. If ne entry is required, Entry for the account ctles and enter O for the amounts List el dret estr les defane crentes) Account Titles and…arrow_forwardProvide 7 entries in worksheetarrow_forward

- A company purchased 100 units for $30 each on January 31. It purchased 300 units for $20 each on February 28. It sold a total of 370 units for $110 each from March 1 through December 31. If the company uses the last – in, first – out inventory costing method, calculate the cost of ending inventory on December 31. (Assume that the company uses a perpetual inventory system.) A. $900 B. $600 C. $2,400 D. $30arrow_forwardDon't give answer in imagearrow_forwardJournalize each of the following transactions assuming a perpetual inventory system and PST at 8% along with 5% GST. June (1) Purchased $2,000 of merchandise; terms 1/10, n/30. (5) Sold $ 1,000 of merchandise for $1,400; terms n/15. Please answers in Journal entry worksheetarrow_forward

- Qq.12. Subject :- Accountarrow_forwardThe following units of inventory item is available for sale durning the year : beginnig inventory 10 units at $55 first purchase 25 units at $60 second purchase 30 units at $65 third purchase 15 units at $70 the firm uses the periodic inventory system. Durning the year 60 units of items were sold the value of ending inventory using lifo isarrow_forwardSuppose that Pharoah has the following inventory data: July 1 Beginning inventory 25 units at $5.00 5 Purchases 101 units at $5.50 14 Sale 67 units 21 Purchases 50 units at $6.00 30 Sale 47 units Assuming that a perpetual inventory system is used, what is the cost of goods sold on a LIFO basis for July? O $650.50 ○ $980.50 O $330.00 O $485.00arrow_forward

- Recording Inventory ActivitiesPerpetual SystemQuestion 1: Shipped merchandise that cost us $790 to a customer for $1050. The customer agreed to pay us in 30 days.Dr Account Dr AmountCr Account Cr AmountDr Account Dr AmountCr Account Cr Amountarrow_forwardA company had inventory, on November 1 of 22 units at a cost of $26 each. On November 2, they purchased 27 units at $27 each. On November 6, they purchased 23 units at $29 each. On November 8, 25 units were sold for $38 each. Using the FIFO perpetual inventory method, what was the value of the inventory on November 8 after the sale? Multiple Choice о $1,315 $1,269 $1,222 $1,247 $1,271arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education