FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

answer within 30 minutes. its urgent.

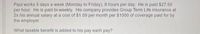

Transcribed Image Text:Paul works 5 days a week (Monday to Friday), 8 hours per day. He is paid $27.50

per hour. He is paid bi-weekly. His company provides Group Term Life insurance at

2x his annual salary at a cost of $1.09 per month per $ 1000 of coverage paid for by

the employer.

What taxable benefit is added to his pay each pay?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4. Five transactions for Jodry & Associates follow. A. Journalize the five transactions under a GST/PST system. The rate of GST is 5%; PST is 8%. Both taxes are charged on all sales, and both percentages are calculated on the original amount of the invoice. Use the following accounts: A/R - Booker Industries A/R - Genco Corporation A/R - Hall Industries A/P- Bell Cellphones HST Payable HST Recoverable PST Payable Sales Office Supplies Expense Telephone Expense A/P- Great Stationers GST Payable GST Recoverable TRANSACTIONS October 19 Sales Invoice No. 459 to Booker Industries, $1250 plus GST and PST. 19 Sales Invoice No. 460 to Genco Corporation, $1500 plus GST and PST. 20 Sales Invoice No. 461 to Hall Industries, $2700 plus GST and PST. 22 Purchase Invoice No. 49390 from Bell Cellphones, $313.20 plus GST. (Note: This transaction is exempt from PST because it is a service not covered by the provincial tax regulations.) 25 Purchase Invoice From Great Stationers, No. 15586 for office…arrow_forwardCalculate the amount of interest that the following note will earn (for the life of the note). Please show work! $1,000 Face 7% interest Term: 90 daysarrow_forwardFind the savings plan balance after 9 months with an APR of 4% and monthly payments of $150. The balance is?arrow_forward

- Which of the following would indicate the BEST Average Collection Period? 30 days 20 days 25 days 15 daysarrow_forwardA business acquaintance promises to deliver a $20 bill to you one year from today. How much should you be willing to pay today for this promise? A) Less than $20 B) More than $20 C) Exactly $20arrow_forwardThe collection of a 1200 account after the 2 percent discount period will result in aarrow_forward

- Hel Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Baker's Financial Planners purchased nine new computers for $910 each. It received a 20% discount because it purchased more than four and an additional 5% discount because it took immediate delivery. Terms of payment were 5/10, n/30. Baker's pays the bill within the cash discount period. How much should the check be? (Do not round intermediate calculations. Round your final answer to the nearest cent.) Amount $ 5835.38 8 10 of 10arrow_forwardIf this was a BELO plan with a pay rate of $22.00 per hour and a maximum of 53 hours, how much would Overwood be paid for 48 hours?arrow_forward10arrow_forward

- Peg Gasperoni bought a $50,000 life insurance policy for $190 per year. Ryan Life Insurance Company sent her the following billing instructions along with a premium plan example: "Your insurance premium notice will be mailed to you in a few days. You may pay the entire premium in full without a finance charge or you may pay the premium in installments after a down payment and the balance in monthly installments of $50. The finance charge will be added to the unpaid balance. The finance charge is based on an annual percentage rate of 18%." If the total policy premium is: $190 290 390 And you put down: Finance Charge $50.00 70.00 95.00 The balance subject to finance charge will be: $140.00 220.00 295.00 $ 4.96 The total number of monthly installments ($30 minimum) will be: Peg feels that the finance charge of $4.35 is in error. a. What is the actual finance charge for the first three months? Note: Round your answer to the nearest cent. 3 5 6 The monthly installment before adding the…arrow_forward8 Suppose a health care organization buys supplies from a vendor but has not yet paid for the supplies. The vendor will give a 5% discount to the health care organization if it pays the invoice within 20 days as an incentive to pay quickly. What is the liability that the health care organization should record on its balance sheet: the full cost of the invoice or the discounted amount?arrow_forwardData table T Plan A: Pay $0.09 per minute of long-distance calling. Plan B: Pay a fixed monthly fee of $18 for up to 300 long-distance minutes and $0.06 per minute thereafter (if she uses fewer than 300 minutes in any month, she still pays $18 for the month). Plan C: Pay a fixed monthly fee of $23 for up to 480 long-distance minutes and $0.05 per minute thereafter (if she uses fewer than 480 minutes, she still pays $23 for the month).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education